Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

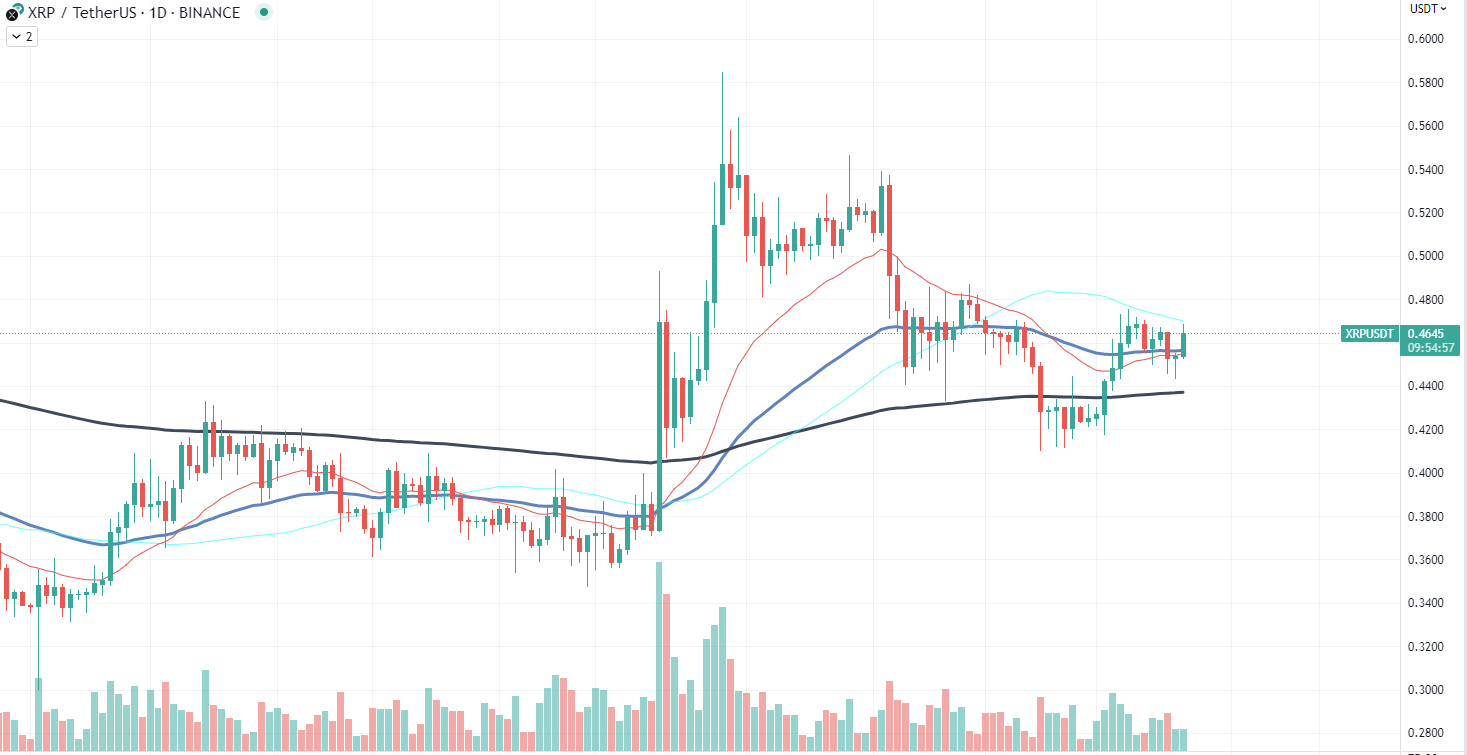

In recent trading activities, XRP is exhibiting an interesting formation known as a symmetrical triangle. This setup is emerging from XRP getting squeezed between two converging trendlines, which can often signal a major price move on the horizon.

At present, XRP is trading at $0.46, holding comfortably above the 50-day exponential moving average (EMA), a common indicator used by traders to analyze price trends. This suggests slightly bullish short-term sentiment. However, XRP's price action has remained relatively stagnant, moving sideways in a constrained range.

The symmetrical triangle is a formation that typically represents a period of consolidation before the price is forced to break out or break down due to the narrowing price range. The formation of this pattern, combined with the average trading volume, further confirms a looming breakout, but the direction remains uncertain.

Currently, a key level to watch for is the $0.60 mark, the recent high in XRP's trading price. A breakthrough beyond this resistance level, accompanied by an increase in trading volume, could signal the start of a significant uptrend. Conversely, if the price breaks below the 50 EMA, this could indicate a potential downward trajectory.

Demand for Arbitrum drops

Layer 2 scaling solution Arbitrum (ARB) has seen a significant liquidity outflow to the tune of $120 million. This development underscores a noteworthy shift in the Ethereum ecosystem as activity on Ethereum has become stale, and transaction fees, once a significant issue, are no longer a major concern for users.

The platform's native token, ARB, has been exhibiting a sideways trend, failing to attract new investors or to provide significant returns to its existing ones following the airdrop. This stagnant performance has added to the pressure on Arbitrum, with investors seeking more dynamic investment opportunities.

The Layer 2 scaling solutions, such as Arbitrum, were initially developed to provide a respite from Ethereum's high transaction costs. However, with the current lull in Ethereum activity and the consequent decrease in transaction fees, the once dire need for such solutions is slowly fading.

A considerable number of investors is choosing to migrate funds away from Arbitrum, resulting in a liquidity outflow. The $120 million outflow signifies a loss of a major chunk of Arbitrum's liquidity, posing a significant challenge to the network. The dwindling popularity of Layer 2 solutions, combined with the sideways movement of the ARB token, further compounds the issue.

PEPE still alive

The cryptocurrency market has been buzzing with various meme tokens, and PEPE is one of the names that stands out. Despite experiencing a significant loss of 68% from its all-time high (ATH), PEPE has managed to stay afloat, recently recording a modest 7% gain.

One of the reasons why meme coins like PEPE often face a steep decline is due to their speculative nature. Initially, these tokens gain traction due to hype and FOMO (Fear of Missing Out), which often results in a price pump.

Another contributing factor is the lack of intrinsic value in these meme coins. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, meme tokens generally do not have a solid use case or utility, making them susceptible to price volatility and market sentiment shifts.

PEPE's recent price drop from its ATH suggests that the largest holders, often known as "whales," might have unloaded their holdings. This move, referred to as "whale dumping," can trigger a domino effect, prompting other investors to sell their holdings, contributing to a further drop in price.

Presently, the majority of PEPE holders seem to be retail investors. Although this does not guarantee price stability, it can sometimes lead to less price manipulation as the token distribution is spread across a larger group of individuals.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov