Yesterday's trading session on the crypto market turned into a veritable bloodbath, with $1.5 billion in various long and short positions being liquidated by smaller measures. As for the popular meme-inspired cryptocurrency Shiba Inu (SHIB), about $20 million were liquidated in derivatives on it, represented mainly by open-ended futures, of which a much larger part is long positions, which is obvious.

The price of the Shiba Inu token has dropped by almost 25% over the past day and has seen lows not seen since the end of November. The on-chain data on the Shiba Inu token presented by IntoTheBlock paints an interesting picture against this background.

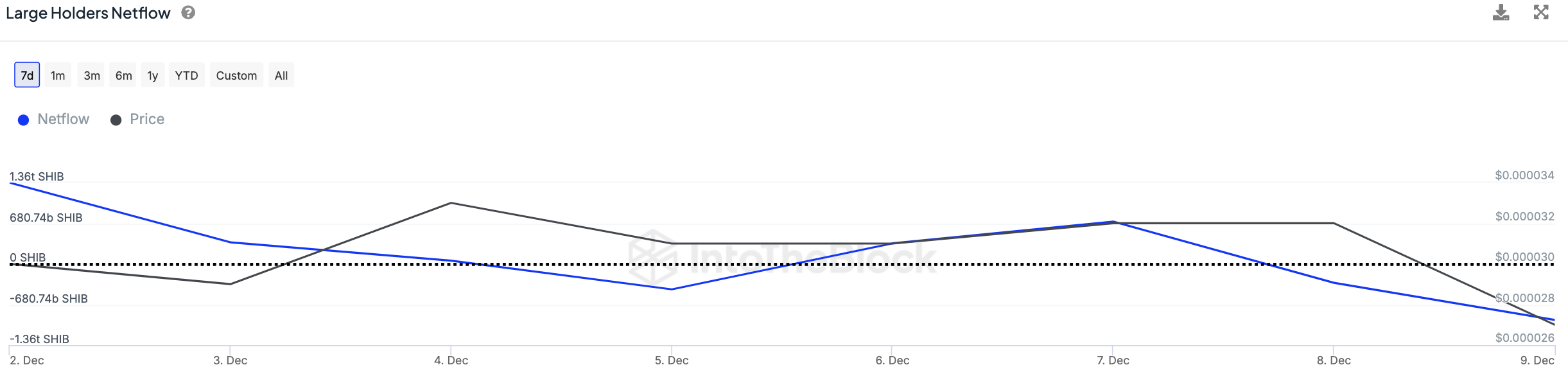

According to the Large Holders Netflow metric, the cryptocurrency's net flow to wallets holding at least 0.1% of the circulating SHIB supply not only declined during the period under review, but a net outflow of 940.01 billion SHIB was recorded.

In other words, whales got rid of almost a trillion tokens over the past 24 hours, equivalent to approximately $30 million.

We could speculate on what came before, but according to on-chain data, a decrease in net Shiba Inu token flow to large addresses has been observed since as early as Dec. 7.

Although the fall in the price of Shiba Inu was not triggered by the whales' sell-offs, but was a consequence of the fall of the entire crypto market, their behavior was exemplary and predicted this correction.

In an uncertain environment like the current one, with U.S. CPI data also due this week and Jan. 3 weeks away, watching how the big players on the market will behave is one of the best decisions. After all, there will surely be more shakeouts to come.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov