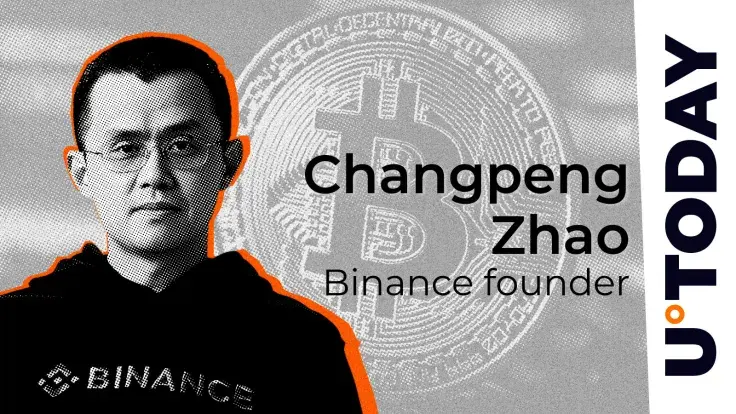

Changpeng Zhao, the former chief executive officer of the Binance exchange, has suggested that the price of Bitcoin could surge to $1 million in the long run.

In fact, he believes that some governments will actually be lucky to purchase the cryptocurrency at such a price level.

The performance of Bitcoin will likely depend on how much money other countries are willing to print in order to Bitcoin.

CZ's bold prediction comes after Ales Michl, the governor of the Czech National Bank (CNB), has proposed allocating up to 5% of the bank's assets to buying Bitcoin.

The proposal, if approved by the CNB's board, could be a watershed moment for the flagship cryptocurrency, which has long been pitched as an alternative to gold.

Zhao appears to believe that there could be a potential race to adopt Bitcoin among governments in the near future, with late buyers potentially exorbitant prices.

The U.S. government could set such a trend in motion by creating a Bitcoin reserve. Polymarket bettors currently see a 55% chance of the reserve being launched this year.

Galaxy CEO Mike Novogratz has predicted that the price of the leading cryptocurrency skyrocket to as much as $500,000 this year if the US ends up being created since he expects other countries to follow suit.

MicroStrategy CEO Michael Saylor has urged the U.S. government to replace its vast gold holdings with Bitcoin.

Christian Lindner, one of the leading German politicians, previously opined that Bitcoin should be added to the country's national reserves as well as the European Central Bank's reserves.

Caroline Amosun

Caroline Amosun Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk