The hacker behind the breach of one of India's largest crypto exchanges, WazirX, has resurfaced as the criminal moved 10,000 ETH, worth $23.3 million, in a recent 24-hour development. The anonymous entity sent 5,000 ETH to Tornado Cash, a notorious privacy protocol associated with cryptocurrency laundering, and another 5,000 ETH to a new address to further obscure the stolen funds.

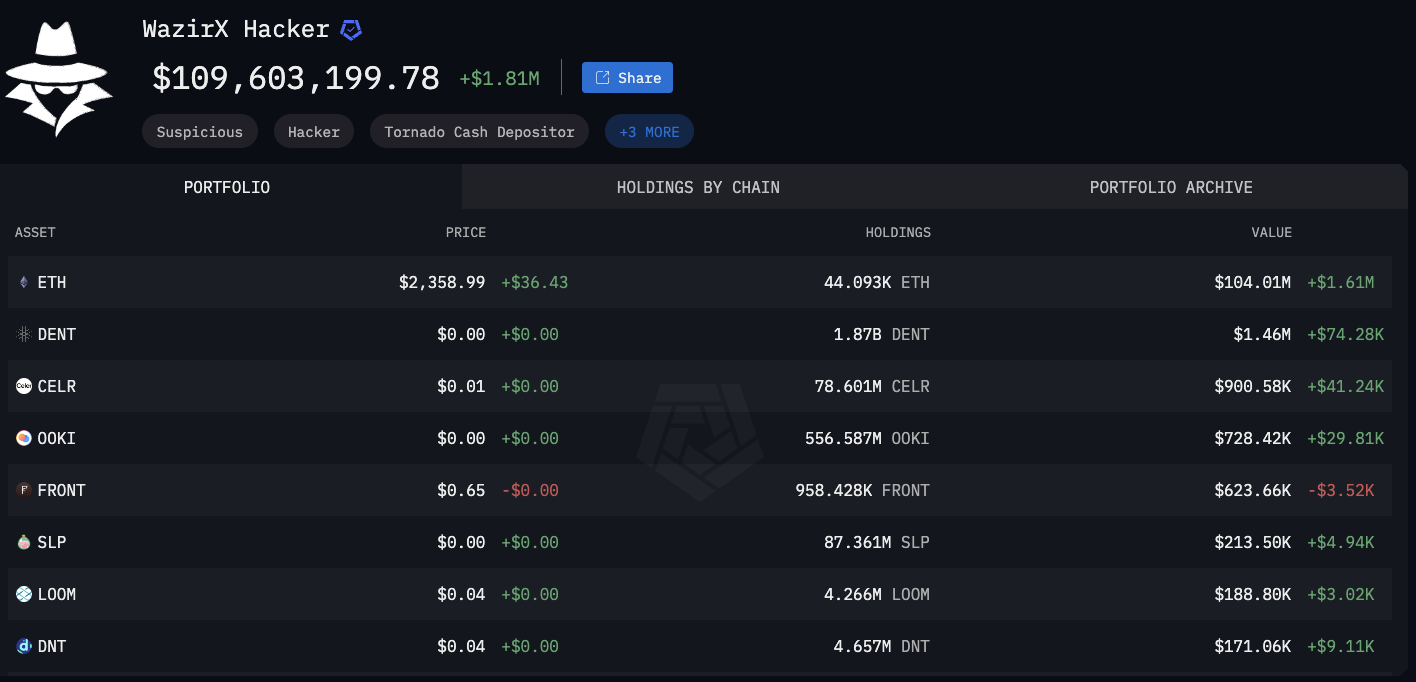

In the past eight days, the hacker has already laundered 12,600 ETH, or approximately $30.13 million. This brings his current stash to a staggering 49,100 ETH, worth $115 million.

The hacker's latest moves follow the massive WazirX breach at the end of July, which saw nearly a quarter of a billion dollars worth of various cryptocurrencies stolen from India's leading exchange. These stolen assets have been actively traded, with Ethereum becoming a major focus.

One of the most striking examples of the hacker's impact on the market is the sale of 5.4 trillion Shiba Inu (SHIB), valued at $102 million, triggering an 8% drop in the price of the popular meme-inspired cryptocurrency.

WazirX hack: The latest

To try and manage the fallout from the breach, Zettai, the Singapore-based company behind WazirX, has asked the High Court of Singapore for a temporary stay on some of its obligations. They are hoping to gain time to restructure their liabilities in the wake of the $230 million hack and compensate affected users.

What's more, an independent audit found that Liminal Custody - WazirX's main infrastructure provider - was not involved in the breach. This contradicts what exchange management initially said. At this point, it appears that the hack was the result of external vulnerabilities rather than internal infrastructure weaknesses.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov