The year 2025 continues to be a wild ride for the cryptocurrency market, and Bitcoin (BTC) in particular. From crazy back-to-back price swings of 10% each, liquidations of no less than $1 billion almost every weekend, and major events like the creation of the Strategic Bitcoin Reserve by the United States of America, not many understand where this market is going.

It is safe to say that instability is the most stable thing on the market right now. What is bad about it is that in a period of such uncertainty, not many investors prefer to be involved in a roller coaster and, judging by recent trends, feel better on the sidelines. This tendency is quite noticeable when you take a look at the Bitcoin ETF space.

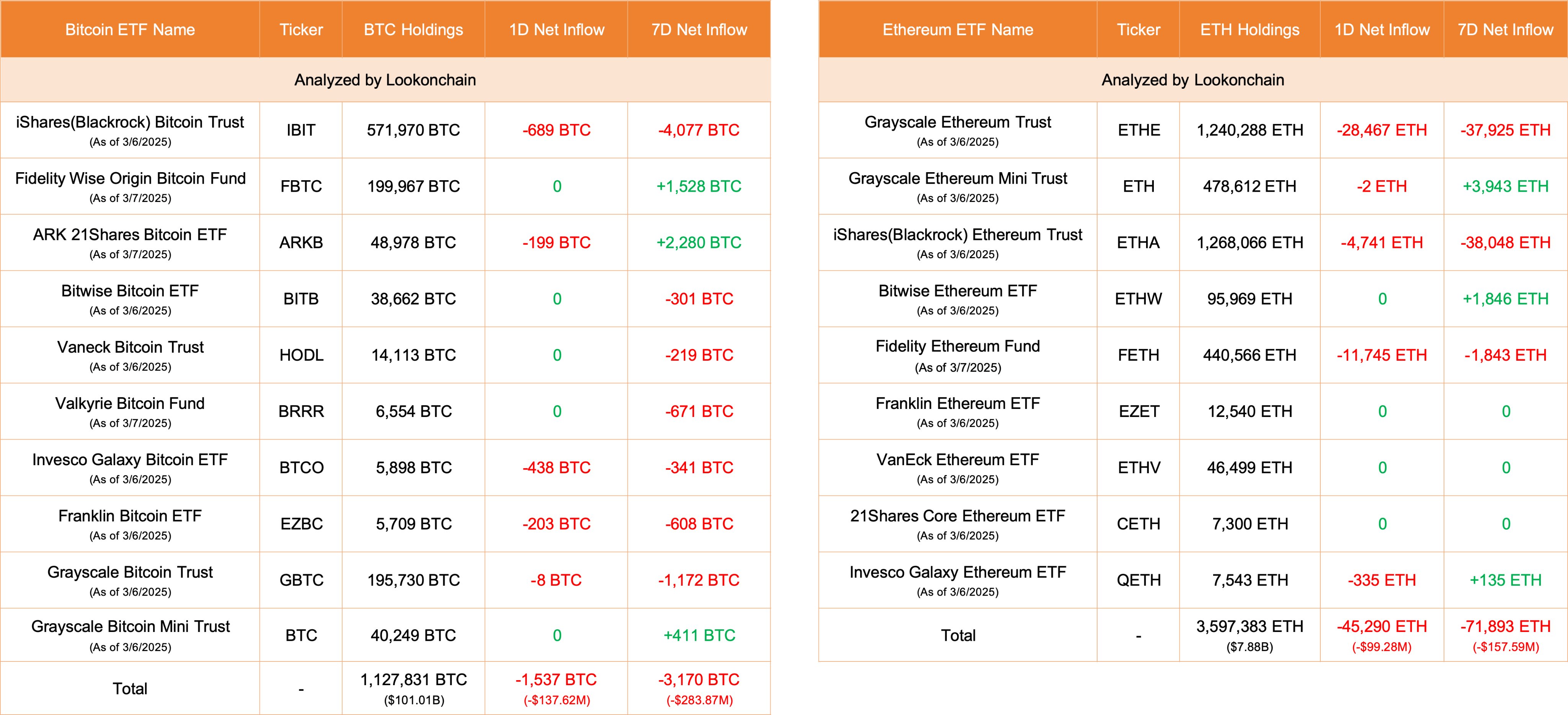

For example, according to the latest data presented by Lookonchain, in the last 24 hours, these crypto-oriented investment products experienced another round of outflows with a net figure of -$137.62 million, or -1,537 BTC in equivalent.

It was just last week when the market saw over $2.9 billion in outflows, and it seems that this trend has not yet reversed.

The largest outflows over the course of the last day were observed in IBIT, a Bitcoin ETF from BlackRock. During the period under review, the $10 trillion financial mastodon lost 689 BTC from its accounts, which is about $61.7 million.

This figure reflects the actions of IBIT ETF holders, who were actually selling.

As it stands, BlackRock still owns 571,970 BTC, which is worth $51.23 billion at current prices. The total for all Bitcoin ETF issuers is almost double that - 1,127,831 BTC, or $101 billion.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov