After the activation of EIP 1559 (periodic burn of Ethereum (ETH) fees based on network activity dynamics), Ethereum (ETH) became deflationary, as the number of tokens issued is lower than number of ETH burned. However, the dramatically low on-chain activity puts an end to this status of second largest cryptocurrency.

Ethereum (ETH) becomes inflationary thanks to market exhaustion

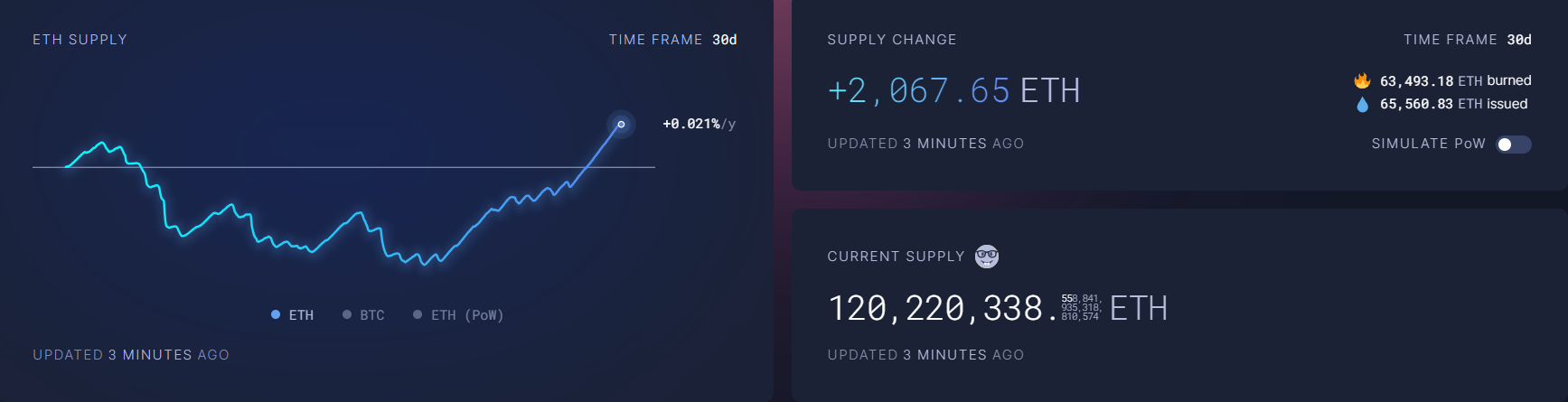

In the last 30 days, Ethereum (ETH) registered a net increase in the number of coins in its supply. A total of 63,490 Ethers (ETH) were burned, while 65,548 Ethers (ETH) were issued. As such, 2,058 "new" coins were added to Ethereum's (ETH) circulating supply, per statistics tracked by Ultrasound Money analytical dashboard.

After the activation of Ethereum's EIP 1559 mechanism, such periods of "inflationary" status occur periodically. The ongoing "dip," though, is a special one: the Ethereum (ETH) burn rate declines faster, so the delta between the "ETH issued" and "ETH burned" numbers increases aggressively.

In the past year, the Ethereum (ETH) supply has fallen by over 300,000 ETH thanks to the activation of EIP 1559. The ongoing anomaly should be attributed to super-low activity of Ethereum (ETH) accounts.

According to multiple trackers, ETH gas metrics are close to 2023 lows or have even dropped below them. For instance, CoinMetrics sees a mean ETH fee below $2.5, which is the lowest level since January 2023.

One OpenSea sale can therefore be confirmed for as low as $3, while on-chain swaps via Uniswap (UNI) will be charged with $7.6.

MEV bot became top Ethereum (ETH) gas spender

Amid the apathetic performance of on-chain actors, MEV bot becomes the most productive spender of Ethereum (ETH) gas. As covered by U.Today previously, Jared From Subway, the operator of the most effective MEV bots, paid over $70 million in gas since being launched in February 2023.

The bot made over 1.1 million transactions but paid more in gas fees than the wallets of exchanges that used Ethereum (ETH) 10 times more frequently.

Per the statistics, during periods of pale market performance, Ethereum (ETH) MEV bots — mechanisms for frontrunning transactions by paying extra gas fees — might be responsible for 80-90% of top DEXes' trading volumes.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov