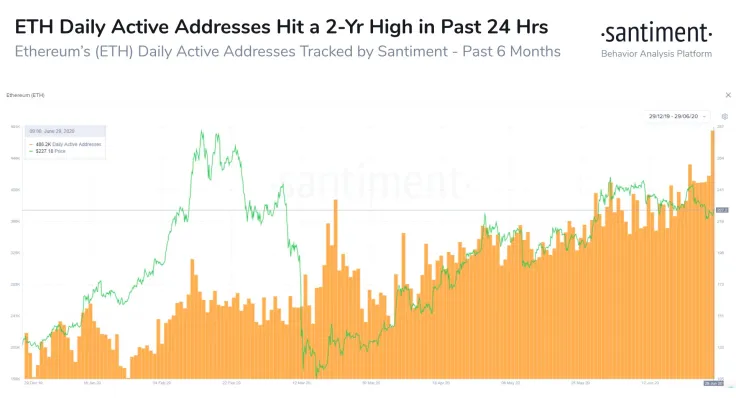

According to data provided by cryptocurrency research firm Santiment, the number of active Ethereum addresses has surged to a two-year peak of 486,000.

The last time the second-largest blockchain saw this king of address activity was in May 2018.

What’s bolstering Ethereum’s fundamentals?

Notably, the number of Ethereum wallet with at least 0.1 ETH recently touched a new all-time high.

Meanwhile, Ethereum continues to surpass Bitcoin for the third straight week in terms of daily fees paid on the translation network.

As reported by U.Today, this is attributed to the growth of the rapidly increasing issuance of Tether (USDT).

The ERC20 version of Tether represents the lion’s share of the stablecoin’s total supply. Tether users have to pay gas fees (thus, interact with the network) in order to perform USDT transactions.

With the value of the decentralized finance (DeFi) ecosystem reaching $1.66 bln, it’s also an important headwind for the growth of Ethereum transactions.

Tether outshines Ethereum

It is worth mentioning that surging Ethereum transactions are not necessarily a price foreshadower given that users choose to send stablecoins instead of Ether.

Back in May, the total value of ERC20 tokens was about to trump Ethereum on its blockchain.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun