Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

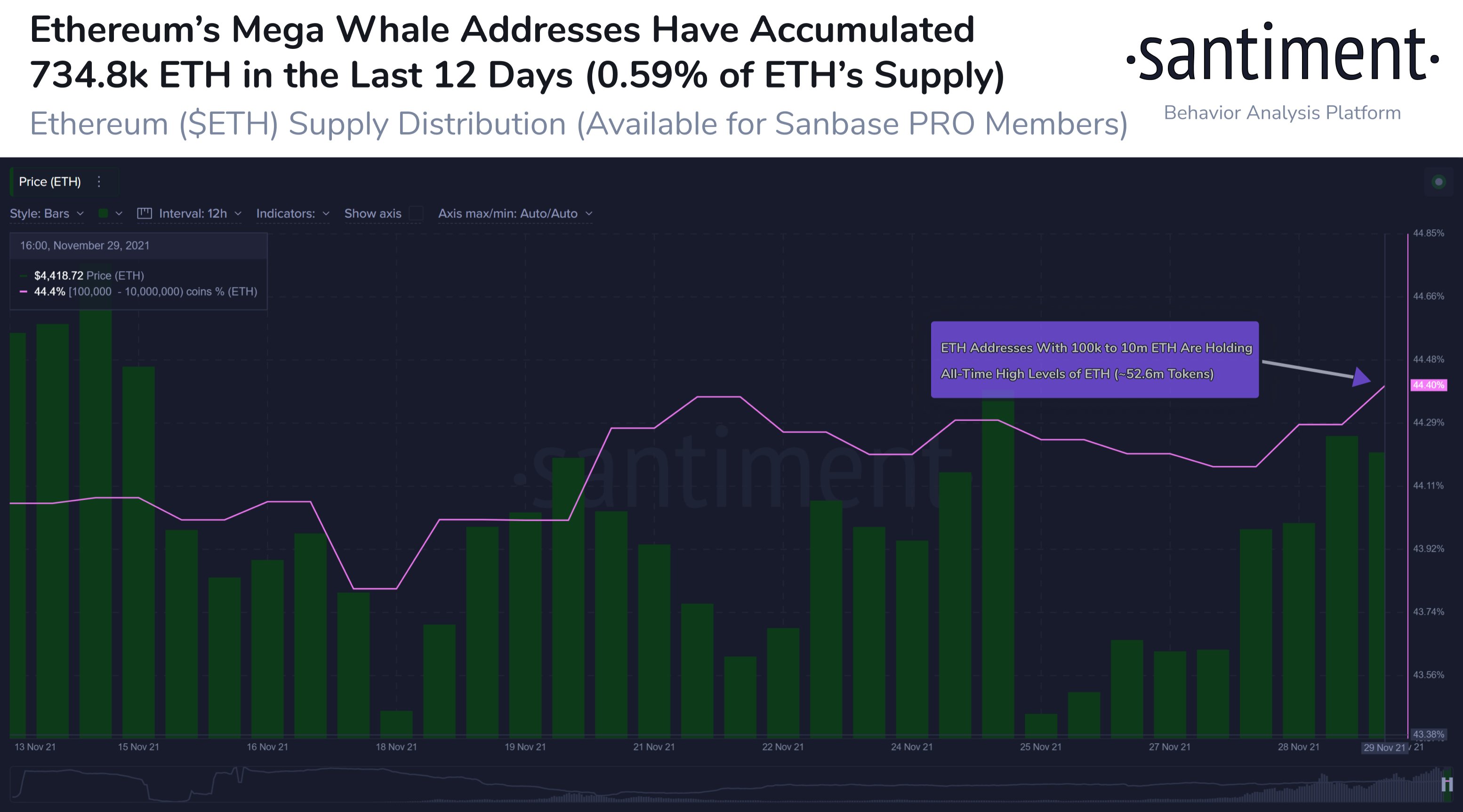

Data from on-chain analytics firm Santiment suggests that Ethereum mega whales have bought 0.59% of Ether's total supply within the last 12 days.

Ethereum's price dropped to lows beneath $4,000 various times since mid-November, allowing some whales to accumulate more portions of the asset.

#Ethereum’s Mega Whale Addresses (Holding 100k to 10m $ETH), Courtesy: Santiment

As outlined by analytics company Santiment, Ethereum's mega whale addresses, typically considered entities holding 100,000 to 10 million ETH, have accumulated nearly 734,800 ETH within the last 12 days, representing 0.59% of ETH’s total supply.

While periods of macro consolidation and even price dips have the tendency to shake off some weak hands, it might not be the same with large holder addresses, referred to as whales. They have always been known to gobble up coins that small-time investors unload during periods of panic.

Santiment also notes that these whale entities have purchased 1.28 million ETH in the past 45 days and 1.46 million ETH in the past 60 days (coinciding with the September drop).

As reported by U.Today, the Ethereum price remains in an upward trajectory. Ethereum is trading presently at $4,735 while marking four consecutive days in the green. ETH is now barely 2.40% away from its Nov. 10 all-time high of $4,867.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev