Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

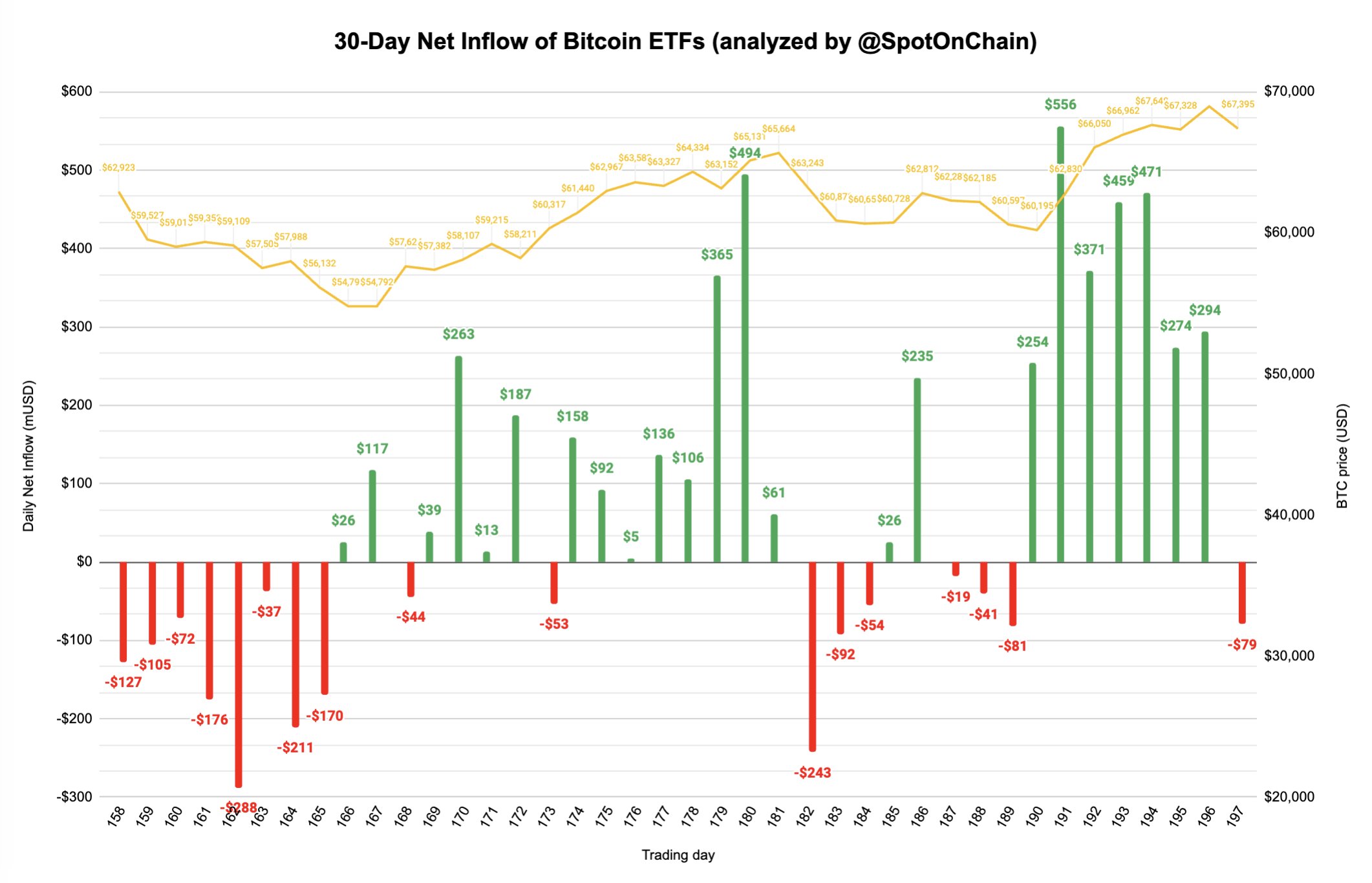

On Oct. 22, net outflows from spot Bitcoin ETFs reached $79.1 million, a sharp contrast to the inflows of $294.3 million seen in the previous trading session. Meanwhile, Ethereum spot ETFs recorded a modest inflow of $11.9 million, recovering from the prior session’s outflow of $20.8 million.

The latest report from Spot on Chain highlights the market's shift, with U.S. Bitcoin ETFs experiencing outflows after seven consecutive days of strong inflows. Despite Bitcoin hovering around $67,200, BlackRock's IBIT continued its aggressive accumulation, adding 22,480 BTC, worth $1.51 billion, over the last week, bringing its total holdings to 392,121 BTC.

This development comes just days after a CoinShares report revealed significant inflows into crypto ETPs, with $2.2 billion entering the market, marking the largest inflows since July.

However, the shift in Bitcoin ETF flows, despite Ethereum's gains, has exposed cautious market sentiment. Outflows, while below $100 million, have added to concerns that investors are growing wary of the cryptocurrency market.

Bitcoin (BTC): Price outlook

Bitcoin’s price action has added to the uncertainty, as the leading cryptocurrency continues to lose key support levels. Currently, it appears set to retest the dynamic resistance around the $65,000 zone.

The broader altcoin market has also suffered, with the TOTAL2 index, which tracks the market capitalization of non-Bitcoin cryptocurrencies, declining by over $40 billion since the start of the week.

Despite BlackRock's significant buying activity, market participants remain cautious, reacting sensitively to any market news. The recent outflows suggest that confidence is still shaky, even as major institutional players like BlackRock maintain a strong presence.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov