Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

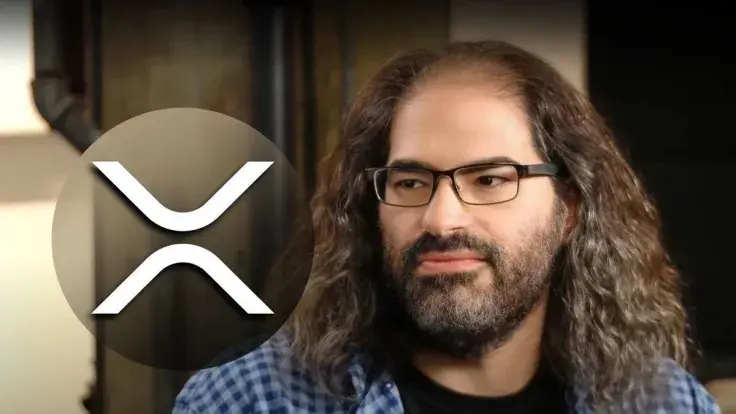

Recently, a member of the XRP community on X, "Mr. Huber," ignited a discussion on the nature of securities in the context of crypto assets. The debate centers on the question of whether staking could be considered a literal investment contract in the context of the smart contract it utilizes. David Schwartz, Chief Technology Officer of Ripple, joined the conversation.

Schwartz responded that a smart contract is simply a fact that defines certain properties of an asset: "a smart contract is just a fact that is a property of the asset. Every asset has facts that are their properties."

Gold, Metamask used as analogy

The Ripple CTO illustrated his point with a comparison to gold, stating, "The fact that gold has 79 protons isn't a contract that makes the sale of gold an investment contract." With this, he highlights that every asset has inherent properties, but these properties alone do not constitute a contract.

Schwartz further elaborates that if the mere act of "all the people who have the asset do stuff" qualifies as a common enterprise, then virtually everything could be classified as a security. This broad definition would blur the lines between various asset classes and their legal standing.

The discussion took an interesting turn when the Ripple CTO cited Metamask as an example. According to Schwartz, the efforts of Metamask do not determine the profits of its users any more than the efforts of De Beers determine the profits of diamond holders. This analogy highlighted his belief that the involvement or actions of a company related to an asset do not necessarily make the asset a security.

Implications for crypto industry

This debate, which remains ongoing, touches on a critical issue for the cryptocurrency industry, which is still grappling with regulatory definitions and frameworks. The distinction between what is and is not a security has significant implications for the future of digital assets and how they are regulated.

As the community awaits the final ruling in the ongoing lawsuit involving Ripple, this current discussion sheds light on the intricate dance between technology, law and regulation.

Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin Dan Burgin

Dan Burgin Arman Shirinyan

Arman Shirinyan