Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Just yesterday, the price of Dogecoin (DOGE) was rising, and whales were stuffing their bags with the popular meme cryptocurrency, as today the situation has changed dramatically.

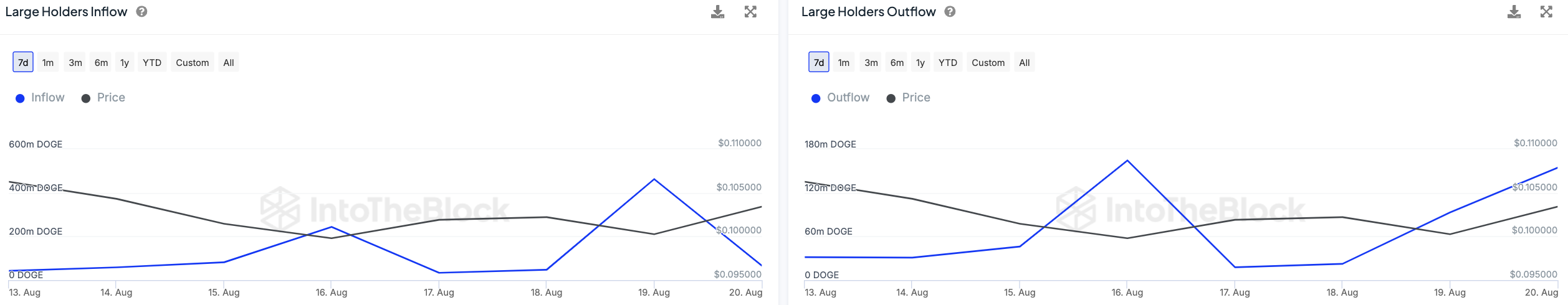

As indicated by on-chain data from IntoTheBlock, the netflow of DOGE to wallets of large holders has decreased from 369.46 million tokens to -88.01 million. To put this into perspective, in the past 24 hours, 457.47 million DOGE, which is equivalent to around $46 million, has flowed out from the wallets of big holders.

As a general rule, any holder with more than 0.1% of the circulating supply is considered a large holder, or whale. The net change in inflows and outflows for these addresses is tracked by the Large Holder Netflow metric. When declines in netflow occur, they signal a significant reduction in holdings or selling activity by large investors.

These dips indicate a change in bias as major players reduce their positions, which often precedes a bearish trend.

Pump, dump or bump?

Interestingly, just the previous 48 hours saw an almost 1,500% surge in netflow, while the next day saw a sell-off. This is further confirmed by separate metrics of inflows and outflows.

Thus, in the period under review, the figure of inflows decreased by 85.6% to 66.21 million DOGE. At the same time, the amount of Dogecoin flowing out of the wallets of major holders totaled 154.22 million DOGE, which is 66% more than the day before.

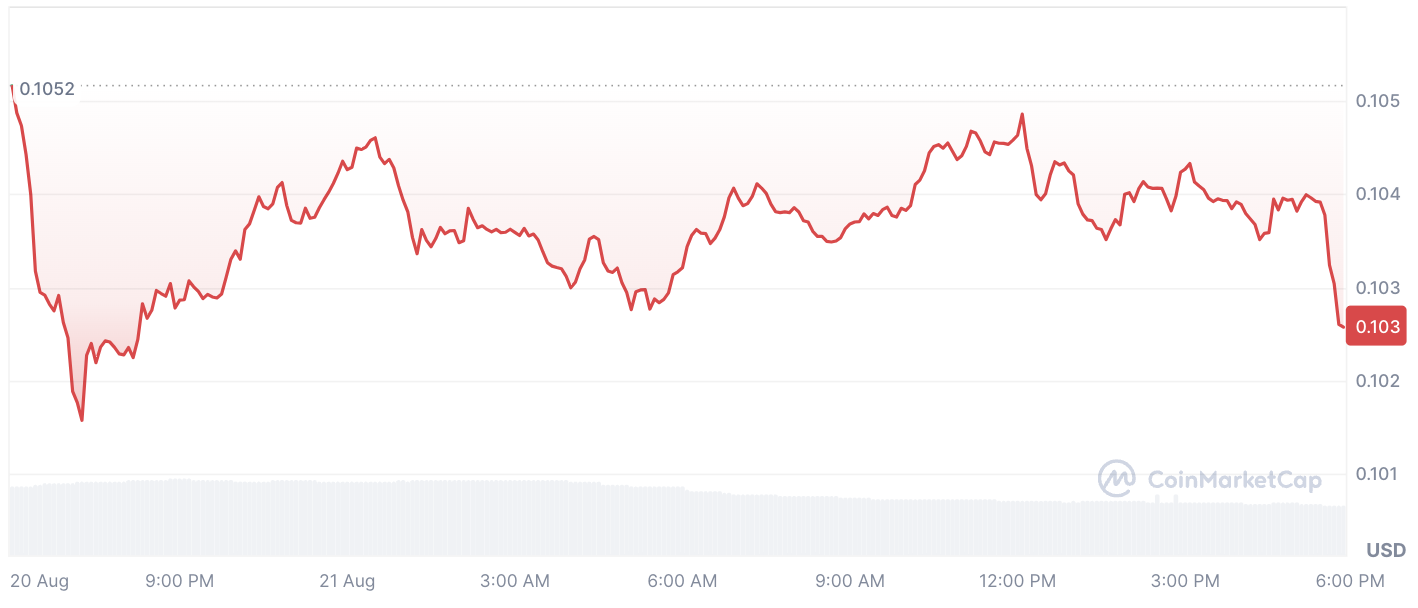

As for the price of the meme cryptocurrency, it soared by 7% yesterday to $0.106 per DOGEbut then dumped by 4.2%. Later, it was also accompanied by a series of micro pumps and dumps, but generally this price action is nothing more than a chop.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov