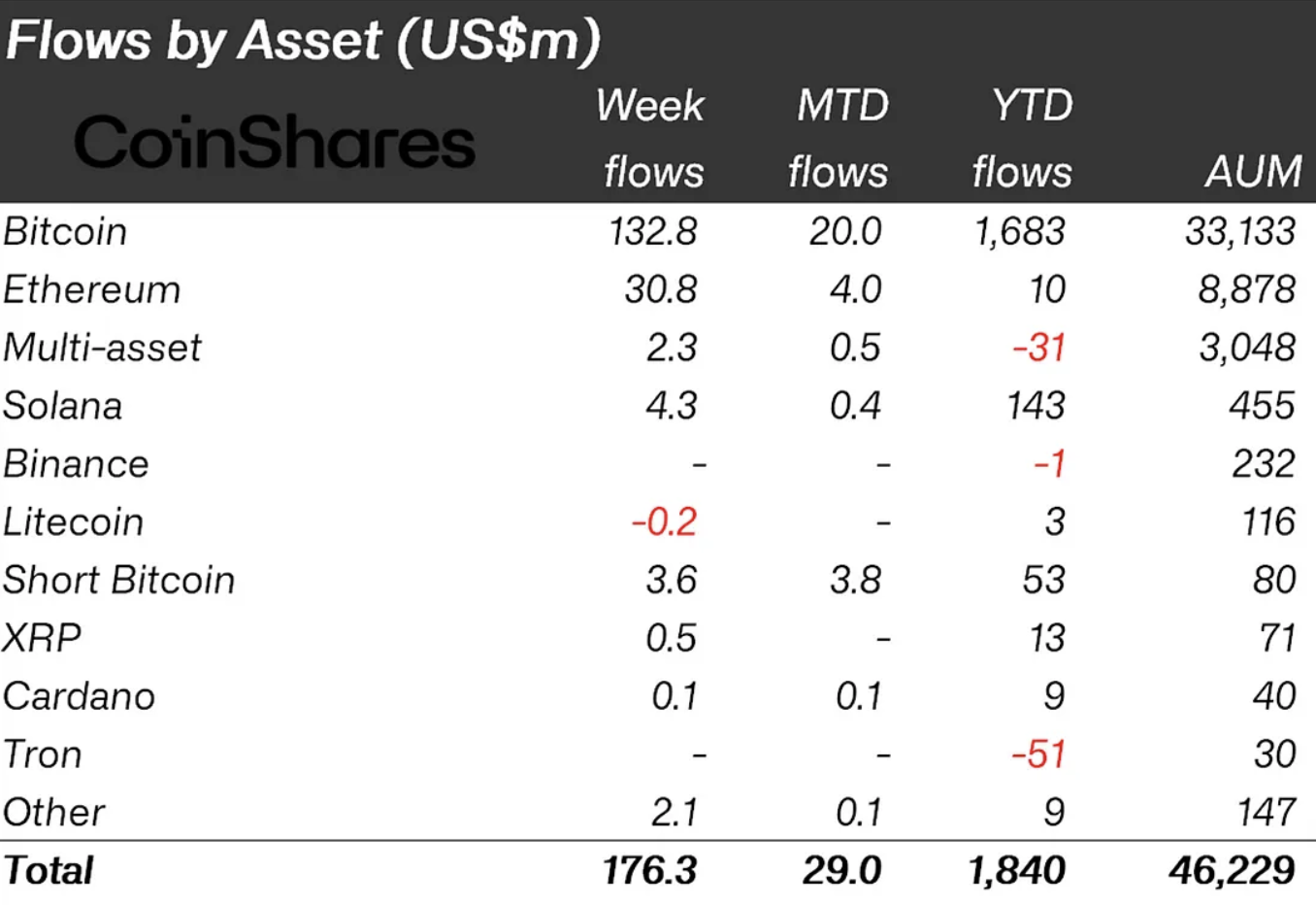

In a major bullish stride reminiscent of the 2021 crypto boom, the latest data from CoinShares reveals that digital asset investment products experienced an impressive surge, with inflows reaching a staggering $176 million last week.

This marks the 10th consecutive week of inflows, bringing the cumulative total to an impressive $1.84 billion.

The primary driver of this surge was Bitcoin, attracting a substantial $133 million in inflows. Notably, Short-Bitcoin, after a three-week spell of outflows, witnessed a resurgence, with $3.6 million flowing in last week.

XRP-focused exchange-traded products (ETPs) also saw a noteworthy uptick, with over half a million dollars flowing into these instruments. While the amount may seem modest, it represents a doubling from the previous week.

Year to date, XRP ETPs have accumulated $13 million, positioning it as the third-best performer among altcoins, trailing only Ethereum (ETH) and Solana (SOL).

Ethereum continued its positive momentum, securing inflows of $134 million in a monthlong streak. This marks a significant turnaround as net flows for Ethereum turned positive for the first time this year, following an extended period of negative sentiment.

It can be considered that the current influx of funds represents the most substantial bull run since October 2021, coinciding with the launch of futures-based ETFs at that time.

However, despite a remarkable 107% increase in assets under management this year, reaching $46.2 billion, the total remains below the all-time high of $86.6 billion recorded in 2021.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov