Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

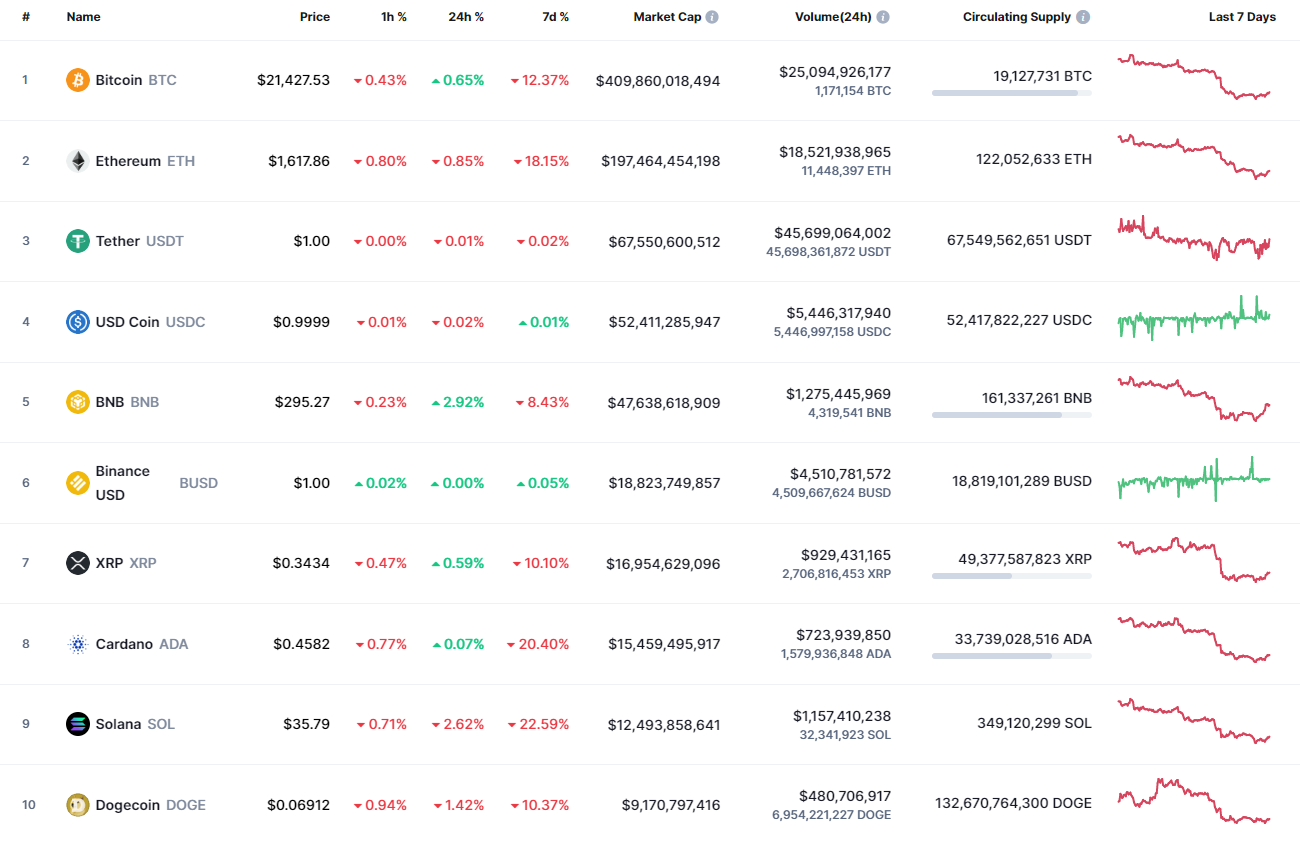

The cryptocurrency market is neither bullish nor bearish, according to CoinMarketCap.

ETH/USD

The rate of Ethereum (ETH) has gone down by 18.23% over the last week.

On the local time frame, Ethereum (ETH) has bounced off the $1,628 level. If buyers can't seize the initiative, there is a high chance to see a test of the $1,600 mark by the end of the day.

On the daily chart, Ethereum (ETH) is located in the middle of the narrow range between the support at $1,524 and the resistance at $1,655. Currently, neither side has accumulated enough power for a sharp move. Respectively, sideways trading around the mentioned levels is the more likely scenario for the upcoming week.

From the mid-term point of view, Ethereum (ETH) has made a false breakout of the support level at $1,560. Until the price is above it, bulls have a chance for an upward move. In addition, the selling volume is low, which means that bears are running out of strength.

Ethereum is trading at $1,608 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov