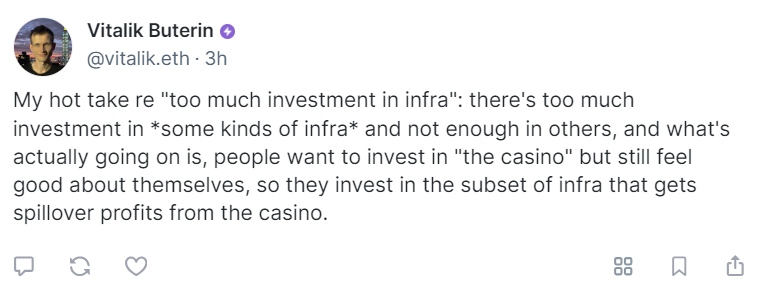

In an unexpected manner, Vitalik Buterin has criticized overextended investment practices, particularly investments in infrastructure that does not really need it. However, his line of thought could be a double-edged sword.

According to Buterin's viewpoint, a lot of investors are lured to high-risk high-reward situations (the casino) but attempt to rationalize their bets by funding infrastructure that indirectly gains from these speculative endeavors.

Although this may be true for some market segments, it is important to think about the arguments' wider implications. Vitalik's perspective may be criticized for being a little limited. Infrastructure spending frequently results in more significant technological breakthroughs and innovation, even when it is not directly tied to speculative markets.

For example, beyond the original speculative investment blockchain infrastructure, improvements can benefit a wide range of applications. These can include developments in supply chain logistics, public governance systems and even decentralized finance. Furthermore, a lot of interest and money are frequently brought into the market by so-called casino investments, which supply the money needed for new ventures and start-ups.

This capital inflow may result in innovations that would not have been feasible in an environment where investment was more cautious. The delicate balance between risk and innovation should not be overlooked as writing off high-risk investments could stifle the boldness and creativity that propel the sector forward. Buterin's criticism is not wholly without merit, though.

Instances of excessive speculation resulting in bubbles that can have disastrous consequences when they burst have been observed on the cryptocurrency market on multiple occasions. This volatility has the potential to erode investor confidence in the technology and result in sizable losses. For the ecosystem to remain healthy over time, it is crucial that investments are made carefully and sustainably.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov