It took only three weeks for Bitcoin (BTC) to perform an amazing rally from revisiting 2017’s high at $19,800 to a new record over $42,000 registered on Jan. 8, 2020. These days were really red hot for all parts of the global crypto infrastructure. Is the ongoing rally different from the one in 2017? And what is going on in the crypto exchange segment when the “greed” is on the streets?

Crypto is on fire again

Bitcoin (BTC) is not the only major cryptocurrency that has already printed a new all-time high in this cycle. Also included are Ethereum (ETH), Chainlink (LINK), Aave Protocol (AAVE). Synthetix Network (SNX) followed the example of the king coin and excited enthusiasts with new historic highs.

2017 vs. 2020: Is history repeating itself?

Meanwhile, for Bitcoin (BTC), the ongoing rally does not look like the previous one. First of all, the impact of the closest Bitcoin (BTC) halvening is much weaker. In absolute terms, the reduction of Bitcoin (BTC) on May 10, 2020 (the third halvening) was only 40 percent as powerful as that of July 9, 2016 (the second halvening). As a result, if the Bitcoin (BTC) price is truly affected by halvening events, their influence in 2020-2021 will be far less impressive.

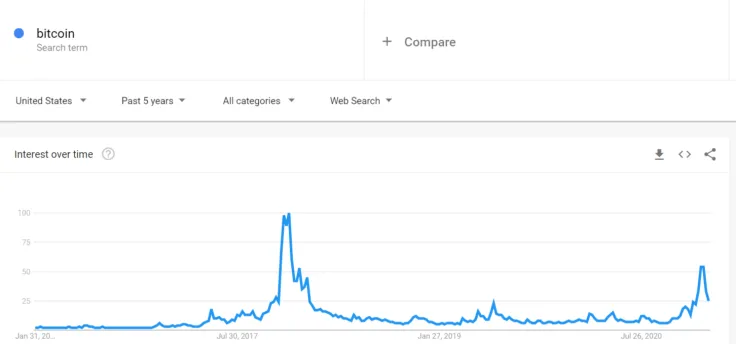

The ongoing rally is most likely driven by institutions. The simplest metric to illustrate this fact is relatively low interest in the word “Bitcoin” on Google Trends, as googling Bitcoin (BTC) is normally attributed to retail investors.

As a result, it is obvious that the ongoing rally is not (yet) about hype among retail investors. It is hard to believe, but Google Trends indicates that “Bitcoin” was three times as popular in 2017 as it is today. Thus, massive interest in this run is yet to come.

Finally, although the quantity of cryptocurrencies has quadrupled over the last three years (e.g., according to Coinmarketcap), the landscape of market capitalization is becoming increasingly BTC-and-ETH dominated.

In particular, Bitcoin and Ethereum were responsible for 51 percent of net crypto market capitalization in 2017, while today this metric is above 86 percent.

Derivatives vs. spot markets

This run is definitely led by derivatives trading platforms and not by spot exchanges. While derivatives trading was in its infancy in 2017, today it surpasses spot trading by a wide margin. The reasons are obvious: “spot” Bitcoin (BTC) trades imply the physical movement of Bitcoin (BTC) between wallets or accounts of centralized exchange.

Derivatives platforms buy and sell nothing but bets on Bitcoin (BTC) price dynamics. So, it is much easier to launch them - and to meet all of the requirements of strict regulators.

According to a research thesis, “The Tail Wags the Dog: An Evolution of Bitcoin Futures,” contracts markets process 360 percent more trading volume than spot competitors. In the derivatives segment, growth looks evangelical: from $6 billion to $1.7 trillion in average daily volume.

Q2, 2018, was the last quarter in which spot platforms dominated derivatives platforms. Partially, this supremacy should be attributed to the high leverage offered on the majority of platforms but, at the end of the day, the supremacy of derivatives is obvious.

Aggregated open interest (OI) is another metric that illustrates the dominance of the derivatives market. In the days of rapid Bitcoin (BTC) price moves in late Q4, 2020, it surpassed $10 billion for the first time.

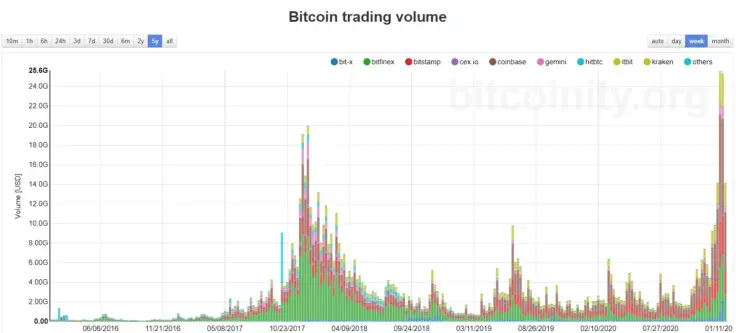

Trading volume has gone ballistic

Meanwhile, the spot trading volume for the first crypto also witnessed multi-month highs across multiple exchanges. As displayed below (weekly candles, all exchanges), during the last two weeks of a turbulent 2020, it spiked above $20 billion per week for the first time since December 2017.

In late December, 2020, Bitcoin’s (BTC) spot trading volume spiked above $25 billion per week for the first time in crypto history. Thus, it is 25 percent higher than the volume during the peak days of the previous bull run.

To sum up, we can only guess in which stage of market euphoria we currently find ourselves. At the same time, crypto market activity has already toppled the previous cycle by all accounts.

So did traffic on the top-tier crypto platforms.

How do crypto trading platforms handle the increased pressure

It does not take a seasoned crypto expert to figure out that the upsurge in trading volume brings an increase in the quantity of requests on trading platforms. Practice has shown that not all of the popular platforms are ready for such gargantuan pressure.

Amidst Bitcoin (BTC) price spikes, more and more crypto exchanges are going offline

The year of 2020 was one big stress test for the infrastructure of cryptocurrency exchanges. On Crypto Black Thursday (March 13, 2020), pioneering derivatives exchange BitMEX was offline for almost an hour.

When Bitcoin (BTC) bulls started to retest 2017’s high in sub-$20,000 zones, going offline at times of highest market volatility unfortunately became a pattern for top exchanges. Mostly, it is valid for Coinbase and Binance.

Binance also went down several times when the crypto king was striving to get back above $10,000 after the March carnage.

In mid-November, two top-league exchanges, crypto veterans Kraken and Poloniex, went offline almost simultaneously. Teams promptly informed their customers about emergency maintenance, but all traders onboarded by these platforms survived very nervous moments.

Despite it having barely started, 2021 has already witnessed this sort of “maintenance.” Coinbase shut down for an hour during a surprising double-digit pump of Stellar Lumens (XLM).

Why does this matter?

Besides being an untapped source of memes for eagle-eyed Crypto Twitter inhabitants, these failures of multi-billion-dollar companies have prevented their customers from earning amazing profits. It is really challenging to develop a strategy when all of your orders can become inaccessible at any moment.

If there is a moment at which serious crypto services should keep 100 percent uptime, it is during a rally.

All in all: Is it possible for a crypto exchange to survive a bullish run online?

For sure. But keeping this uptime requires long-term preparations and periodic upgrades of software and hardware.

For instance, crypto ecosystem StormGain started to register an increase in traffic in October 2020, when the Bitcoin (BTC) price confidently reestablished itself in five-digit waters.

Since then, aggregated traffic on StormGain - a derivatives exchange for major cryptos, a multi-currency wallet service, a fiat-to-crypto on-ramp, a Bitcoin (BTC) cloud mining service - has witnessed a sixfold increase. In general, it has gone hand-in-hand with the Bitcoin (BTC) price.

All metrics rocketed: the trading/exchange volume, deposits/withdrawals, visitor numbers and so on. Some of them grew 100-200 percent faster than scheduled. But StormGain customers did not suffer from irritating “maintenance.”

Which services does the market need most during hype?

Since long-term crypto price dynamics print obvious cycles, there are a number of strategies that can help crypto owners to get the most out of every rally regardless of the level of his/her understanding of market processes.

To hold

Good old holding is a smart bet amidst an over-hyped market. During all of 2020, top-tier analysts from Glassnode repeatedly reported the increased aggression of holders, long-term Bitcoin investors: the “strong hands” of the market.

StormGain releases a series of intuitive crypto wallets to make the process of holding secure and seamless. Right now, Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Tether (USDT) and Bitcoin Cash (BCH) wallets are available as web interfaces and desktop applications.

To trade

The growing market allows derivatives traders to implement the most aggressive strategies with the domination of “long” positions. For instance, at press time, the supremacy of long positions is obvious. Thus, even crypto newbies can get their hands dirty with derivatives trading.

StormGain introduces intuitive dashboards for derivatives trading. Starting from $10 only, traders can open long/short positions for 23 pairs against U.S. Dollar Tether (USDT) and Bitcoin (BTC).

All top-tier blockchains (Bitcoin, Ethereum, Cardano, Qtum, Dash, Litecoin), as well as their forks (Bitcoin Cash, Bitcoin Gold, Ethereum Classic), are available for trading in the form of contracts. High leverage (up to 200x for Bitcoin) allows sophisticated traders to use exchanges’ reserves in their strategies.

To buy

It is during bullish markets in which the majority of newbies decide to purchase their first tokens. Buying crypto with fiat remains the most convenient and familiar way to do this.

Meeting this use case, StormGain has partnered with Israeli-based service Simplex, leading a fiat on-ramp in the crypto segment. As a result, no-coiners can obtain first Bitcoins, then Ethers and other major coins using Visa and Mastercard.

To mine

When the Bitcoin (BTC) price surges, its mining becomes more profitable. Trying to join Bitcoin (BTC) mining in a bullish market may be a smart bet.

StormGain launched the Bitcoin Miner program. It allows renting Bitcoin (BTC) mining facilities without the necessity of investing tens of thousands dollars into purchasing mining equipment. A user can sign a contract and start earning a share of Bitcoin (BTC) miners’ rewards from a certain hashrate: the computational power of the Bitcoin (BTC) network.

The profitability of Bitcoin (BTC) mining depends on the user’s status in StormGain’s loyalty program. This status correlates with the aggregated trading volume of a StormGain client.

To enjoy

Finally, StormGain implemented a toolkit of passive income instruments available for all traders. Day traders (“scalpers”) with high social exposure can monetize it through a referral program by sharing unique affiliate links with their followers.

Holders with “strong hands” can deposit their tokens and earn on idle crypto savings. Some offers include double-digit APR.

Bottom line

A bullish crypto market filled with euphoria and hype is a very special period for crypto enthusiasts. The ongoing one is characterized by increased trading volume, domination of derivatives platforms, reduced influence of halving and large-scale involvement of institutions.

For a crypto exchange, it results in increased traffic and pressure on mechanisms. While veterans go offline, new-gen platforms maintain 100 percent uptime. Multi-purpose ecosystem StormGain is a textbook example of how the progress of infrastructure can allow comfortable trading even in periods of maximum hype.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin