According to data shared by the Skew analytics company, things keep going well for Ethereum options on the Deribit exchange.

The open interest for them has reached a new high, while the Bitcoin options OI is still above the $1-bln level.

Ethereum options OI tops $140 mln

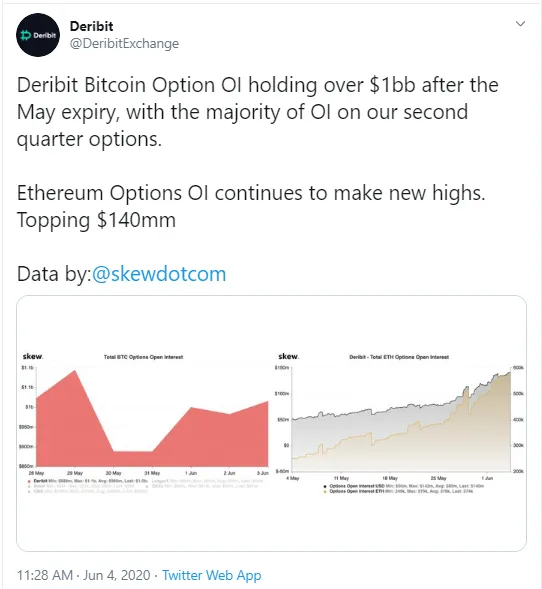

Deribit exchange has shared a chart provided by the Skew analytics provider which shows a rise in ETH options OI to a $140 mln high.

The chart also shows that after the May expiry, BTC options OI on this platform is still above $1 bln. The majority of OI is on the second quarter options now.

More investors are betting on Ethereum

Despite the fact that the Ethereum 2.0 launch has again been postponed, to Q3 2020 this time, the community is looking forward to it as the project promises big changes for the second most popular blockchain.

More cash is getting locked in with DeFi apps. All of this, together, is making ETH's popularity grow and getting more investors to bet on it.

As per this Skew graph, Ethereum has recently been outperforming BTC regarding price growth and some believe ETH is gradually decoupling from Bitcoin.

Meanwhile, Glassnode reports that the amount of Ethereum wallets holding more than 32 coins has surged to an all-time high of 116,703.000 over the past twenty-four hours.

Fed eyes adopting Ethereum-based index

In late May, Fed Chairman Jerome Powell made a statement about replacing LIBOR with AMERIBOR.

The latter is a product based on the second biggest open ledger Ethereum and it monitors interbank lending rates.

LIBOR (The London Interbank Offered Rate) has been a popular benchmark used for short-term interest rates. However, recently it was involved in several major scandals involving bankers manipulating lending rates in the US.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin