Capriole Investments cofounder, Jan Uytenhout, has shared data according to which Grayscale's existing customers still long to get more Bitcoin.

This is happening despite the company having temporarily suspended accepting funds into its Bitcoin Trust and other trusts based on a few other top cryptos like ETH, LTC and BCH.

Grayscale adds another 12,000 BTC to its holdings

On Dec. 21, large media outlets reported that the "biggest Bitcoin buyer," as Peter Schiff recently referred to it, suspended inflows of cash from investors into its major crypto trusts.

Those include Bitcoin, Litecoin, Ethereum, Bitcoin Cash and a few other coins. Despite this, it seems that the company's clients are still eager to place their money in Bitcoin.

Capriole Investments cofounder Jan Uytenhout has taken to Twitter to share that the company has acquired another gargantuan Bitcoin amount: 12,000 BTC.

This is worth $282,416,400 at the current rate.

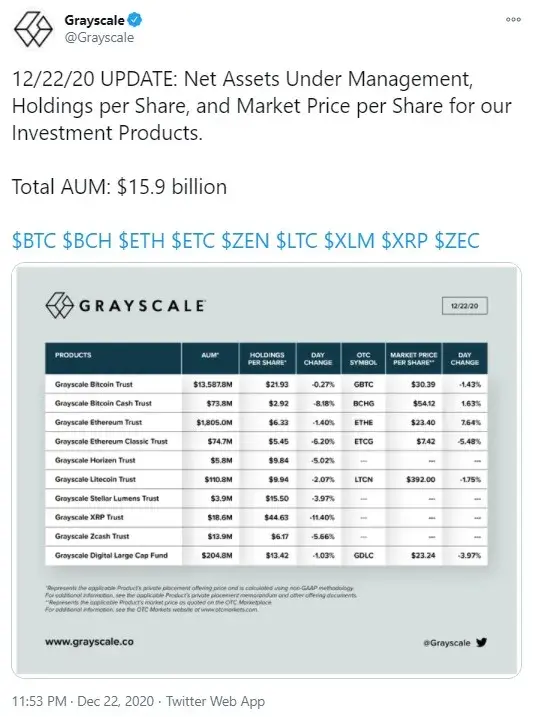

As of Dec. 22, Barry Silbert's Grayscale held a total of $15.9 billion in crypto AUM. Now, one can confidently add another $282,416,400 to this sum.

Bitcoin recovers from below $22,000

On the same day, Dec. 21, the flagship currency showed a sudden reverse and plunged from the $23,800 area, losing around $2,000 to go below $22,000.

However, Bitcoin quickly recovered and, at press time, is sitting at $23,579 per figures from CoinMarketCap.

As the digital gold rate tanked, $789 million worth of crypto was liquidated across various digital exchanges, pushing BTC down.

Cryptocurrency whales also stirred and started to move mammoth-sized amounts of Bitcoin.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov