Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

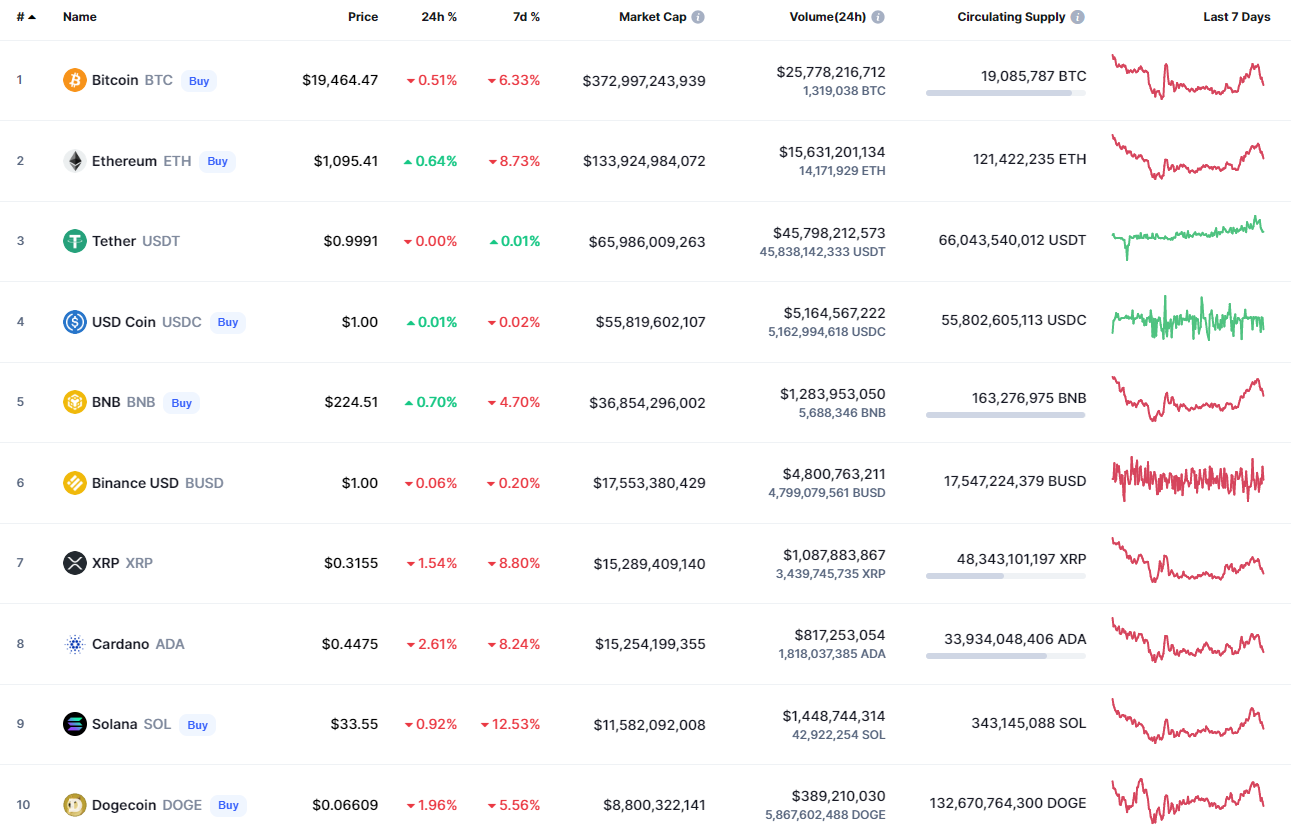

After a few days of growth, the market has faced a slight correction as some coins are trading in the red zone.

BTC/USD

Bitcoin (BTC) could not conitnue yesterday's rise, falling by 0.71%.

Bears have almost absorbed yesterday's bullish candle, however, the situation might still change until the end of the day. At the moment, one should pay close attention to the $19,000 mark. If buyers can hold this level, there is still a chance of an upward move to the $21,000 zone soon.

Bitcoin is trading at $19,420 at press time.

ETH/USD

Ethereum (ETH) fell together with Bitcoin, shedding roughly 1.75%.

The price of Ethereum (ETH) has declined after the false breakout of yesterday's peak at $1,160. The selling volume is high which means that bears are not going to give up so easily. In this case, if the pressure continues and the daily candle fixes near the $1,050 mark, sellers could seize an opportunity to push the price lower.

Ethereum is trading at $1,081 at press time.

XRP/USD

XRP is underperforming Bitcoin (BTC) and Ethereum (ETH) as the price of the altcoin has decreased by 2.91%.

XRP is already trading near yesterday's low at $0.3139, confirming the fact that the coin is weaker than other cryptocurrencies. If buyers lose the support level at $0.31, one can expect a sharp drop to the $0.305-$0.31 zone until the end of the week.

XRP is trading at $0.31435 at press time.

BNB/USD

Binance Coin (BNB) is the best-performing coin on the list today as the decline has accounted for 0.67%.

Despite the current decline, BNB has not updated yesterday's low, which means the power of the native exchange coin against the market correction. If bears could not get to the $220 mark until the end of the day and fix below it, buyers might seize an opportunity tomorrow.

BNB is trading at $224.3 at press time.

ADA/USD

Cardano (ADA) could not show the same strength as BNB, falling by 4%.

Cardano (ADA) is looking weaker than most other coins as it has not shown any bounce back. At the moment, the altcoin has accumulated enough power for a further sharp move. If the candle fixes at the $0.44 mark, there are chances to see the breakout of the support level at $0.4359 within the next few days.

SOL/USD

Solana (SOL) is not an exception from the rule, losing 1.1% of its price share since yesterday.

Sellers have come back the rate of SOL to yesterday's low which means that the coin might not accumulate enough effort for the continued rise. Thus, the price is far away from the resistance level at $37, confirming the bulls' weakness. Respectively, sideways trading between $33 and $35 is the more likely scenario.

SOL is trading at $33.52 at press time.

AVAX/USD

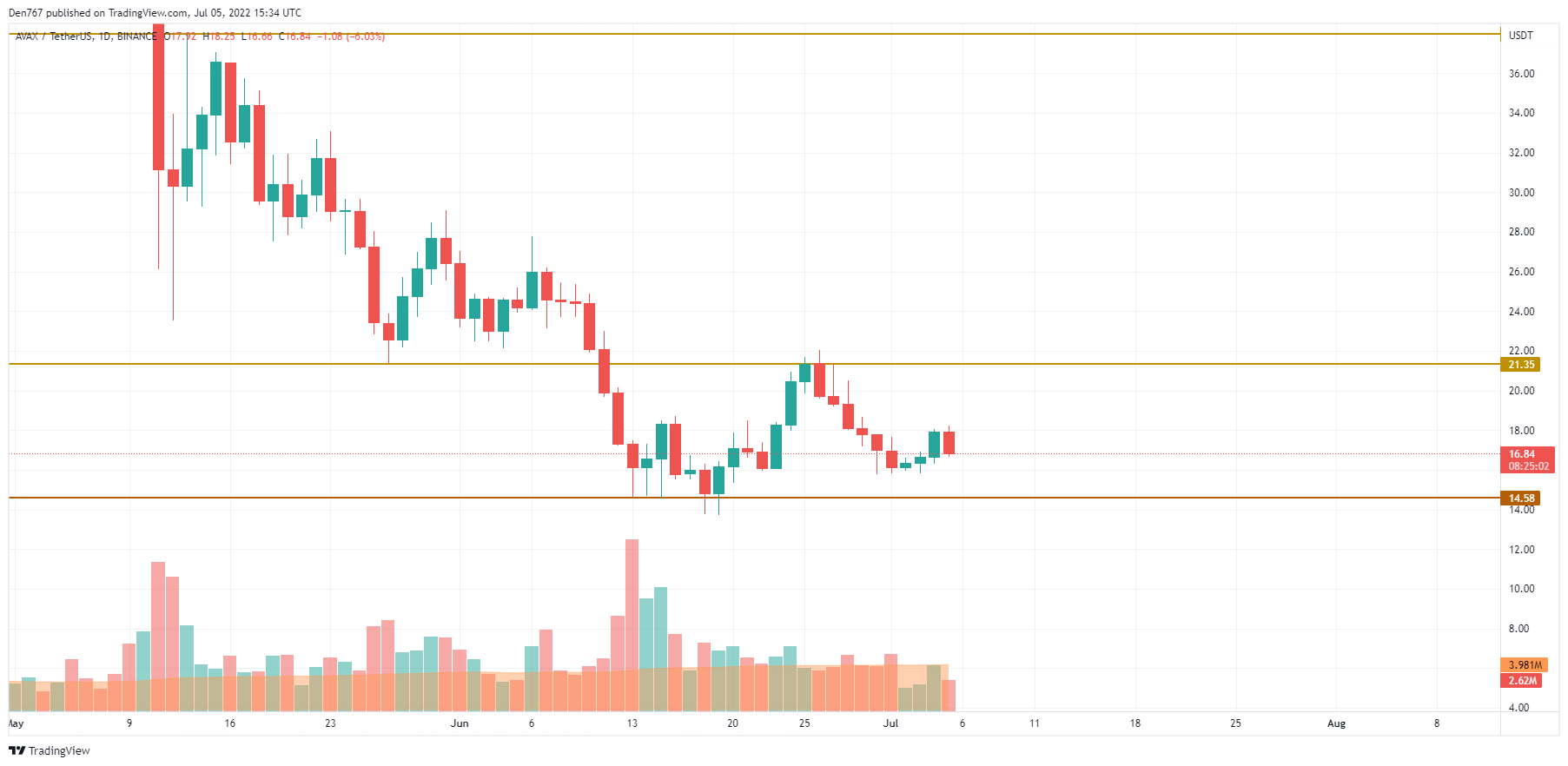

Avalanche (AVAX) is also going down by 0.72% over the last day.

AVAX is trading similar to SOL as the rate could not go up after yesterday's bullish candle. Thus, the rate is coming back to the support level at $14.58, confirming the bears' power. If buyers cannot hold the $16 mark, the mid-term fall may continue.

AVAX is trading at $16.88 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov