Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Concerns have been raised regarding Ethereum exchange-traded funds (ETFs) viability in the market since their launch because of the volume at which they have been trading compared to Bitcoin ETFs.

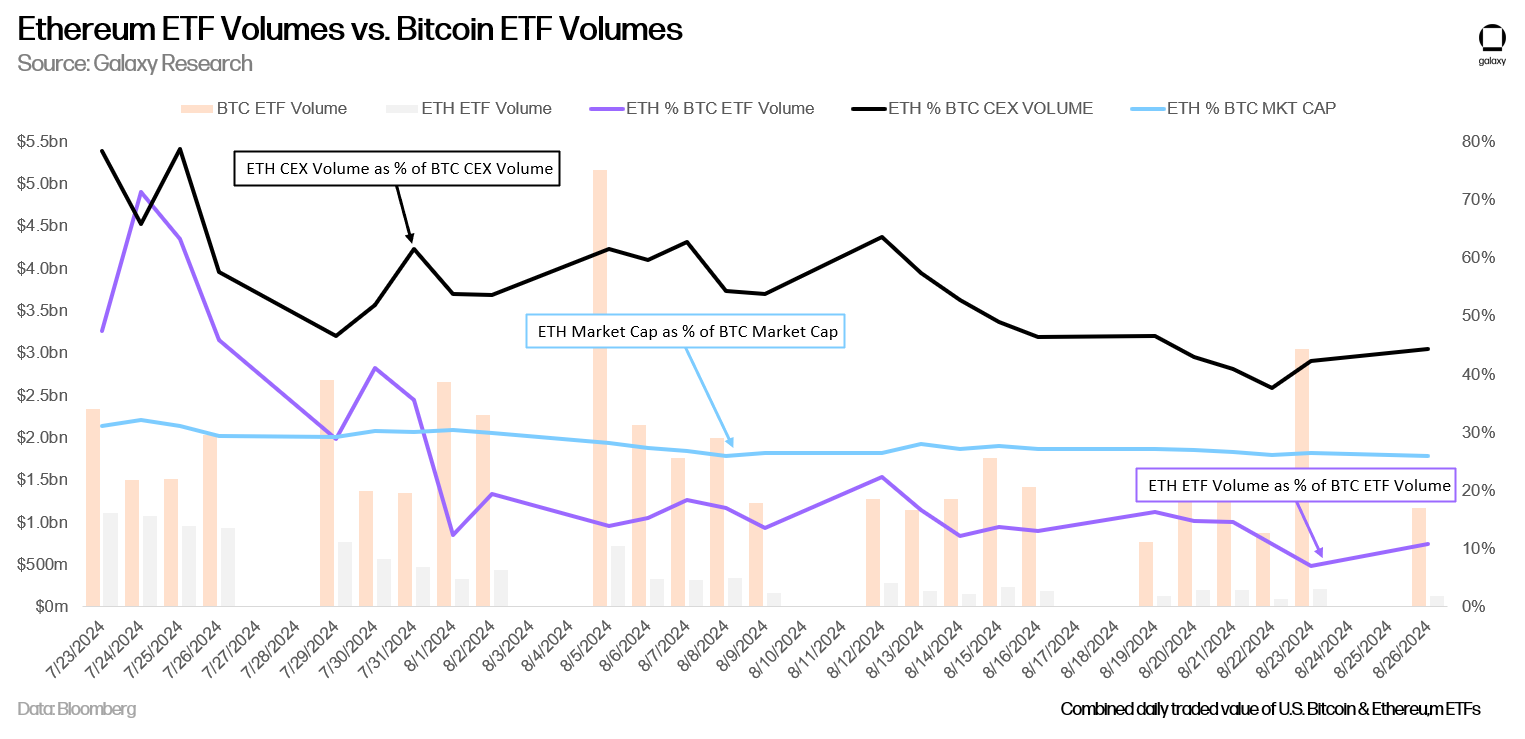

Data from Galaxy Research indicates that when taking into account Ethereum's market capitalization and its trading volumes on centralized exchanges, the volume of Ethereum ETFs has not only fallen well short of the expected ratios, but has also lagged behind Bitcoin ETFs. This difference is shown very well in Galaxy's chart.

Ethereum ETFs have struggled to attract the same interest with their volumes, frequently falling short of expectations, while Bitcoin ETFs regularly see high trading volumes. The dynamic also highlights the sharp differences in trading volumes between ETFs and more general market factors like Ethereum's percentage of Bitcoin's market capitalization and CEX volumes.

The truth is that Ethereum ETFs are actually underperforming as seen by the fact that their volumes barely make up a small portion of those of Bitcoin ETFs. This poor performance is caused by multiple factors. One of the main causes is that Ethereum ETFs are not available for margin trading, which severely reduces institutional traders and investors appeal.

These products are less appealing for large-scale trades because prime trading desks, which are vital to the liquidity and trading activity of ETFs, do not currently offer margin on them. To make matters worse, the volume disparity has been aggravated by the lack of leverage options, which has probably discouraged many potential traders from dealing with Ethereum ETFs.

The price chart adds more context. The daily chart shows a bearish trend with Ethereum's price showing signs of resistance after a sharp drop. Due to their association with a faltering asset, investors may be reluctant to participate in Ethereum ETFs as a result of this price action.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov