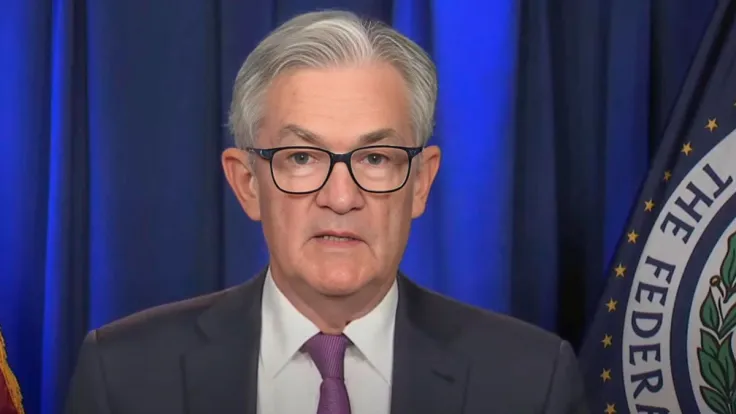

Federal Reserve Chair Jerome Powell has signalled that the central bank is ready to implement a much-awaited rate cut this September during a press conference.

As noted by Powell, the economy is now "moving closer" to the point where reducing the current policy rate would be appropriate. "In that we will be data dependent, but not data point dependent," he added.

There were some debates about the prudence of implementing the first rate cut as early as this July. However, the Fed decided to wait until the next meeting. According to Powell, the decision was unanimous.

For now, the central banks is carefully monitoring potential signs of weakness in the labor market. "The total scope of the data suggest a normalizing labor market. We are carefully watching to see that continues to be the case," he said.

Powell stated that "there was a real discussion, back and forth, what the case would be for moving at this meeting."

The Fed likely did not risk reigniting inflationary fire with a surprise July rate cut.

Meanwhile, the odds of a September rate cut currently stand at 93.5% after Powell's most recent dovish speech.

As reported by U.Today, Galaxy Digital CEO Mike Novogratz named rate cuts as a bullish catalyst for Bitcoin in 2024.

Powell did not rule out that there could be several rate cuts this year, but he also cautioned that the Fed might end up holding the rates steady throughout the year.

Meanwhile, Bitcoin is getting absolutely crushed, dropping below the $65,000 level despite the seemingly imminent rate cut.

The cryptocurrency is under renewed selling pressure after Mt. Gox moved roughly $3.3 billion worth of Bitcoin earlier today.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin