Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

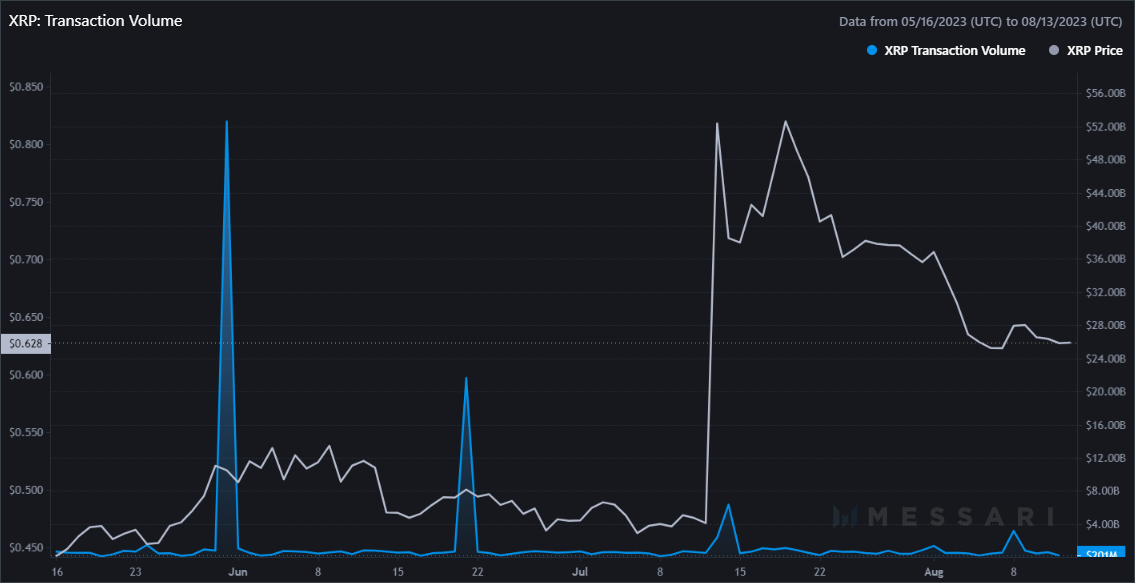

Recently, XRP experienced a staggering $3 billion volume surge, as reported by Messari. This surge, intriguingly, did not correlate to a proportionate uptick in XRP's price, sparking a wave of speculation.

The muted price movement despite such a significant increase in volume suggests that the volume did not primarily represent buying support for the asset. This phenomenon can be attributed to various potential factors:

Sideways trading: One of the most common interpretations of high volume without a significant price increase is a substantial amount of sideways trading. This typically signifies market indecision where neither bulls nor bears are gaining ground, leading to higher trading volumes but little price movement.

Sell-offs: A significant volume increase could indicate selling pressure. While this might sound counterintuitive, a large volume surge without a corresponding price hike can suggest that there is enough selling happening to counteract buying pressure, resulting in a net neutral price movement.

Whale movements: Large holders, often termed "whales," can have a profound impact on trading volumes. Their decision to move vast quantities of XRP between wallets or exchanges, even without selling, can spike trading volumes. A massive transaction by a few significant holders can easily distort volume data.

Preparatory phase: Sometimes, a massive volume surge can act as a precursor to significant price action. Traders and investors should closely monitor the market for any signals that this volume might be the calm before the storm, indicating a potential breakout in either direction.

While deciphering the root cause behind such a volume surge without an accompanying price hike remains speculative, understanding these potential factors can aid investors in making informed decisions.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin