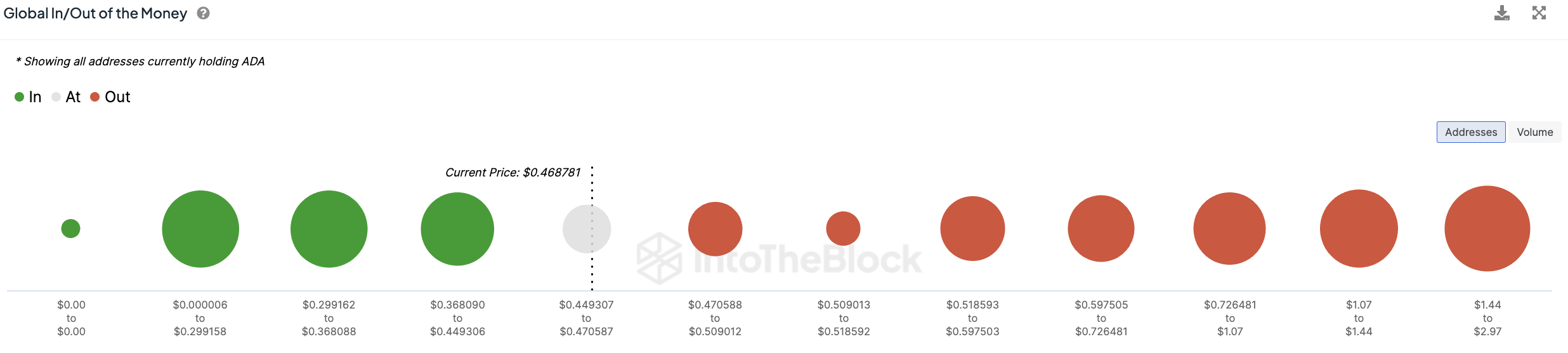

A recent report by data analytics firm IntoTheBlock has spotlighted a concerning trend in the Cardano (ADA) ecosystem: a significant portion of ADA holders find themselves in the red. The analysis delves into the profitability of holders across various layer-1 networks, revealing stark disparities.

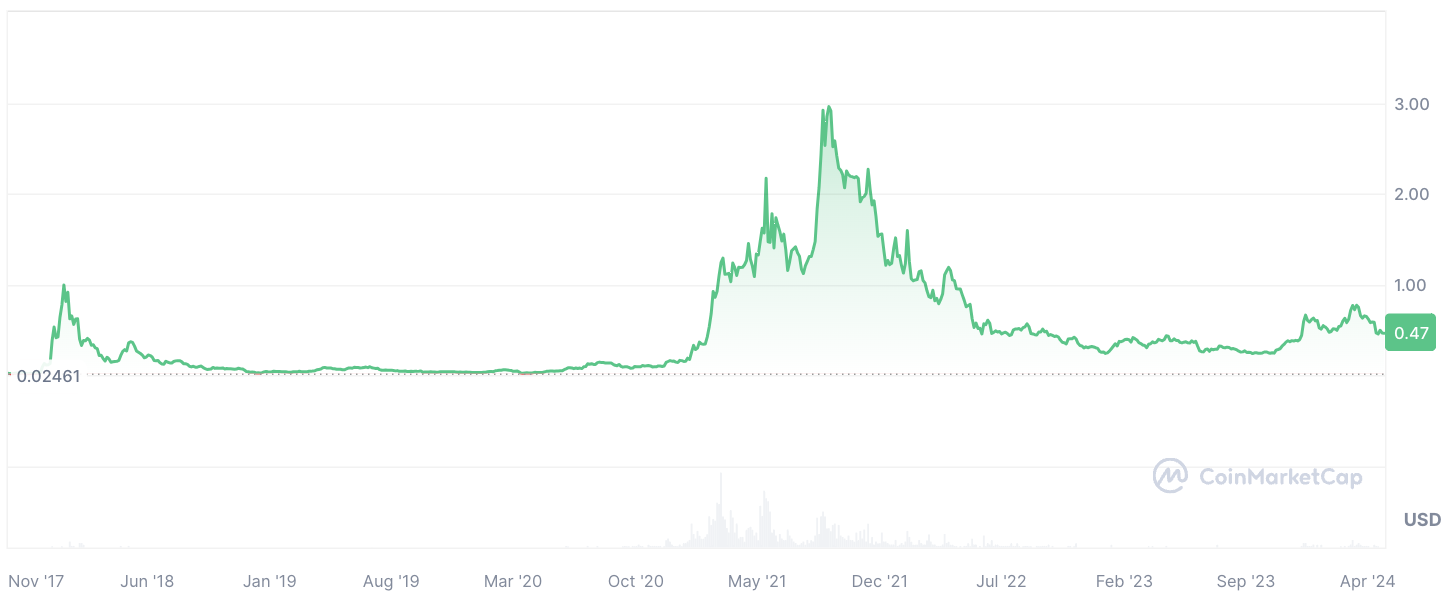

Bitcoin emerges as the undisputed leader, boasting a high percentage of holders in profit, closely followed by TRX. Notably, Dogecoin (DOGE) and Ethereum (ETH) also demonstrate robust profitability among their holders. However, Cardano stands out starkly, with a mere 35% of its holders currently seeing green.

Delving deeper into the data, it becomes apparent that the profitability of ADA addresses is under strain. Among the 1.59 million addresses holding 14.07 billion ADA, a substantial portion — 5.71 billion ADA — were purchased at prices ranging from $0.000006 to $0.299162 per token.

Conversely, a staggering 2.73 million addresses are experiencing losses, holding 20.07 billion ADA, particularly stemming from purchases made between $0.5975 and $0.7265 per ADA.

Presently, 152,940 addresses find themselves at break even point, with 947.87 million ADA collectively held. This intricate web of data prompts varied interpretations. On the one hand, the mounting losses incurred by Cardano holders exert significant downward pressure on the cryptocurrency's price.

Yet, on the other hand, it hints at a potential undervaluation on the market, suggesting the possibility of a substantial revaluation should positive developments arise unexpectedly.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya