In a recent op-ed published by the Wall Street Journal, Charlie Munger, vice chairman of Omaha-headquartered multinational conglomerate holding company Berkshire Hathaway, argues that the U.S. should impose a federal ban on cryptocurrencies.

Munger believes that a cryptocurrency is just “a gambling contract,” refusing to recognize digital assets as either securities or commodities and complaining about the lack of investor protection.

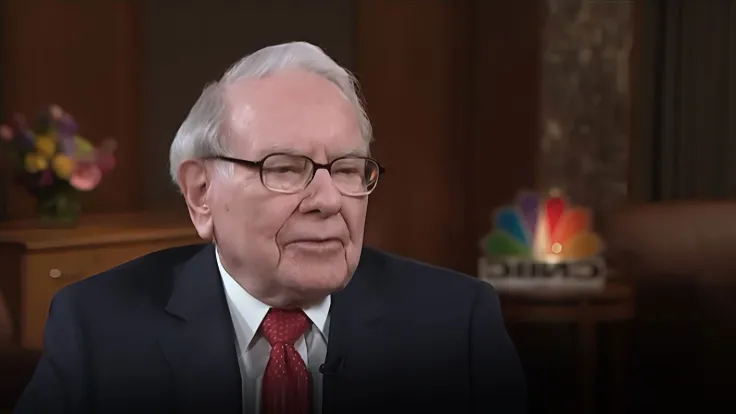

Warren Buffett’s right-hand man suggests that the U.S. should follow the lead of China by prohibiting cryptocurrencies.

Munger also cites England's reaction to a depression in the early 1700s as another precedent for a blanket ban on digital assets.

In response to a promotional scheme that led to a depression, the English Parliament banned all public trading in new common stocks. The ban was in place for approximately 100 years and Munger argues that during this time, England made the biggest national contribution to the enlightenment and industrial revolution, and also spawned the United States.

Munger concluded his op-ed by calling for the U.S. to follow the Chinese communist leader's "splendid example of uncommon sense" and ban cryptocurrencies in order to prevent further harm to the public.

As reported by U.Today, Munger has been one of the harshest critics of Bitcoin. Last year, he predicted that the flagship cryptocurrency was likely going to zero.

In the past, the prominent investor also compared crypto to “some venereal disease” and a louse.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov