Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

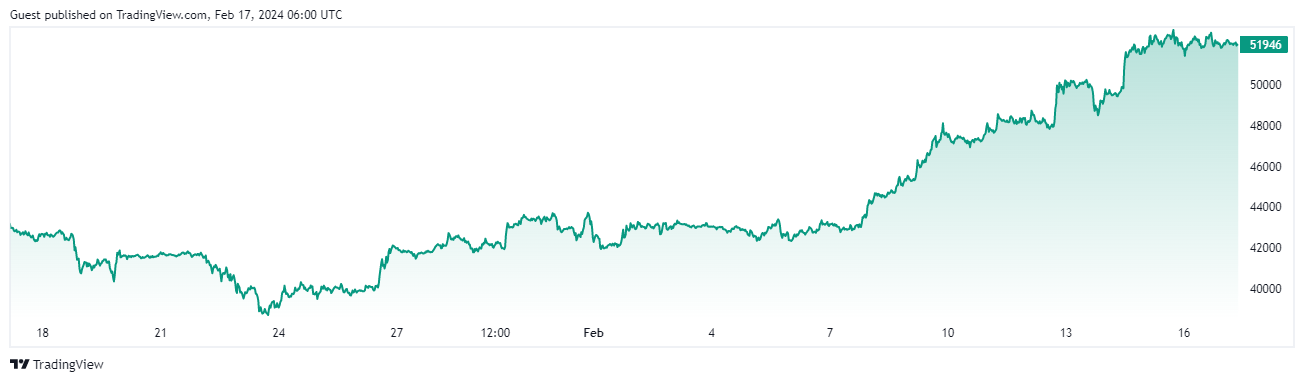

As the Bitcoin price is targeting 2022 highs in the wake of the 2024 halving, the crypto market seems to be as bullish as one can get. One major factor was the SEC's approval of spot Bitcoin ETFs in January. While initial skepticism prevailed among investors and traders, both within and outside the crypto realm, the landscape has since evolved.

Here's a breakdown of the Bitcoin ETFs so far as well as key lessons we could learn from the world's largest asset manager's strategy.

Not great start, but have patience

The decision from the SEC had been strongly anticipated for months ahead. The market has sought a spot Bitcoin ETF as a means to engage U.S. retail investors through an affordable, secure and regulated investment vehicle.

Despite persistent demand, the SEC has consistently rejected such applications, citing concerns over the lack of investor protections due to Bitcoin price determination on unregulated exchanges. As BlackRock CEO Larry Fink put it in a tweet six months prior to the decision:

As major Wall Street players, including BlackRock, have introduced spot Bitcoin ETFs, the cryptocurrency's price initially dropped around 15% following the SEC's approval. Yet as of today, evidence suggests that BTC ETFs are attracting new capital into the market.

Recently, investors could purchase Grayscale's Bitcoin investment fund, GBTC, at a discount to its net asset value due to restrictions on withdrawals. However, since the SEC approved Grayscale's conversion into an ETF, GBTC has seen $4.3 billion in outflows, likely driven by profit-taking on previous investments made at a discount to NAV. This has put downward pressure on Bitcoin prices.

J.P.Morgan suggests that most of this outflow represents profit-taking rather than a shift to cheaper spot Bitcoin ETFs. The remaining $1.3 billion could have moved into competing lower-cost ETFs, but it is uncertain if investors are solely selling in favor of alternative assets.

Despite this, J.P.Morgan believes that the U.S. ETF approvals will significantly change the market structure for Bitcoin. The introduction of spot Bitcoin ETFs could increase market depth and liquidity, making the price discovery process more efficient.

Additionally, Grayscale's plan to introduce a covered call Bitcoin ETF could further enhance market depth and liquidity, potentially benefiting both GBTC and Bitcoin's derivatives markets if approved.

One month later, BTC price soars

The current Bitcoin surge is driven by growing interest from institutional investors such as BlackRock (BLK) and Franklin Templeton (BEN) in various exchange-traded funds (ETFs), with BlackRock’s leading IBIT contributing almost $500 million.

Institutional demand for Bitcoin has been on the rise, particularly evident in the stellar debut of the top two spot BTC ETFs from BlackRock and Fidelity. Within their first month of trading, these ETFs amassed over $3 billion in assets under management, setting a new record for ETF launches, as reported by Bloomberg analyst Eric Balchunas.

Spot Bitcoin ETFs as a whole have acquired over 200,000 BTC, equivalent to nearly $9.5 billion in value. The previous week witnessed a substantial influx of $1.1 billion into spot Bitcoin ETFs, marking their most significant weekly inflow to date, according to Coinbase (COIN).

James Butterfill, head of research at CoinShares, noted that despite a lackluster ETF launch, continued inflows into newly issued funds suggest growing organic demand for Bitcoin.

Data from CoinShares indicates that the newly approved Bitcoin ETFs have attracted approximately $3 billion in net flows, despite more than $6 billion being withdrawn from Grayscale's product since its transition to an ETF.

Current inflows

Inflows into prominent Bitcoin exchange-traded fund (ETF) products remain robust, with nearly $630 million added on Tuesday across various products. BlackRock's IBIT led the pack, bringing in almost $500 million, solidifying its position as the top provider among the 11 ETFs. Bitcoin ETF net inflows are surging, averaging over $500 million daily since Feb. 8, totaling more than $2 billion in the past four days.

Excluding Grayscale's Bitcoin Trust (GBTC), these ETFs have amassed over $11 billion worth of Bitcoin. Analysts note a gradual easing of outflows from GBTC, reducing selling pressure and bolstering bullish sentiment. The Bitcoin price climbed above $51,000 on Wednesday, up 2% in the last 24 hours, while the CD20 Index gained 0.8%.

Some traders anticipate a rally to $64,000 in the short term, citing technical analysis and institutional buying. Alex Kuptsikevich, FxPro's senior market analyst, highlighted the emergence of the Fibonacci pattern, projecting a target around $63.7K. While this marks historical highs, Kuptsikevich anticipates a further rally, albeit with a notable correction expected.

According to data from J.P.Morgan, in January 2024, BlackRock's spot Bitcoin exchange-traded fund (ETF) surged to $1 billion in assets within its first four days of trading, making it the first among recently launched ETFs tracking spot Bitcoin prices to reach this milestone. The U.S. Securities and Exchange Commission (SEC) green-lit nearly a dozen ETFs linked to the world's largest cryptocurrency last week, marking a significant regulatory shift after years of resistance.

Since their debut, BlackRock and Fidelity have attracted the majority of inflows, benefiting from lower fees and brand recognition. BlackRock's iShares Bitcoin ETF (IBIT.O) amassed $1.07 billion in assets under management by Jan. 17, followed closely by Fidelity Wise Origin Bitcoin ETF with $874.6 million, as per J.P.Morgan data.

In total, the nine newly launched ETFs captured $2.90 billion in investment flows during their initial four days of trading. However, the Grayscale Bitcoin Trust, which transitioned from a closed-end fund to an ETF, imposes higher fees compared to the recently launched ETFs and experienced $1.62 billion in outflows during the same period.

The iShares Bitcoin Trust (IBIT) by BlackRock (BLK) has swiftly amassed over $1 billion in Bitcoin, achieving this milestone within just five days of its ETF debut on Jan. 11. While impressive, it falls short of the record set by SPDR Gold Trust (GLD), which reached $1 billion in just three days back in 2004.

Rachel Aguirre, BlackRock's head of U.S. iShares product, noted on Bloomberg TV that IBIT is attracting flows from various sources, including retail and self-directed investors.

While retail interest in spot Bitcoin ETFs remains moderate, accessibility plays a role, with some brokerages like Vanguard not offering these products or offering only a limited selection. Despite this, analysts anticipate significant growth in the spot Bitcoin ETF market, with projections suggesting it could reach $100 billion. Mark Yusko, CEO of Morgan Creek Capital, believes these new products could facilitate up to $300 billion flowing into the Bitcoin market.

Whales of Wall Street emerge

Wall Street's embrace of Bitcoin is evident as big financial firms race to tap into the crypto market. BlackRock's CEO, Larry Fink, and Cantor Fitzgerald's Howard Lutnick are among those expressing optimism about Bitcoin's future. Firms like Invesco, VanEck and Franklin Templeton are leveraging social media to show their support for Bitcoin, with tweets and profile updates reflecting their enthusiasm for the cryptocurrency.

However, skeptics view this enthusiasm as a ploy to generate fees rather than genuine belief in Bitcoin's potential. Vanguard Group and JPMorgan Chase remain cautious, with Vanguard refusing to offer Bitcoin ETFs on its platform. Meanwhile, regulatory concerns loom large, with FINRA flagging potential violations in crypto-related communications from brokerage firms.

This shift in attitude marks a departure from the past, when Wall Street kept its distance from cryptocurrencies. Now, financial firms are echoing crypto messaging, highlighting Bitcoin as a hedge against government intervention and inflation. As the financial industry increasingly embraces crypto, questions remain about its role on Wall Street and the potential risks involved.

As cryptocurrencies continue to gain traction in traditional finance, issuers remain optimistic that mainstream investors will gradually allocate a portion of their portfolios to products like Bitcoin ETFs, alongside traditional investments in stocks and bonds.

Tim Huver, managing director at Brown Brothers Harriman, believes that over time, there will be a specific allocation to Bitcoin ETFs as they establish a longer track record. Kathy Kriskey, senior alternatives ETF strategist at Invesco, suggests that investors could start by reallocating a small percentage of their equity exposure to Bitcoin, emphasizing the importance of moving from zero to even a modest allocation.

Despite the optimism surrounding Bitcoin, some analysts remain cautious about its sustained upward momentum. Jim Angel, a faculty affiliate at Georgetown McDonough's Psaros Center for Financial Markets and Policy, highlights the volatile nature of Bitcoin's price, driven by both believers and skeptics in the market. He notes the lack of focus on Bitcoin's fundamental value in online discussions, which are predominantly centered around short-term technical analysis.

Overall, while optimism persists about Bitcoin's future, analysts emphasize the importance of understanding both the opportunities and risks associated with investing in cryptocurrencies.

Never go full retail?

Currently, retail investors primarily access cryptocurrency through ETFs that trade in cryptocurrency futures. However, the introduction of a spot Bitcoin ETF would offer a direct pathway for investors, particularly retail ones, to invest in Bitcoin without the need for a Bitcoin wallet.

Other financial firms, like JPMorgan Chase & Co., also offer similar portfolio-analysis technology to advisers, reflecting the growing competition in the wealth management sector. As regulatory changes and investor demands reshape the industry, firms are increasingly turning to innovative strategies to retain advisers and attract investors.

According to reports from Wall Street Journal, BlackRock's CEO stated that the company has been collaborating with Circle for over a year. With assets under management exceeding $9 trillion, BlackRock is extensively researching the crypto sector, including stablecoins, digital assets, permissioned blockchains and tokenization, driven by growing interest from its clients.

Conclusions

The market's resounding confidence in Bitcoin spot ETFs underscores their significance, and in the financial world, market sentiment reigns supreme. Despite initial skepticism among the public, BlackRock and other prominent investment institutions have definitively demonstrated that the future of digital assets is intertwined with Wall Street.

As an institutional investor, BlackRock was not merely seeking to introduce a new product for short-term gains. Instead, they have validated their long-term digital asset strategy by securing the largest market share in the industry. Regardless of one's stance on traditional finance versus digital assets, it is crucial to recognize the strategic acumen of Wall Street.

Reflecting on this year's developments in crypto markets, several fundamental principles for long-term investment strategy emerge:

- Make up your long-term strategy based on rationale.

- Hold on to your strategy, even if it seems wrong at the beginning.

- Think like a whale.

- Understand how big money works.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin