Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Popular meme-inspired cryptocurrency Shiba Inu (SHIB) might be on the verge of a fall, and there are exactly two reasons to think so.

The first one is the price action of SHIB, as it lost 3.57% after falling during yesterday's session and, more importantly, it fell below the important 200-day moving average on the daily price chart.

Digging deeper, this is also confirmed by the 50-day moving average on the hourly chart, as the Shiba Inu token failed to break above this important dynamic resistance for 19 straight hours despite multiple attempts.

Currently, SHIB is trading at $0.00001856. If the sellers, or bears, continue to dominate the buyers, or bulls, the price of the popular meme-inspired cryptocurrency may see a drop to as low as $0.00001776, where the 200-day moving average on the hourly chart is located, or even as low as $0.00001687, where the 50-day moving average on the daily price chart is located.

Whales leave Shiba Inu (SHIB)

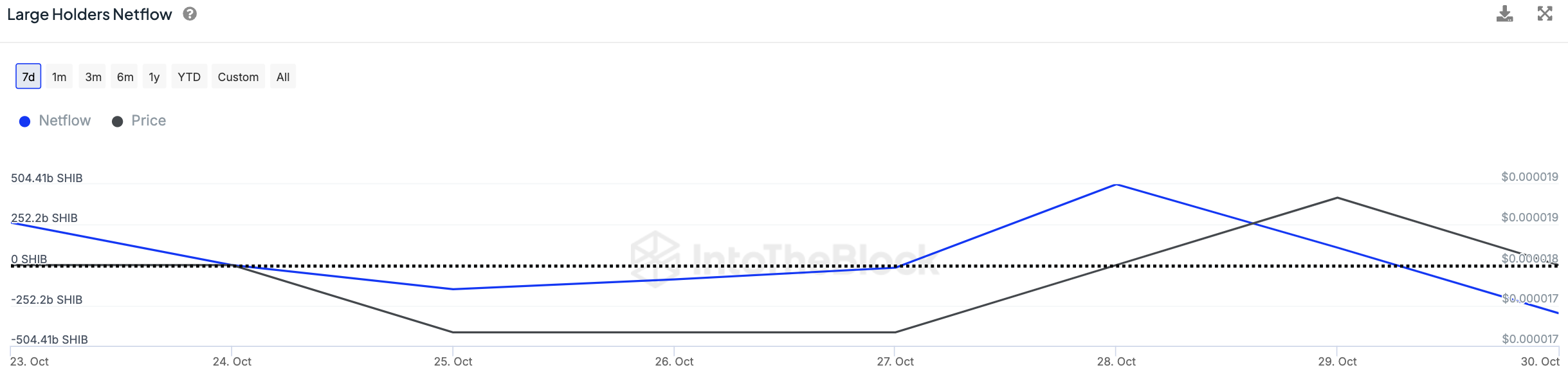

Another indicator of the impending storm for the Shiba Inu token is the behavior of large holders, which has been quite bearish over the past 48 hours, to say the least.

According to on-chain metrics provided by IntoTheBlock, the wallets that control no less than 0.1% of the circulating supply of the token have seen a negative net flow of around 810 billion SHIB since Tuesday.

This is clearly an indication of selling by large SHIB holders, which may be justified by the inconsistent market dynamics where, when the token reaches a strong resistance level, it is less risky to sell and then watch than to hold out in hope of a breakout.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov