According to Arca’s Bodhi Pinkner, Ethereum is still “very possible” to flip Bitcoin, Bloomberg reports.

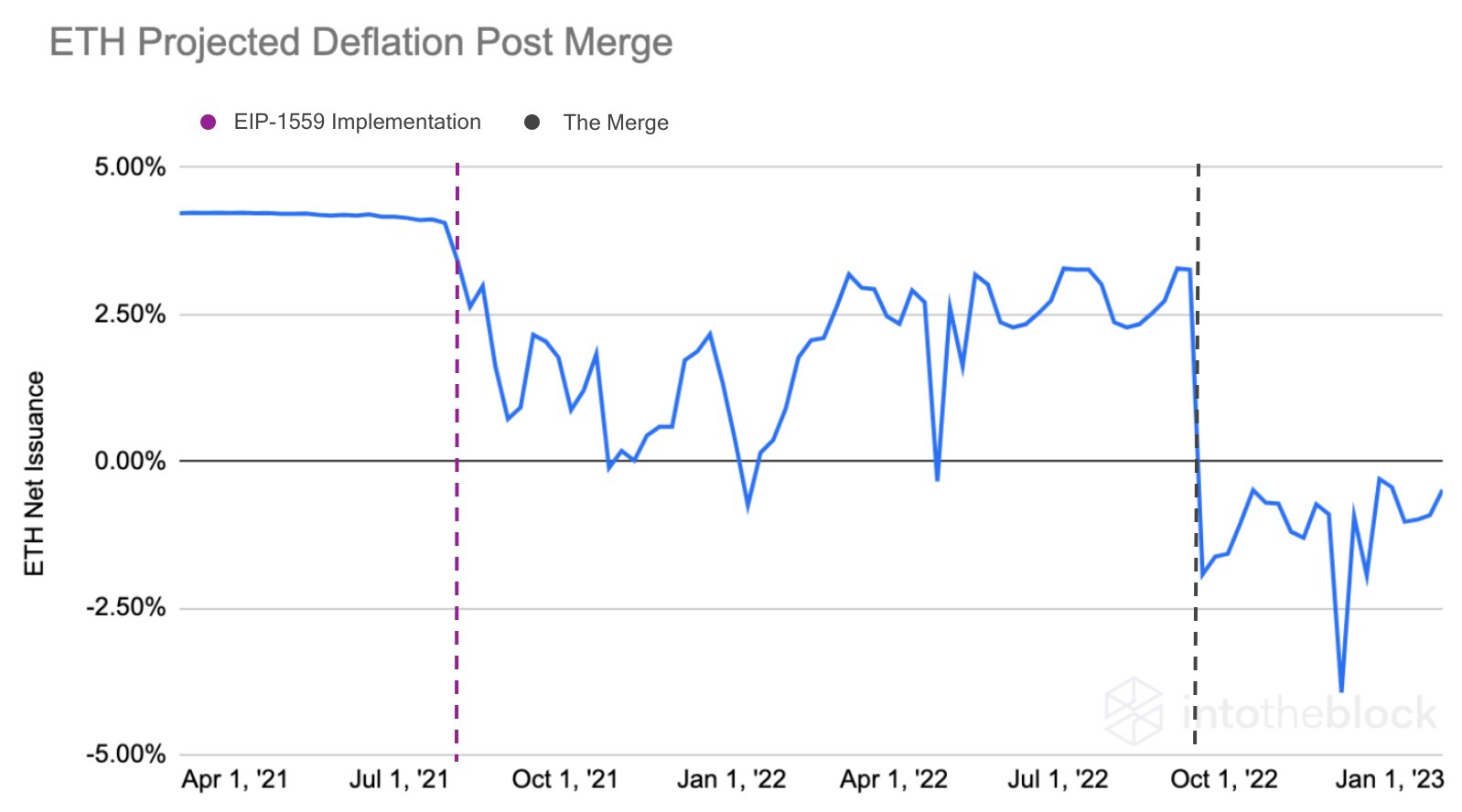

Pinkner has predicted that the second-largest cryptocurrency will become deflationary after the merge event, which is expected to take place in September. Ethereum will finally switch to proof-of-stake from proof-of-work after years of delays.

Earlier this month, Lucas Outumuro, an analyst at cryptocurrency research firm IntoTheBlock, estimated that the issuance of the second-largest cryptocurrency would be between -0.5% and -4.5%.

This means that Ethereum will be getting scarcer, which gives it an upper hand over Bitcoin. The fact that the cryptocurrency’s circulating supply will keep falling also bodes well for the cryptocurrency’s price.

The cryptocurrency is currently trading at $1,707 on major spot exchanges, according to CoinMarketCap data.

The ETH/BTC pair has soared by roughly 34% over the past month due to excitement surrounding the much-anticipated merge upgrade. Still, the pair is down more than 12% from its year-to-date high of 0.82.

It is also worth noting that the ETH/BTC pair is down as much as 54% from its record high that was achieved all the way back in June 2017.

Pinkner believes that the current macro environment could potentially benefit Ethereum.

The Federal Reserve has been laser-focused on monetary tightening since late 2021, putting extreme pressure on the prices of leading cryptocurrencies.

Bitcoin’s dominance has been diminishing since early 2021, with Ethereum and other top altcoins chipping away at its market share. The flagship cryptocurrency is responsible for 41% of the market value.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin