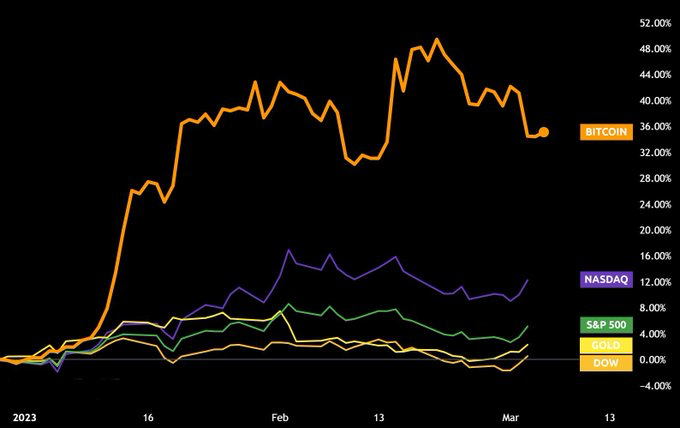

Bitcoin, the flagship cryptocurrency, has outperformed the tech-heavy NASDAQ as well as the S&P 500 and Dow Jones indices, according to data from MarketWatch.

As of March 6, Bitcoin's year-to-date return stood at 32.23%, far exceeding the performance of the major stock indices and gold.

The NASDAQ Composite gained 12.41%, the S&P 500 rose 5.86%, and the Dow Jones edged up by 0.12% this year.

Meanwhile, gold had a YTD return of only 1.17%, greatly underperforming Bitcoin.

Bitcoin and other cryptocurrencies remained relatively unchanged on Monday, holding at their lowest levels since early February.

The recent sluggish performance of the bellwether cryptocurrency is linked to concerns about growing regulatory pressure.

The recent implosion of crypto-friendly bank Silvergate Capital has raised fears that crypto businesses may struggle to access banking services in the US.

Additionally, increasing investor concern about inflation and interest rates may also be influencing demand for digital assets.

Technical analysis shows that the "death cross" phenomenon is occurring in Bitcoin's chart, which could indicate a bearish outlook for the near term.

The stock market had a mixed day on March 6. The stock market is currently awaiting Federal Reserve Chair Jerome Powell's congressional testimony on monetary policy, which is expected to guide investors and lawmakers on how the central bank is thinking about inflation and its rate-hiking campaign.

Gold, which is often seen as a safe-haven asset, had a weekly gain of around 0.54% as of March 6.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov