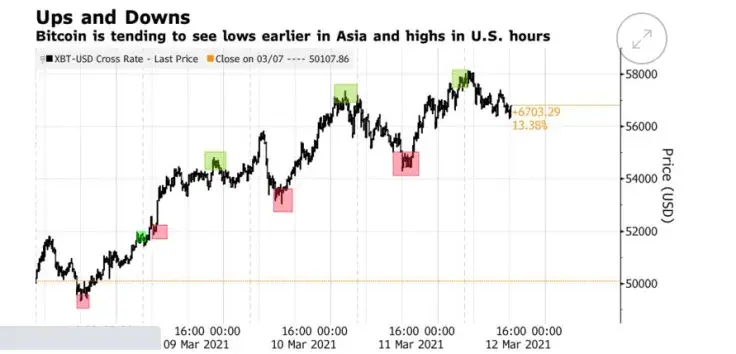

Bloomberg's Joanna Ossinger analyzed recent intraday Bitcoin (BTC) price performance and revealed its strong correlation with European, Asian and U.S. market sessions.

"Selling coming out of Asia"

According to her article, Bitcoin (BTC) price lows coincided with the start of the Asian trading session. For instance, on March 9, 2021, the intraday low was registered right at the start of the Asian session.

Most likely, sellers come to the market during the Asian workday to sell newly mined Bitcoins (BTC) while buyers purchase them during "U.S. hours."

Ruchar Byworth, CEO of Diginex Ltd digital assets company, told Bloomberg that, in his estimation, selling pressure is coming out of Asia.

That theory looks reasonable due to the fact that China retains supremacy in the Bitcoin (BTC) hashrate share. According to some calculations, more than 60 percent of Bitcoin (BTC) hashes are disclosed by Chinese miners.

MicroStrategy copycats push Bitcoin (BTC) price higher

Mr. Byworth added that, in the U.S., people are "replicating MicroStrategy," referring to the flagship company in the ongoing institutional crypto journey.

As covered by U.Today previously, Michael Saylor's Microstrategy aggressively bought Bitcoins (BTC) during the latest "dip" in the king coin's price. Nine- and ten-digit purchases were announced daily.

According to Bitcoin Treasuries, a dasboard of Bitcoin (BTC) holdings by publicly traded companies, the corporations obtained almost 1.4 million Bitcoins (BTC), which equals 6.5 percent of its total supply.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin