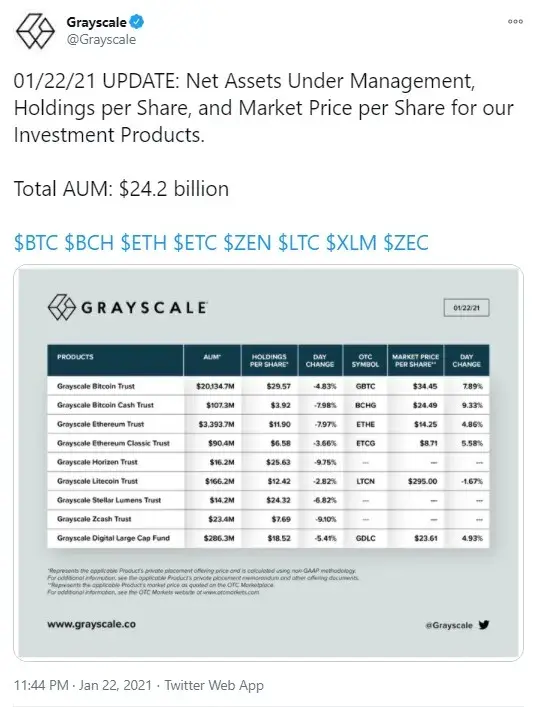

In a tweet published on January 22, Grayscale Investments team announced that the aggregate amount of crypto held by the fund under management totaled $24.2 billion.

That’s approximately $1 billion less than mentioned in a tweet a day earlier.

Grayscale’s crypto stashes keep shrinking in value

As Bitcoin continues trading in a range after recovering from a fall below $30,000 on Friday, Grayscale’s worth of crypto assets seems to become smaller.

On Friday, the flagship cryptocurrency went from a low of $29,350 to the $32,587 level and then managed to regain the $33,666 mark.

However, Grayscale published its tweet with the $24.6 billion AUM figure before Bitcoin went up above $33,500.

The table shared by Barry Silbert’s crypto hedge fund shows that the value of all of its crypto assets shrank – from Bitcoin to Zcash.

As reported by U.Today on Friday, Grayscale had made an acquisition of a whopping $1,276,147,151 worth of Bitcoin - 35,159.01978857 BTC.

At today’s BTC rate, this amount in USD has lost around $100 million and represents $1,156,042,634.

Grayscale lays foundation for LINK, BAT, XTZ and two other Trusts

Crypto news outlet CoinDesk has reported that Grayscale has filed documentation for setting up five more cryptocurrency trusts.

Among them is the top-seven cryptocurrency Chainlink (LINK, one of the top DeFi platforms), 19-ranked Tezos (XTZ), Basic Attention Token (BAT), Livepeer (ranked 245) and Decentraland (MANA), ranked 82.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin