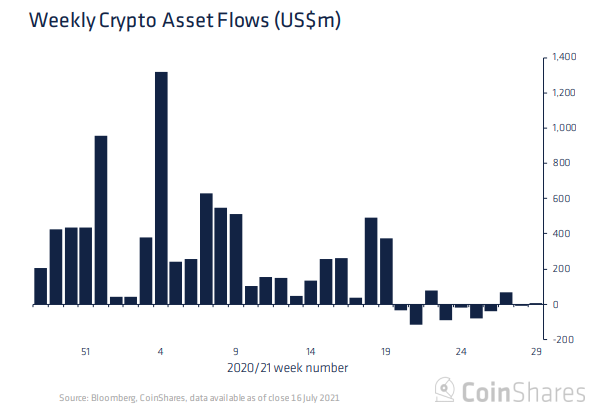

According to data provided CoinShares, Bitcoin funds and products have so far recorded $15 million worth of outflows in July.

Last week alone, the largest cryptocurrency logged $10.4 million of outflows, with institutional investors seemingly remaining bearish due to the dire technical picture.

Bitcoin recently recorded its lowest close since December 2020 before plunging to $30,400 earlier today.

With such bearish sentiment, it’s not surprising that Bitcoin funds keep bleeding funds.

With that being said, inflows for 2021 still stand at an impressive $4.2 billion because of the massive first quarter.

Altcoins see more love from investors

Institutions feel more upbeat about altcoins, with the overall cryptocurrency sector recording $2.9 million of net inflows.

Ethereum managed to attract $11.7 million worth of capital last week. The largest altcoin has now recorded three consecutive weeks of inflows ahead of its much-anticipated “London” hard fork.

Other altcoins, such as Polkadot, XRP, and Cardano, managed to finish the last week in the green with meager inflows.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Gamza Khanzadaev

Gamza Khanzadaev