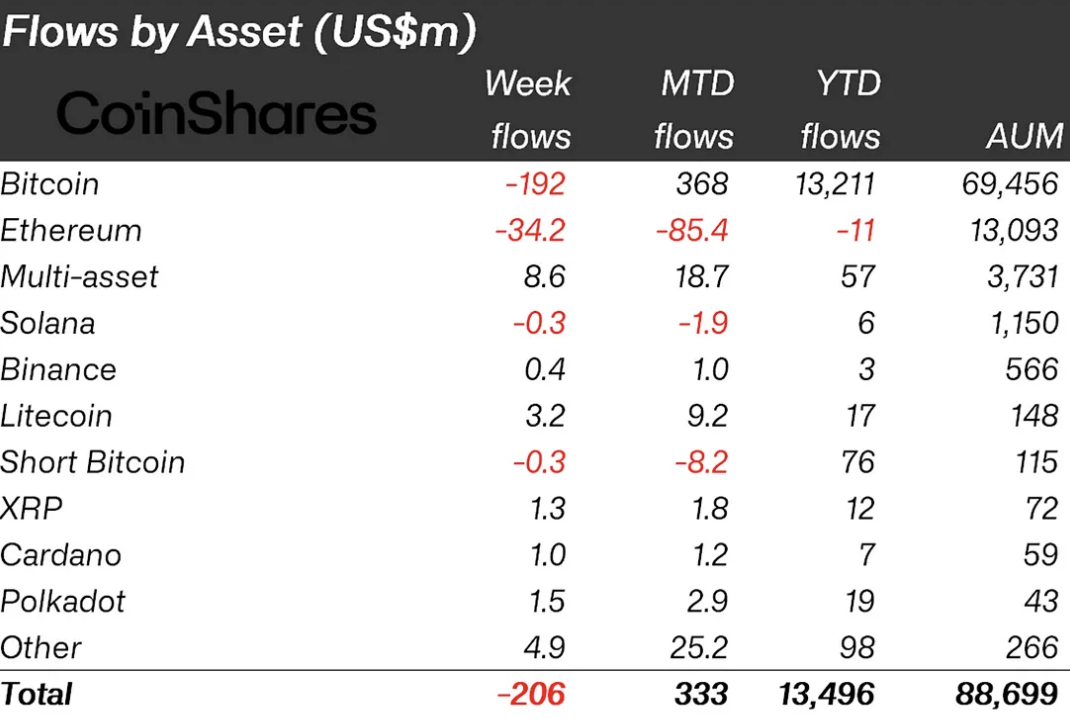

In a recent revelation by CoinShares, Cardano (ADA) has emerged as a frontrunner on the cryptocurrency market, witnessing a staggering 500% surge in fund flows within the past week. The weekly report on fund flows in cryptocurrency-focused investment products revealed that investments tied to Cardano reached a remarkable $1 million mark, marking a significant shift in investor sentiment toward the 10th largest capitalized cryptocurrency.

This surge in investment comes on the heels of a stagnant period, where Cardano-centric investment products experienced a lack of movement in the preceding week, with neither inflows nor outflows recorded. Just two weeks prior, in early April, Cardano ETPs had attracted a relatively modest sum of just over $200,000, making the recent surge all the more striking.

Since the outset of 2024, a total of $7 million has flowed into Cardano-oriented investment products, positioning ADA token as a prominent player among the top altcoins. Despite facing stiff competition from rivals such as Solana (SOL) and Binance Coin (BNB), Cardano has managed to maintain its edge on the market.

The Cardano ETP market boasts a diverse array of investment solutions, including offerings from prominent providers such as 21Shares, WisdomTree, CoinShares and ETC Group. This diversity reflects the growing appeal of Cardano among institutional and retail investors alike.

Meanwhile, the broader digital asset investment landscape has seen consecutive weeks of outflows, totaling $206 million. This trend, coupled with a slight dip in trading volumes for ETPs, suggests a waning appetite among investors.

Speculation regarding the Federal Reserve's stance on interest rates likely contributes to this subdued sentiment, with expectations of prolonged high rates dampening investor enthusiasm.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov