Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Jurrien Timmer, director of global macro at Fidelity, claims that Bitcoin is “cheap” in a recent Twitter thread.

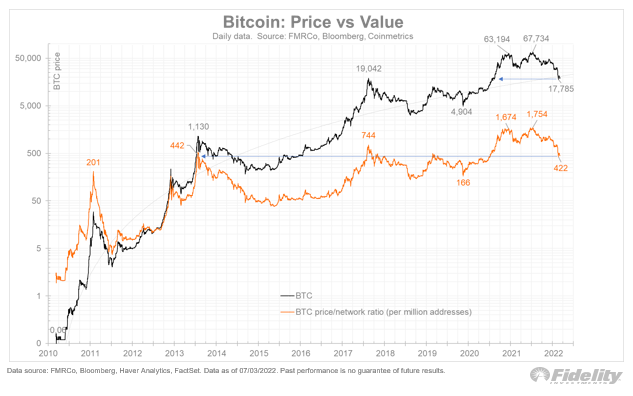

The executive has pointed to the fact that Bitcoin’s valuation is the lowest it has been since 2013.

At the same time, Timmer claims that Ethereum, the second-largest cryptocurrency, is even “cheaper” compared to Bitcoin at current prices.

The two largest cryptocurrencies are down 68.58% and 74.95%, respectively, from their record peaks, according to data provided by CoinGecko.

Timmer believes that Ethereum might be close to reaching the bottom of the correction.

Speaking of Bitcoin’s adoption, the executive believes that Bitcoin is following the internet adoption curve instead of “the more exponential” mobile adoption curve. This suggests that Bitcoin will experience more “modest” price appreciation in the future.

As reported by U.Today, Timmer recently drew parallels between Bitcoin and Apple in terms of their growth trajectory.

Fidelity, the first U.S. financial giant to adopt Bitcoin, remains bullish on the largest cryptocurrency in spite of the massive price correction.

Last month, Timmer pointed to the fact that Bitcoin’s price/network ratio was at the lowest level since 2017.

Earlier today, Bitcoin surged to $22,000, but the largest cryptocurrency gave up some of its gains due to the stronger-than-expected U.S. jobs data.

The cryptocurrency market remains under pressure due to the Federal Reserve's extremely hawkish monetary policy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov