Digital asset management firm Grayscale Investments now holds more than $5.1 bln worth of cryptocurrency assets, according to a recent announcement posted by its official Twitter handle.

The firm added more than $1 bln worth of investments in July alone, which underscores the growing institutional demand for crypto.

It’s mostly just Bitcoin

Grayscale was founded by its current CEO Barry Silbert back in 2013. It is owned by venture firm Digital Currency Group that is also helmed by the entrepreneur.

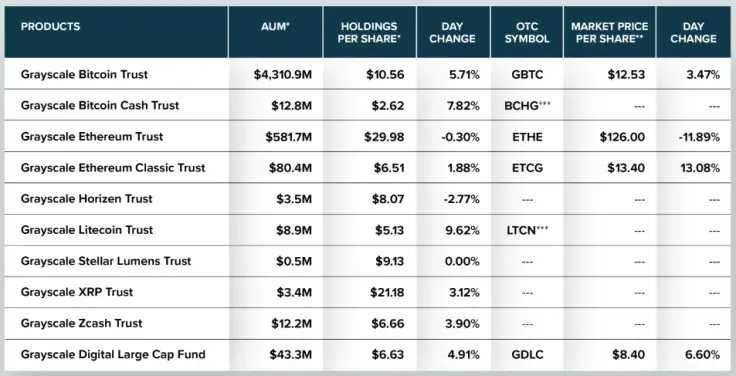

Its family of products consists of nine trusts for separate cryptocurrencies and a diversified fund for investing in a basket of large-cap cryptocurrencies.

Since its inception, Grayscale remains heavily invested in Bitcoin. With a staggering $4.3 bln, Grayscale Bitcoin Trust (GBTC) is solely responsible for 84 percent of all assets under management. As reported by U.Today, the firm has been hoarding Bitcoin at record rates, outpacing miners.

Grayscale’s Ethereum Trust (ETHE) comes in a distant second place with $581.7 mln. It is followed by the firm’s Ethereum Classic Trust (ETC).

“Look at us now”

According to Grayscale’s Q2 report, 84 percent of all outflows that it received last quarter came from institutional investors.

The firm also highlighted that the lion’s share of investors (54 percent), meaning that a lot of fresh money went into crypto.

Silbert, while commenting on the $5 bln milestone, says that “everybody” dismissed the idea of launching a Bitcoin investment fund, but the bet has certainly paid off:

“In 2013, everybody thought we were crazy for launching a bitcoin investment fund. Well, look at us now…”

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin