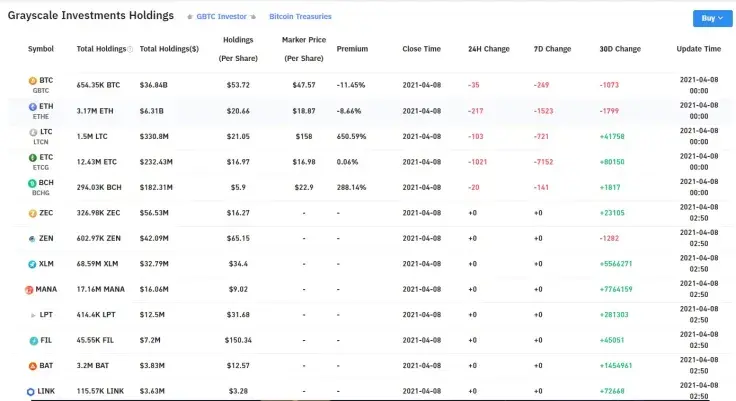

According to analytics website Bybt, over the past 30 days, the largest buyer of Bitcoin and other crypto assets, Grayscale, has acquired millions of altcoins that it has recently added as the basis for new trusts.

Grayscale adds eye-popping amounts of BAT, FIL, LINK, LPT, MANA

Data shared by analytics platform Bybt shows that, in the past 30 days, Grayscale Investments—related to Barry Silbert's Digital Currency Group—has purchased large amounts of altcoins, which now power the recently added cryptocurrency trusts.

The company has bought large amounts of altcoins on which the newest crypto trusts have been formed: BAT (1,454,961), MANA (7,764,159), FIL (45,051), LINK (72,668) and LPT (281,303).

Grayscale has also purchased 41,758 LTC ($9,380,517), 80,150 ETC ($1,517,267) and 5,566,271 XLM ($2,700,843).

As of today, Grayscale holds a total of $44.07 billion in crypto. This includes $36.84 billion in Bitcoin, $6.31 worth of Ethereum and $182.31 million in Bitcoin Cash.

Grayscale intends to convert its Bitcoin Trust into Bitcoin ETF

Four days ago, Grayscale Investments clarified the issue of whether it will or will not turn its leading investment product—Grayscale Bitcoin Trust—into a Bitcoin exchange-traded fund (ETF).

The company confirmed its firm intention to do just that, being "100 percent committed" to it.

The timing for making it happen will depend fully on regulators' actions. The company already tried to convert its Bitcoin Trust into a Bitcoin ETF in 2016 but had to withdraw its application over the regulatory hurdles the initiative faced back then.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov