The Layer-2 scaling solution Arbitrum has overtaken Ethereum in terms of decentralized exchange (DEX) volume.

The latest figures indicate that Arbitrum's 24-hour trading volume has reached $1.83 billion, a significant 32.58% weekly increase.

This surge has propelled Arbitrum to command 33.40% of the total DEX volume, topping the chart and dethroning Ethereum, which saw a 4.77% decrease in its 24-hour volume to $1.444 billion.

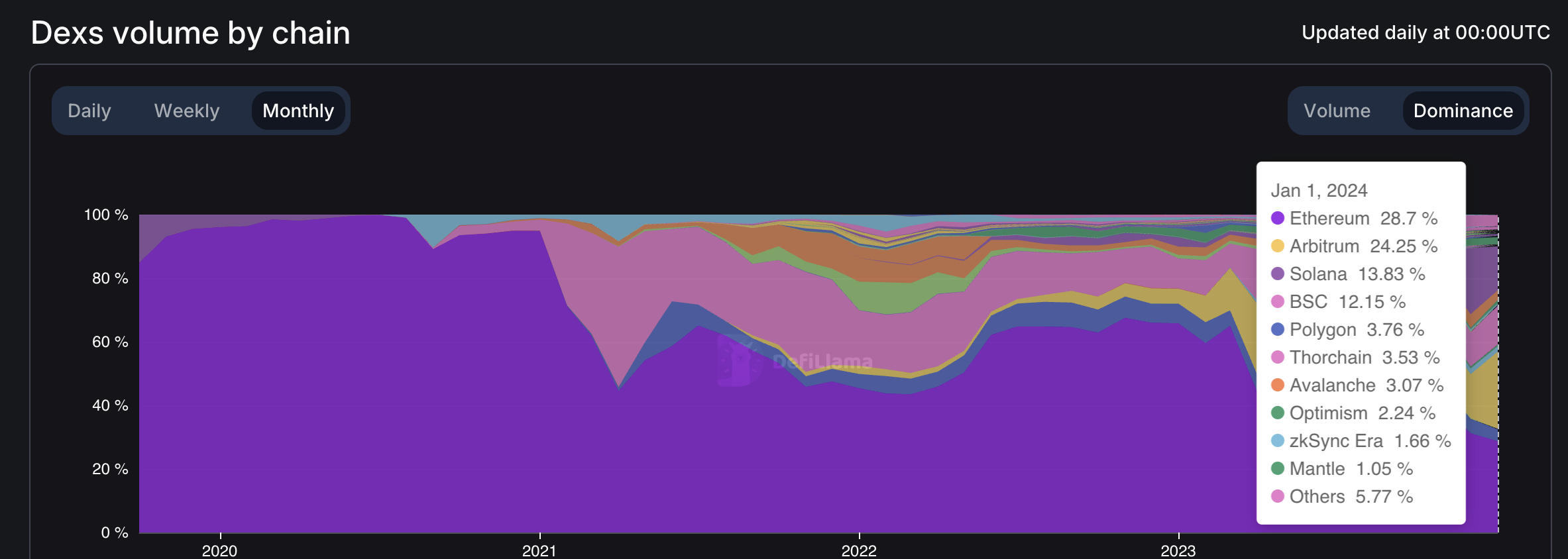

Shifting landscape of DEX volume

The decentralized finance (DeFi) sector is witnessing a remarkable shift as Arbitrum leads the pack with a weekly change of 32.58% in trading volume, marking a dominant presence in the DEX space.

Ethereum, the longstanding leader, has experienced a decrease in its 24-hour trading volume. However, it still maintains a substantial total value locked (TVL) of $5.96 billion, accounting for 26.29% of the total DEX market.

Meanwhile, Solana and Binance Smart Chain (BSC) have seen varying degrees of changes in their trading volumes, with the former experiencing a steep decline of 51.26% in its 24-hour volume.

BSC’s volume slightly dipped by 0.83%, while Polygon faced a significant drop of 34.53%.

Ethereum's dwindling dominance

A monthly dominance chart provided by DefiLlama paints a clear picture of the changing tides in the DEX ecosystem. Ethereum, which once towered over the market, has seen its dominance reduced to 28.7% as of January.

The challenger, Arbitrum, now holds 24.25% of the market, a testament to its growing influence. Solana, BSC and Polygon follow with 13.83%, 12.15% and 3.76%, respectively.

Smaller players like Thorchain, Avalanche, Optimism, zkSync Era and Mantle together with other minor protocols contribute to the remaining share.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov