Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Since the inception of ERC-20 tokens and DeFi, tokenized real-world assets have remained a red-hot segment of Web3 development. Once called a “trillion-dollar” opportunity, the sphere of RWAs has its own risks and promises.

RWA tokens, i.e., cryptocurrencies somehow associated with protocols addressing real-world use cases, are also in the spotlight. In this guide, we are going to navigate through the basics of the on-chain real-world assets sphere and the largest RWA cryptocurrencies.

Real-world assets in crypto: Quick facts

Real-world assets (abbreviated as RWAs) represent tokenized (on-chain) avatars of various classes of goods or rights that exist outside blockchains.

- Real-world assets or RWAs in crypto should be referred to as a class of tokens bonded to off-chain goods;

- There are a plenty of assets that can be tokenized as on-chain RWAs: stocks and commodities, raw materials, agriculture products, real estate;

- Also, non-fungible RWAs can represent artworks, content pieces or associated copyright licenses;

- Cryptocurrency RWAs pave the path for tokenized documents in insurance, banking, investing and so on;

- Stablecoins backed by precious metals can also be viewed as a sort of on-chain RWAs just like NFTs bonded to physically available artworks;

- RWA cryptos are among popular segments of altcoins in 2023-2024 with Mantra (OM), Ondo (ONDO), Pendle (PENDLE) being the largest RWA coins by market cap.

As per CoinGecko, the segment of RWA tokens is valued over $19 billion, while the total addressable market (TAM) size for tokenization exceeds trillions of dollars.

What are real-world assets in crypto?

In crypto and blockchain, real-world assets or RWAs refer to traditional financial assets like agriculture products, precious metals, binds and stocks, but represented as blockchain-base tokens. Therefore, on-chain RWAs can be easily stored and transferred on-chain just like regular tokens.

Thanks to the process of tokenization, ownership rights or claims are converted into digital tokens, allowing them to be traded solely on-chain.

With RWAs, people can both invest in the assets that already exist in the physical world (like raw materials) and purchase the goods unimaginable in Web2 (1/1,000 share of an artwork, a tokenized piece of content and so on).

RWAs in crypto: possible use cases

With modern tokenization principles, almost every asset and object that exists in the physical world can be tokenized. However, with the proper economic motivation, some classes of assets became more popular than others.

- Financial/investing/banking assets. On the majority of programmable blockchains, on-chain RWAs are “tokenized representations” of insurance documents, stocks, securities, treasuries, bonds and so on. Also, some developers have already tokenized major indices like S&P500 and even fractionalized shares of TSLA and AMZN stocks.

Example: tokenized fund by Franklin Templeton on Polygon (POL) and other EVM blockchains.

- Tangible real-world materials. Besides fintech assets, on-chain RWAs can be bonded to precious metals, raw materials, real estate objects, artworks and their pieces as well as some types of licenses for digital content. Just like with financial assets, real estate can be available on chain “as is” or in fractionalized form.

Example: tokenized real estate trusts in the U.S.

- Digital ownership rights. Last but not least, RWAs tokenization frameworks can bring on-chain purely digital objects, including rights for this or that piece of intellectual property, datasets, software and so on.

Example: tokenized digital ownership rights in ERC 6551 tokens.

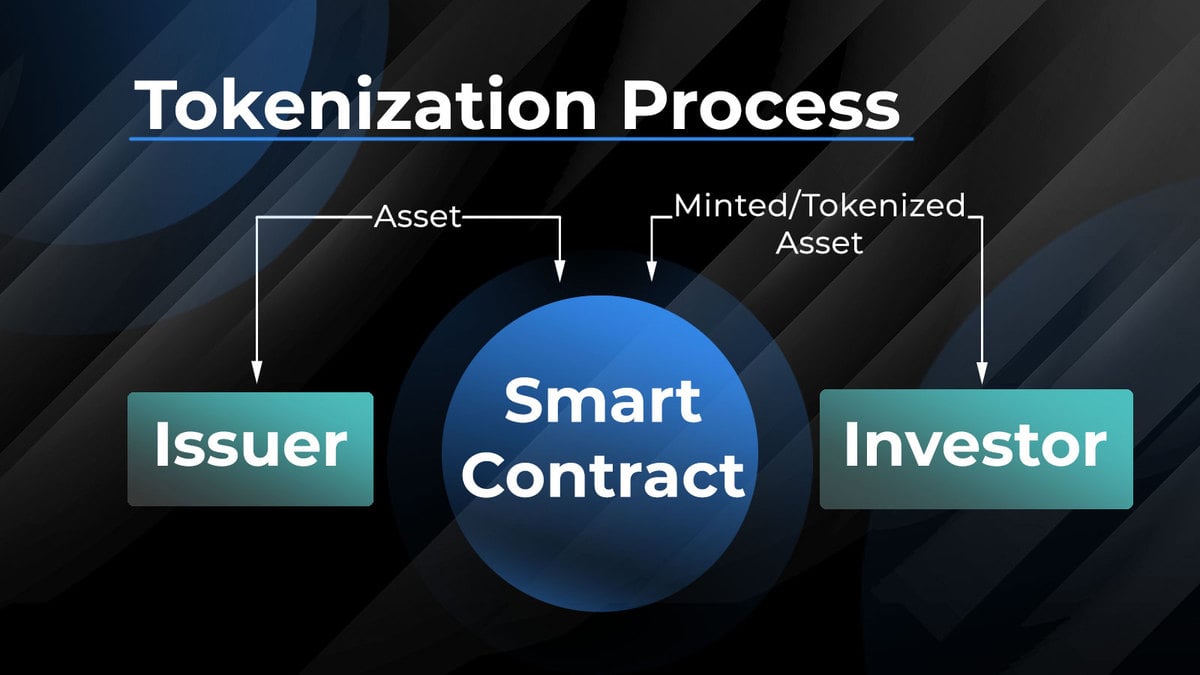

Simply put, that’s how the tokenization process works: Some Web3 firm inks an agreement with the owner or holder of physical assets, obtains the necessary rights and then issues (mints) tokens with predetermined properties (aggregated supply, token code details, fungibility and so on)

Then, these tokens are offered to the community not unlike regular altcoins or, in case of something non-fungible (unique) like ERC-721, NFTs.

Why blockchains are necessary for RWAs trading

Being distributed, decentralized, tamper-proof and transparent systems, blockchains are inevitable for creating digital representations of real-world assets (RWAs).

Transparency

In blockchains, every transaction can easily be verified, including the very fact of asset minting/burning and every transfer associated with it. Even with no specific technical knowledge, every trader or investor can check the status of the asset they are going to buy.

Flexibility

While in Web2 creating new assets is associated with regulatory, infrastructure and economical challenges, in crypto, on-chain assets of various types can be created in a couple of clips. As such, it unveils unmatched opportunities for issuing different types of RWAs suitable for diverse investing strategies.

Resource-efficiency

In cryptocurrency, new tokens can be minted for a fraction of cent while transfers are charged with negligible commissions. Also, the storage of RWAs in crypto wallets is way cheaper than that with “real” Gold, Silver, let alone crude oil or agriculture production.

While in other segments (cross-border transfers, data storage and so on), blockchain accelerated existing developments, in RWAs it created a totally new technical basis that previously could hardly be imagined.

RWA crypto coins: What to know

RWA cryptocurrencies represent the thriving class of crypto assets that are associated with projects addressing real-world assets in blockchain in various ways. The interest in RWA solutions is mirrored by the spikes of popularity of RWA crypto tokens.

Mantra (OM)

Launched in 2020, Mantra (OM), previously known as Mantra DAO, is one of the pioneering Layer 1 blockchains specifically designed for operations with real-world assets. Its mainnet kicked off in October 2024, triggering much enthusiasm in the segment.

OM, Mantra’s native ecosystem token, migrated to its own chain immediately after the mainnet release. OM’s staking is also available. Mantra's (OM) team stresses that it is focused on making on-chain operations with RWAs fully regulatory-compliant.

Ondo Finance (ONDO)

Introduced in early 2021, Ondo Finance (ONDO) offers a wide range of financial products from Web2 available as cryptocurrency tokens. Ondo Finance (ONDO) became popular due to its flagship product USDY, an on-chain stablecoin fully backed by 10-year U.S. Treasury bills.

Besides that, Ondo Finance (ONDO) offers yield-bearing tokenized products backed by stable and predictable assets from the “real-world” economy. Its ONDO token serves as a governance and ecosystem token for all Ondo Finance products.

Pendle (PENDLE)

Pendle (PENDLE) debuted in crypto in 2021; since 2023 the protocol expanded into multi-chain with versions launched on Arbitrum, BNB Smart Chain and Optimism networks.

The protocol leverages two major narratives of this cycle, Fixed Yield programs and RWAs tokenization. Namely, since Q2, 2024, it utilizes MakerDAO’s Boosted Dai (sDAI) and Flux Finance’s fUSDC stablecoin for its RWA products. The protocol offers various opportunities to earn on ETH- and USD-pegged synthetics across major EVM blockchains.

Pax Gold (PAXG)

Pax Gold (PAXG) is a unique stablecoin fully backed by physical Gold. Each Pax Gold (PAXG) asset is mirrored by one fine troy ounce of gold, stored in LBMA vaults in London. The issuer of this token, Paxos Trust Company, guarantees the stability of the peg and customers' opportunity to redeem PAXG tokens for physical Gold or for U.S. dollars.

With an aggregated market cap of almost $700 million, Pax Gold (PAXG) has only one competitor in the segment of tokenized Gold, i.e., XAUT by Tether. However, PAXG is available on a larger number of exchanges.

XDC Network (XDC)

XDC Network, previously known as XinFin XDC, is an Ethereum-like blockchain and one of the earliest forks of the second cryptocurrency. Its diverse ecosystem of products includes a wide scope of applications, from DeFi tools to community-driven meme coins.

However, building a one-stop real-world asset (RWA) accelerator remains the primary focus for XDC Network. Its dApps scene hosts applications for Gold tokenization, tokenized 10-year USTs, bonds and stocks. XDC Network gained traction in the tokenization sphere due to its fast transaction finality and low fees.

Reserve Rights (RSR)

Launched in May 2019 after an IEO on Huobi Prime platform, Reserve Rights (RSR) is a native staking, utility and governance cryptocurrency of Reserve, a one-stop tokenization platform. It is designed to allow every business to start its own journey in RWAs. With Reserve, firms can mint tokens bonded to various types of physical assets.

Also, Reserve enabled a number of fixed yield programs. The money for these rewards is generated by liquidity distributed between RocketPool and Lido Finance by RSR stakers.

Chex Token (CHEX)

Chex Token (CHEX) is the core native cryptocurrency of Chintai, a tokenization protocol for financial products. Chintai is among the first RWAs platforms licensed and regulated by the Monetary Authority of Singapore.

Technically, Chintai is a Layer 1 blockchain natively compatible with Ethereum Virtual Machine (EVM). In September 2024, asset management heavyweight Kin Capital launched a $100 million tokenized real estate debt fund on Chintai. The fund is only accessible for accredited investors with a minimum of $50,000 in deposit with 14-15% in estimated APY.

Polymesh (POLYX)

Launched in October 2021, Polymesh network promotes itself as the first-ever permissioned blockchain built specifically for regulated tokens, i.e., security RWAs. Polymesh allows clients to trade tokenized stocks like ordinary cryptocurrency assets.

Also, its Polymesh Private solution allows firms and issuers to launch their own tokenized assets in a no-code manner. As of today, there are 75 active Polymesh (POLYX) nodes with over 524 million of tokens staked. Over 7,500 corporate clients opened their accounts on Polymesh (POLYX) to start trading security tokens.

Quorium (QGOLD)

Launched in 2023, QGold token by the Quorium project is another attempt to introduce mainstream stablecoin fully backed by physical gold. QGold claims to be fully audited and integrated in many social good initiatives.

The token is minted on top of BNB Smart Chain, Binance's smart contract platform. QGOLD is available on two centralized exchanges in pairs with USDT. So far, Quorum tokenized almost 90,000 ounces of physical Gold to mint the available amount of stablecoins.

OriginTrail (TRAC)

Launched in January 2019, OriginTrail (TRAC) is a distributed ledger platform that uses both a blockchain and a technology called a decentralized knowledge graph (DKG) to manage data about real-world assets in the digital space.

Technically, it is a combination of Layer 1 (OriginTrail itself) and Layer 2 (DKG) designed to fuel supply chain systems and verify the authenticity of this or that product. OriginTrail (TRAC) is exploring solutions at the intersection between blockchain and artificial intelligence (AI).

As such, tokenization of securities and physical gold for streamlined trading remains the dominant use case for RWAs in crypto.

RWA cryptos list: Highlights

Now, let’s check out the key statistical data about the RWA cryptocurrencies based on CoinGecko’s estimation.

N | RWA Crypto | Ticker | Public launch date | Market Cap (Jan 2025) |

1 | Mantra | OM | Oct 2021 | $3.37 billion |

2 | Ondo Finance | ONDO | Aug 2021 | $2.00 billion |

3 | Pendle | PENDLE | Nov 2022 | $874 million |

4 | Pax Gold | PAXG | Sept 2019 | $523 million |

5 | XDC Network | XDC | Jun 2019 | $1.09 billion |

6 | Reserve Rights | RSR | May 2019 | $776 million |

7 | Chex Token | CHEX | Apr 2019 | $537 million |

8 | Polymesh | POLYX | Oct 2019 | $308 million |

9 | Quorium | QGOLD | Mar 2023 | $215 million |

10 | OriginTrail | TRAC | Jan 2019 | $397 million |

As per public trackers, the aggregated capitalization of the RWA cryptocurrencies segment is over $19 billion in equivalent. Besides the aforementioned cryptos, RWA coins OUSG, MPL, CFG, CTC, CHR, EURS, GFI and CPOOL all surpassed the $100 million capitalization milestone as of Jan, 2025.

Bonus: Where to track full lists of RWA coins

To stay updated about the latest developments in the rapidly developing segment of RWA cryptocurrencies, users can track automated dashboards by leading analytical websites on crypto — CoinGecko and CoinMarketCap.

Top real world asset (RWA) coins by market cap: CoinGecko

On CoinGecko, 167 altcoins in the RWA crypto category are tracked. Their aggregated capitalization rate exceeds $19 billion. CoinGecko broadcasts real-time updates on every RWA crypto price, hourly, daily and monthly dynamics, 24h trading volume and the aggregated market cap.

Within the card of every altcoin, traders can also find its social media pages, its listing statistics (exchanges, trading pairs, volume, liquidity and so on), its API data (for L1 networks only) as well as a full list of categories this or that crypto is listed in.

Top real world asset tokens by market capitalization: CoinMarketCap

On CoinMarketCap, one of the world’s most visited websites on blockchain and cryptos, 151 cryptocurrencies are tracked in the corresponding categories. Their net capitalization is over $62 billion as CoinMarketCap labels heavyweights Avalanche (AVAX), Chainlink (LINK) and VeChain (VET) from the top 50 as RWA assets.

The rest of the data provided by CoinMarketCap looks similar to that of competitors. Additionally, CoinMarketCap demonstrates circulating/net supply data and the rating of reliability of exchanges this or that asset is listed by.

Closing thoughts

Real-world assets (RWAs) in crypto represent a class of assets associated with this or that physical asset, document, or digital rights. Through various tokenization frameworks, real-world assets like stocks, bonds, commodities, raw materials, precious metals, agricultural products and so on may be mirrored on programmable blockchains like Ethereum, Polygon, or BNB Smart Chain. Also, some real-world asset projects launched their own specific blockchains typically interoperable with Ethereum Virtual Machine.

On-chain real-world assets (RWAs) became popular thanks to their resource-efficiency, flexibility, customizability and transparency. It is much easier to store digital tokens than gold, oil, corn and so on. Also, they are of paramount importance when it comes to verification procedures.

Gold-backed and silver-backed stablecoins represent specific classes of RWAs in crypto with PAXG and XAUT being the largest assets by market capitalization. Among other projects, OM, ONDO and PENDLE managed to accomplish the biggest caps.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov