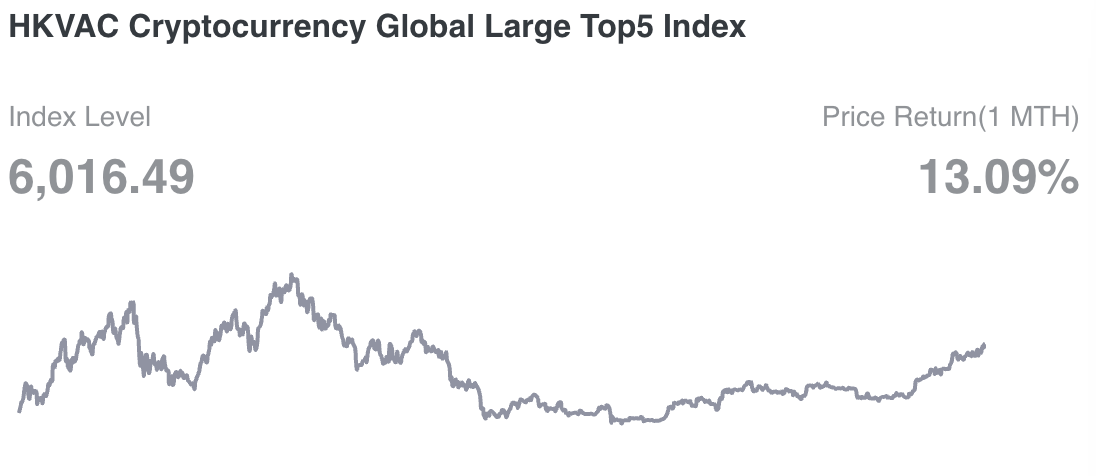

Hong Kong Virtual Asset Rating Agency (HKVAC) has caught the attention of the global cryptocurrency community with its recent announcement of index adjustments set to take effect on Jan. 19. The focal point of this unexpected move is the removal of XRP from its Cryptocurrency Global Large Top5 Index.

Notably, Solana (SOL) has secured a coveted spot in the HKVAC Cryptocurrency Global Large Top5 Index, ousting XRP. This shift follows SOL's remarkable surge of nearly 500% in recent months, propelling its market capitalization to an impressive $42.5 billion.

The removal of XRP comes merely three months after its inclusion in the index, replacing USDC back in October 2023. The timing of SOL's ascent coinciding with XRP's listing on the HKVAC adds an amusing layer to the narrative.

The latest adjustments also include the addition of promising projects such as ICP, NEAR, OP, INJ and IMX to the global index, while TUSD, BUSD, HBAR, FIL and MKR face removal.

Crypto Hong Kong

HKVAC, a virtual asset rating agency based in Hong Kong, introduced virtual asset indices and exchange-traded ratings in late spring. The purpose of these indexes is to capture the performance of various cryptocurrencies, offering local investors a comprehensive overview of the market.

New adjustments come amid another significant development on the Hong Kong cryptocurrency scene. Reports indicate that approximately ten fund companies are actively preparing to launch Virtual Asset Spot ETFs in the region, with seven or eight of them already in advanced stages of development. This suggests a growing interest in cryptocurrency investment products within the financial sector in Hong Kong.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin