Ethereum (ETH), the largest smart contract hosting platform, has activated its London hardfork. This update that includes controversial EIP 1559 went live on Aug. 5, 2021, at 12:39 a.m. UTC.

EIP 1559 implemented. What does that mean?

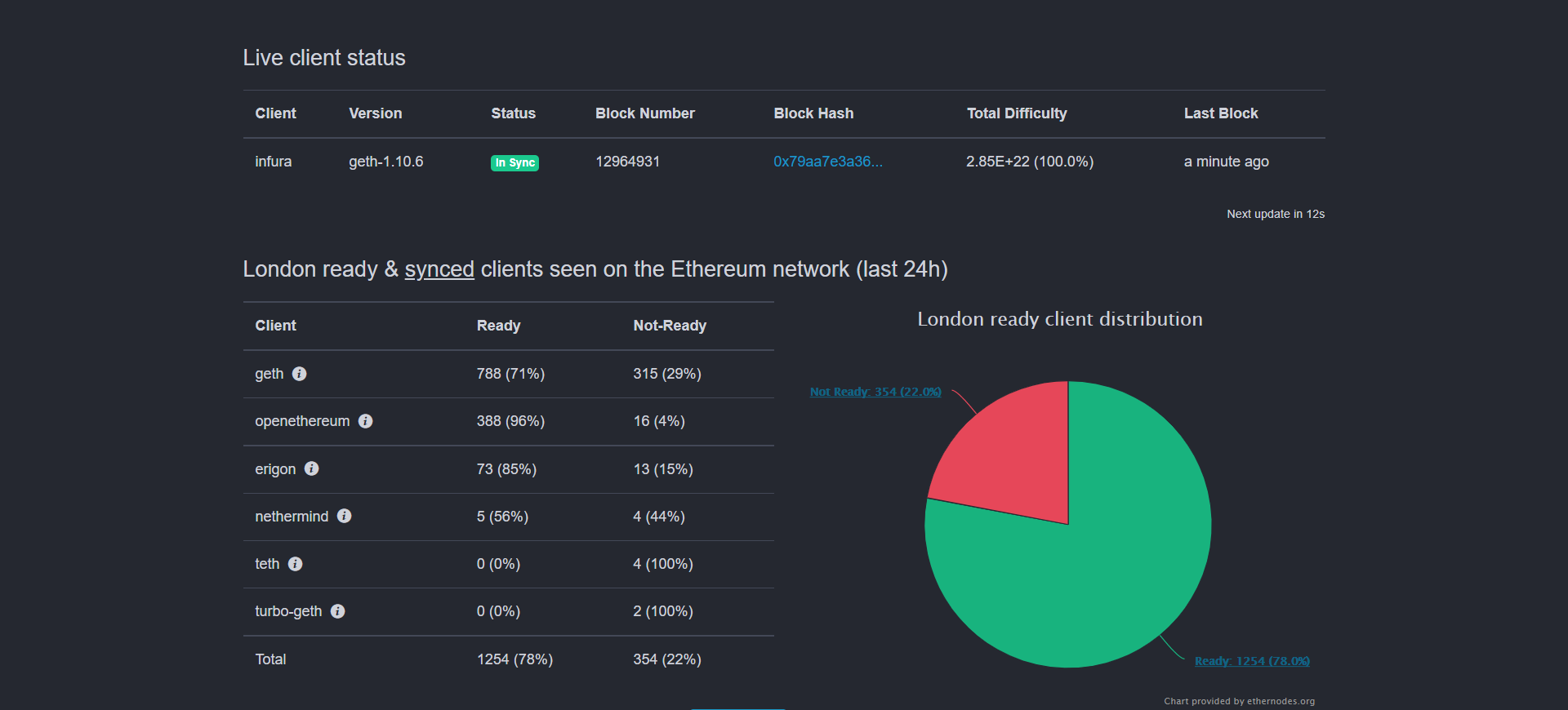

According to publicly available trackers, Ethereum (ETH) mainnet has activated London hardfork. Now, the Ethereum (ETH) node consensus is changed.

Ethereum's (ETH) London comes with five updates (Ethereum improvement proposals, or EIPs), but the most highly anticipated is EIP 1559.

First ETH burned pic.twitter.com/yUNXW6Lbw3

— Alex Svanevik ✨ (@ASvanevik) August 5, 2021

EIP 1559 reshapes the design of Ethereum's fee mechanism. Instead of its previous auction-based model in which users pay maximum fees to have their transactions included, the faster, post-London Ethereum (ETH) boasts a dual model.

Now, to authorize a transaction, a user is required to pay a miner "base fee" and "tips." Base fees are periodically destroyed (burnt).

While the "tips" rate can be adjusted by the dApp user or Ether holder, the "base fee" rate is adjusted by the consensus itself. When the block is more than 50 percent full, the "base fee" rate increases.

Next milestones for post-London Ethereum (ETH)

Ethereum (ETH) London is among the latest crucial updates to proof of work (PoW) Ethereum. The "merge," i.e., the first phase of ETH1-ETH2 transition is in the cards now.

Also, in late December 2021, Ethereum (ETH) mining may come to an end. Researchers at the Ethereum Foundation estimate that miners should move their businesses to a proof of stake (PoS) model prior to this term.

So, with London activated, is Ethereum (ETH) finally a deflationary asset?

Why did it take so long to activate this update if it is so important?

Who opposed EIP 1559?

Be sure to check out our latest comprehensive guide!

Dan Burgin

Dan Burgin Tomiwabold Olajide

Tomiwabold Olajide Godfrey Benjamin

Godfrey Benjamin Caroline Amosun

Caroline Amosun