Mutual fund giant Fidelity had a WebEx meeting with the U.S. Securities and Exchange Commission on Sept. 8 to push for approval of its Bitcoin exchange-traded fund, according to a recent filing.

Apart from Fidelity’s executives, the list of attendees included Kyle Murray, the vice president of Chicago-based futures exchange CBOE.

In the presentation, they put forward a variety of reasons as to why the product has to be approved by regulators.

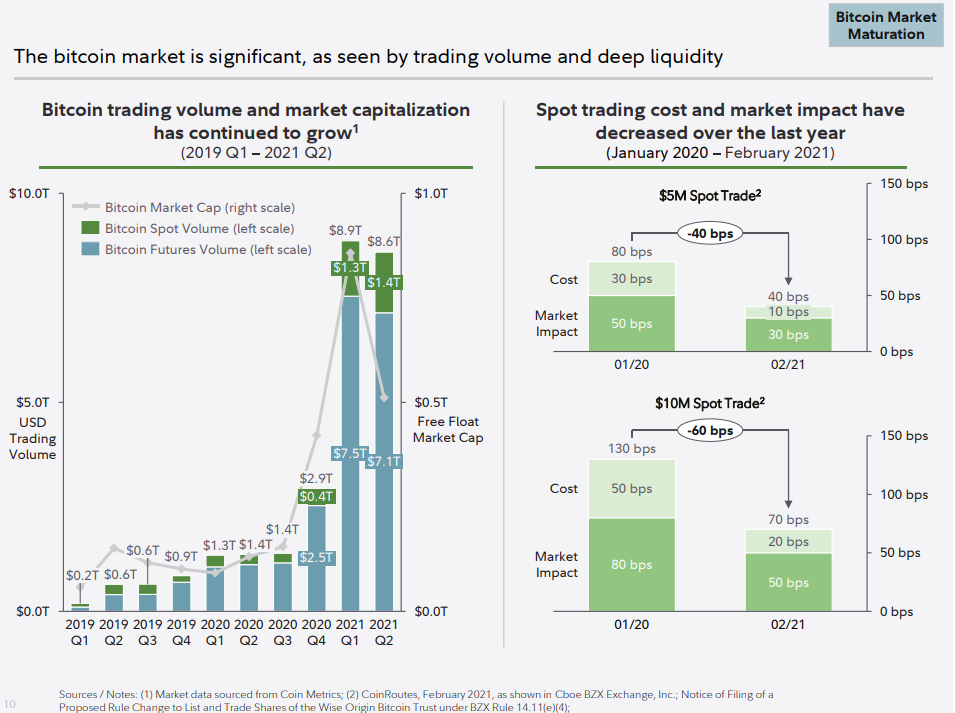

They point to that the fact that the Bitcoin market has matured, touting its significant trading volume and its deep liquidity.

They also mention that both Canadian and European exchange-traded funds and exchange-traded products.

Fidelity says that investors will benefit from the ability to have direct exposure to Bitcoin through ETPs.

While some analysts believe that the SEC might be more inclined to initially approve a futures-based ETF, the presentation says that it doesn’t necessarily have to be an interim step.

The mutual fund giant also highlighted its long-time commitment to Bitcoin. Fidelity started exploring the largest cryptocurrency all the way back in 2014, significantly outpacing other Wall Street giants.

In March, FD Funds Management, a subsidiary of the Boston-based company, filed to launch a Bitcoin ETF called the Wise Origin Bitcoin Trust.

As reported by U.Today, SEC Chair Gary Gensler said that he was looking forward to his commission reviewing a bunch of pending filings:

I'm looking forward to what staff says about these filings.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov