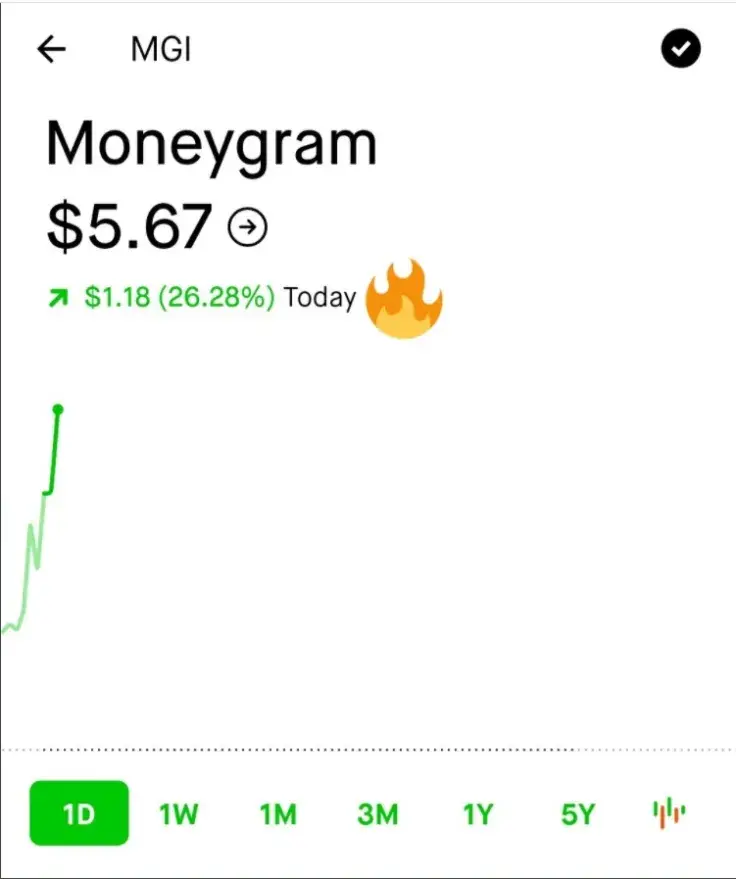

After publishing its quarterly report the other day, global remittance behemoth MoneyGram has seen its stock price soar 26.28 percent within just one day—from $4.80 to $5.80 on Nasdaq.

One of the key drivers for the share price here is likely the fact that another recent cash injection from the Ripple fintech giant was revealed in the report.

The blockchain decacorn led by Brad Garlinghouse transacted $9.3 mln to MoneyGram as part of their partnership.

According to the report, MoneyGram referred to this money as "market development fees."

MoneyGram uses Ripple's technology for cheap and fast remittances called ODL—On-Demand Liquidity—which requires the use of XRP.

Some of the ODL corridors operate in Mexico, Australia, Luxembourg, the Philippines, South Korea and Japan and are based on crypto exchanges.

This year Ripple plans to set up more ODL portals: in Africa, Asia and Latin America.

In an interview with CNBC previously, MoneyGram's CEO Alex Holmes stated that his company does not hold the XRP it receives from Ripple.

Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide