Grayscale Founder and CEO Barry Silbert has retweeted several posts about the recent crypto acquisitions made by his company.

According to data tables shared, over the past 24 hours, Grayscale Investments acquired 1,276.474621 Bitcoin and over 100,000 Ethers.

Grayscale gives its crypto holdings a boost: more BTC and ETH

According to the data shared by Silbert, on Dec. 9, Grayscale added $23,142,357 worth of Bitcoin (1,276.474621 BTC), and it acquired approximately $55,305,000 in Ethereum (over 100,000 ETH) in the past 24 hours.

Overall, during the last week, the "biggest Bitcoin buyer," as Peter Schiff referred to Grayscale recently, put a total of 13,232.30376 BTC into its crypto storage. That's a whopping $240,894,089.

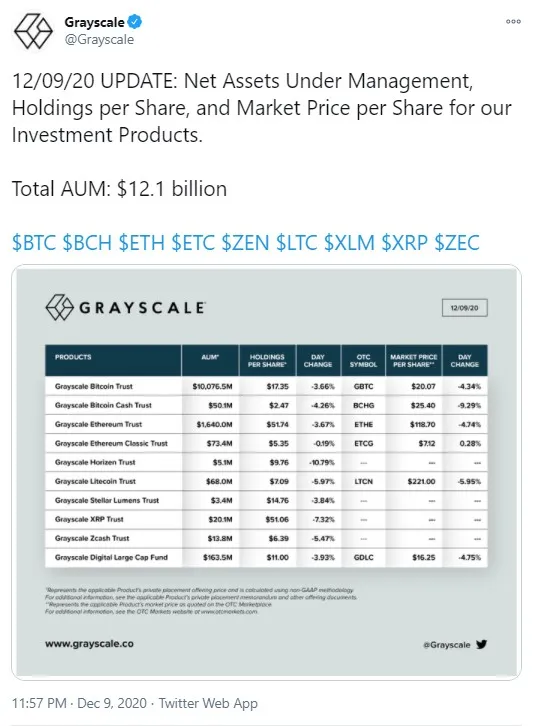

The total amount of ETH under Grayscale management is now worth $1.64 billion.

According to the data on Grayscale's Twitter page, the total amount of crypto under its management is $12.1 billion as of Dec. 9. Meanwhile, on Dec. 3, this amount totaled $12.6 billion in digital assets.

Grayscale sees Ethereum-first investors coming in

In a recent interview with Bloomberg, Grayscale's managing director, Michael Sonnenshein, stated that the company has recently seen an inflow of investors who view Ethereum as their number one digital asset.

Some of these investors are acquiring only ETH shares, not going for even the most popular crypto: Bitcoin.

Sonnenshein pointed out that the conviction around ETH as an asset class is increasing.

He assumed that this fast growing interest may have been caused by the aggressive DeFi growth this year and the Ethereum 2.0 zero phase launch on Dec. 1.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin