Barry Silbert's crypto venture capital behemoth Digital Currency Group is set to invest up to $750 million into the shares of Grayscale Bitcoin Trust, according to a May 3 press release.

In early March, DCG announced its initial plan to purchase $250 million worth of GBTC stock.

Grayscale's parent company is not obliged to actually buy any shares. The timing of purchases, if any, will depend on various factors such as the size of its cash pile and market conditions, the press release reads:

The share purchase authorization does not obligate DCG to acquire any specific number of shares in any period, and may be expanded, extended, modified, or discontinued at any time. The actual timing, amount and value of share purchases will depend entirely upon a number of factors, including the levels of cash available, price, and prevailing market conditions.

Advertisement

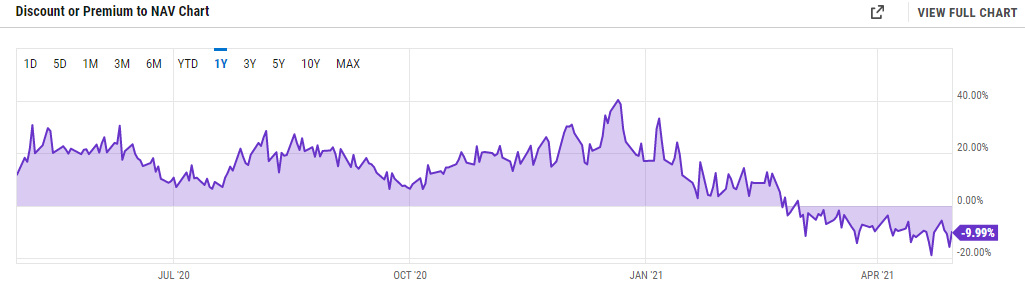

The negative premium continues to persist

While Grayscale remains mum about why it plans to make such a massive buyback, there is some speculation that it is likely related to the fact that GBTC shares have been trading at a negative premium for several months.

On April 22, the trust recorded a record 18.92 percent discount, as per data from YCharts. At press time, the premium stands at -9.99 percent.

As reported by U.Today, Grayscale also confirmed its intentions to convert the trust into an exchange-traded fund last month.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin