Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price of Bitcoin (BTC) is at $13,800, yet the decentralized finance (DeFi) market is struggling to recover. Data shows that a continuous BTC rally has not benefited DeFi tokens in the past 45 days.

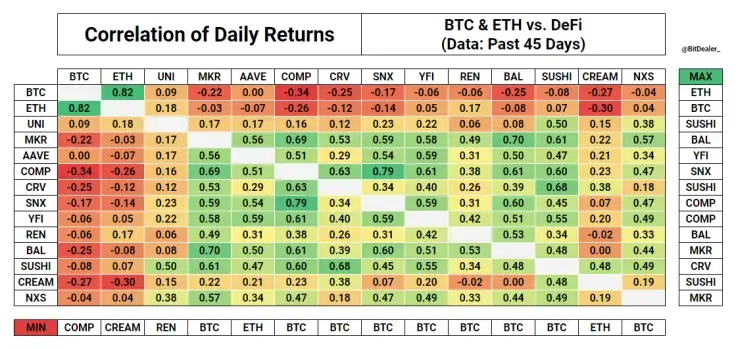

The pseudonymous co-founder of Markets Science known as “Bitdealer” said:

“Correlations between $BTC, $ETH, and DeFi: interesting to see how consistent the negative correlation between BTC and DeFi is. Data is from the past 45 days, since the launch of UNI.”

Advertisement

The data shows that not only did the rally of Bitcoin not propel DeFi tokens to rise, but caused them to drop.

The Big Threat is Bitcoin Rallying

The threat to the DeFi market in the short term is the relentless momentum of Bitcoin. Based on the data in the last 45 days, DeFi could continue to struggle if BTC quickly rallies.

According to the researchers at Santiment, there are signs that the Bitcoin rally could go on. They pinpointed the declining supply of Tether, which typically suggests an inflow of capital on the sidelines into the Bitcoin market. They wrote:

“As #Bitcoin has exploded to a peak of over $14,000 today, we can see how the $USDT supply (and even #Tether's subtle price variations) have changed throughout October. #Tether's supply on exchanges has shrunk by -2.2% this month as $BTC has risen.”

Advertisement

Atop the continuous inflow of stablecoins into the Bitcoin market, a loop of negative futures rate is causing BTC to increase.

Bitcoin futures exchange utilizes a mechanism called funding to find balance in the market. When the majority of traders in the market are longing or buying BTC, the funding rate becomes positive. Vice versa, when most traders are shorting or selling BTC, the funding rate becomes negative.

Throughout the week, the funding rate across major exchanges, including Binance Futures, was negative. That means the price of Bitcoin is rising but the selling pressure is increasing at the same time.

This trend shows two things. First, it shows that buyer demand is offsetting the heightened level of selling pressure. Second, as shorters get squeezed, it is causing BTC to increase.

The term squeeze refers to when short holders have to market buy their positions when BTC goes up. That causes a loop of sellers having to purchase BTC, adding to the overall buyer demand.

Yearn.finance continuously shows weakness

Arguably, one of the most influential cryptocurrencies in the DeFi market is Yearn.finance (YFI). At its peak, it surpassed a valuation of $1 billion, quickly becoming the biggest DeFi token.

YFI appeared to be recovering, but in the last 24 hours, it dropped 7%. It is at risk of dropping back below $10,000, which would be a substantial drop since its peak above $43,000.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin