Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Dogecoin (DOGE) has been recently defying market resistance levels. Recently, DOGE faced a significant hurdle at the 5 billion coin mark — a resistance level that was anticipated to pose a serious challenge. Contrary to these expectations, the meme currency has not only breached this barrier but is also showing resilience against profit-taking pressures, which could lead to a potential reversal in its price trajectory.

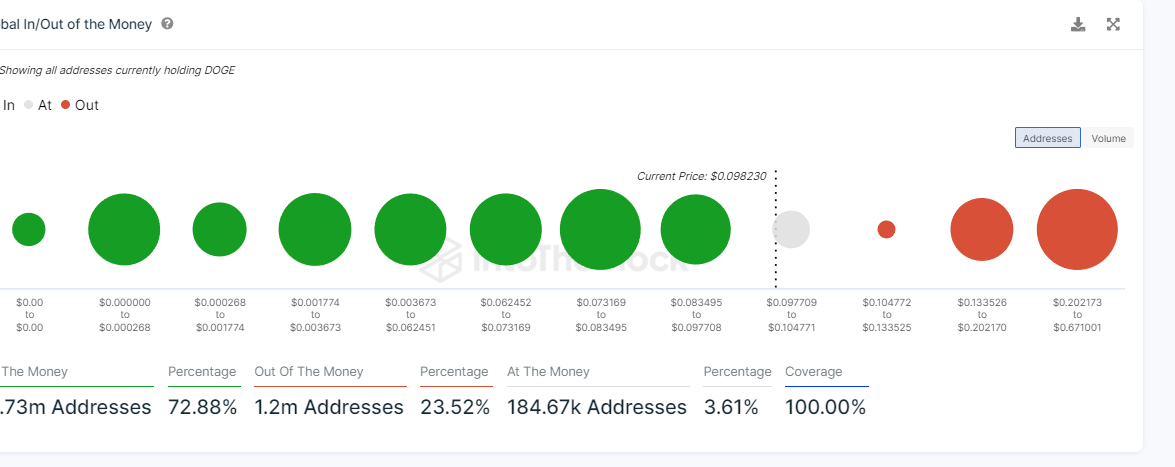

The "in/out of the money" indicator, a tool used to gauge the profitability of addresses holding DOGE, reveals that a substantial portion of the coin holders are "in the money." With 72.88% of addresses currently holding DOGE in profit, this suggests a strong foundation of holders who may be less inclined to sell, providing a solid support level for the cryptocurrency. Despite the presence of 23.52% of holders "out of the money," which could indicate potential selling pressure, Dogecoin's recent performance suggests that the asset is efficiently absorbing sell-offs and maintaining its upward momentum.

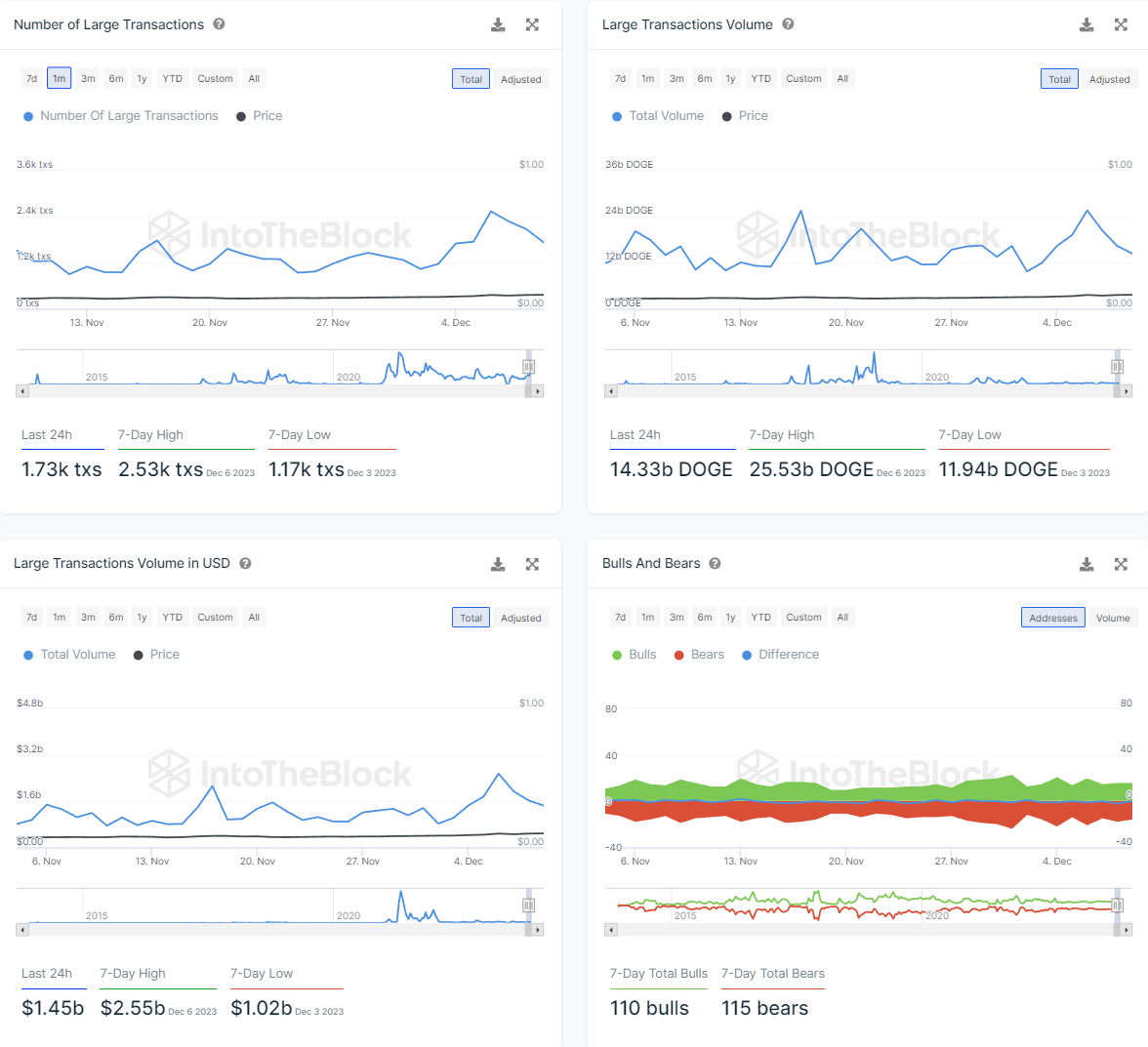

Large transactions and trading volumes offer additional insights into Dogecoin's market activities. A review of the "number of large transactions" and "large transactions volume" indicates that while there have been fluctuations, there is sustained interest and movement from substantial holders. This can contribute to both the support and resistance levels, as large holders have the ability to sway the price more significantly than smaller retail investors.

The price chart for Dogecoin underscores a bullish narrative. After a period of consolidation, DOGE has shown a robust upward trend, marked by its breakthrough of previous resistance levels. The moving averages have aligned to signal continued bullish behavior, with the shorter-term averages crossing above longer-term ones — a classic technical indicator of positive price momentum.

The "bulls and bears" volume indicator further demonstrates the tug-of-war between optimistic and pessimistic market sentiments. Despite the presence of bearish volume, the bullish sentiment has been predominating, which may fortify the argument for a continued upward trend.

Given Dogecoin's recent ability to surpass the 5 billion coin resistance, the meme-fueled currency's market dynamics are proving to be more resilient than many may have presumed. As DOGE continues to navigate through profit-taking and market fluctuations, its defiance against the odds remains a testament to its unexpected and unconventional success story in the crypto world. Investors and spectators alike will be watching to see if Dogecoin can maintain its current trajectory or if a reversal is indeed on the horizon.

XRP's next stop

XRP's recent price performance indicates a strong recovery from its lower support levels, with the price now hovering around the $0.65 mark. The daily chart shows a series of higher lows, a bullish signal that underlines growing investor confidence and a potential trend reversal from previous downturns.

The moving average (MA) lines provide further bullish indicators, with the shorter-term MAs crossing above the longer-term ones. This "golden cross" is often interpreted as a sign of sustained upward momentum, which could lead to further gains. Additionally, the relative strength index (RSI) remains below the overbought territory, suggesting that there is room for growth before the asset hits a potential resistance zone or becomes overextended.

Possible scenarios for XRP's price movement

Continued uptrend to $0.73: If the current support level holds strong and buying pressure continues, XRP could challenge the next significant resistance at $0.73. A break above this level might confirm a new bullish phase, potentially opening the door to further highs.

Consolidation before the next move: Another possibility is a period of consolidation, where XRP prices might fluctuate between the current levels and the next resistance, building the necessary momentum for a breakout. This could involve retesting support levels, shaking out weak hands and attracting more investors eyeing the next rally.

Reversal and retest of support: Despite the bullish signs, there is always the risk of a sudden market reversal. If sell-off pressures emerge, XRP might retrace its steps back to test foundational support levels. This scenario would call for close monitoring of the $0.60 or lower support zones for potential buy zones or a reversal of the uptrend.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin