Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin bulls have failed to gain practically any ground over the last few months, but this long streak of lethargic price action makes some market observers optimistic about where the biggest cryptocurrency is heading next.

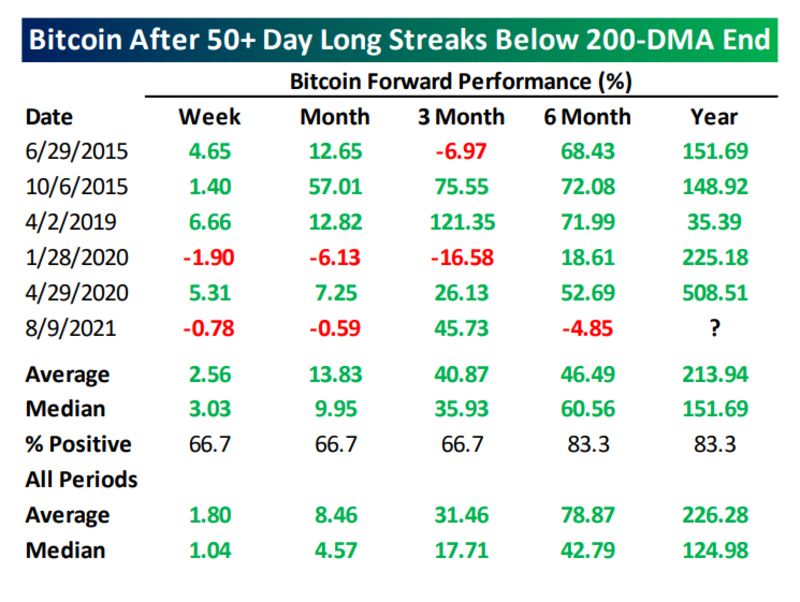

Jake Gordon, Bespoke Investment Group’s analyst, has noted that Bitcoin may be close to bottoming given how it has remained below its 200-day moving average (MA).

Typically, Bitcoin tends to generate significant returns after staying below the aforementioned MA for a prolonged period of time. Bespoke Investment Group has estimated that the average return after at least a 50-day bearish streak is roughly 31%. The average annual return stands at an impressive 226%.

Bitcoin has now been sitting below the 200 MA for 70 consecutive days, one of the longest streaks on record.

In fact, the flagship coin is also below its 100-day and 50-day moving averages, which indicates oversold conditions.

Bitcoin is down 44.18% from its record high. The largest cryptocurrency is currently trading at $38,600 on major crypto exchanges.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin