Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

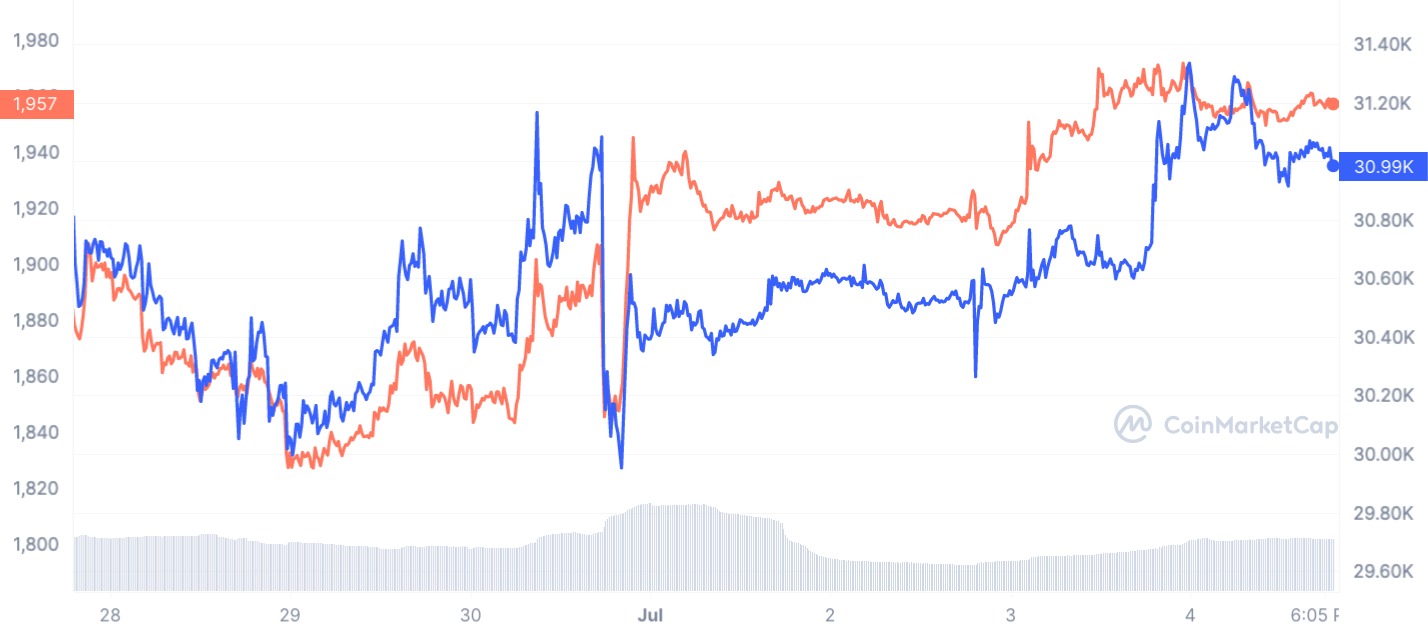

The crypto space witnessed abnormal activity today, as major investors, often referred to as "whales," made substantial investments in options contracts for Ethereum (ETH) and Bitcoin (BTC), as reported by Greeks Live portal. This surge in activity has sparked optimism within the market, pointing toward potential positive developments in the second half of the year.

In particular, a considerable number of block calls, primarily involving Buy-DEC-2200C/2400C and Sell-DEC-3000C Ethereum contracts known as bull spreads, dominated the trading floor. These bullish strategies suggest that traders anticipate favorable price movements for ETH. Impressively, over 12,500 sets of these options contracts were traded, with a total notional value exceeding $50 million, indicating a significant response from the market.

Additionally, there was notable buying activity in out-of-the-money (OTM) JUL calls for Ethereum. This suggests that buyers initiated transactions for options contracts with strike prices above the current market value of ETH. Such buyer interest implies a belief among investors that Ethereum's price may experience further appreciation in the coming months.

While Bitcoin did not witness the same level of activity as Ethereum, signs of active buying were still evident, reaffirming the cryptocurrency's appeal to traders and investors.

These events are surprising, particularly given the usual decrease in market activity after quarterly expiration. The confidence displayed by major investors has challenged this convention, prompting speculation among analysts and enthusiasts regarding the market's prospects for the second half of the year.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov