During an interview with The Street, Jim Cramer, the host of CNBC's Mad Money, expressed concern about Tether's secrecy related to the company's commercial papers that are backing USDT's value.

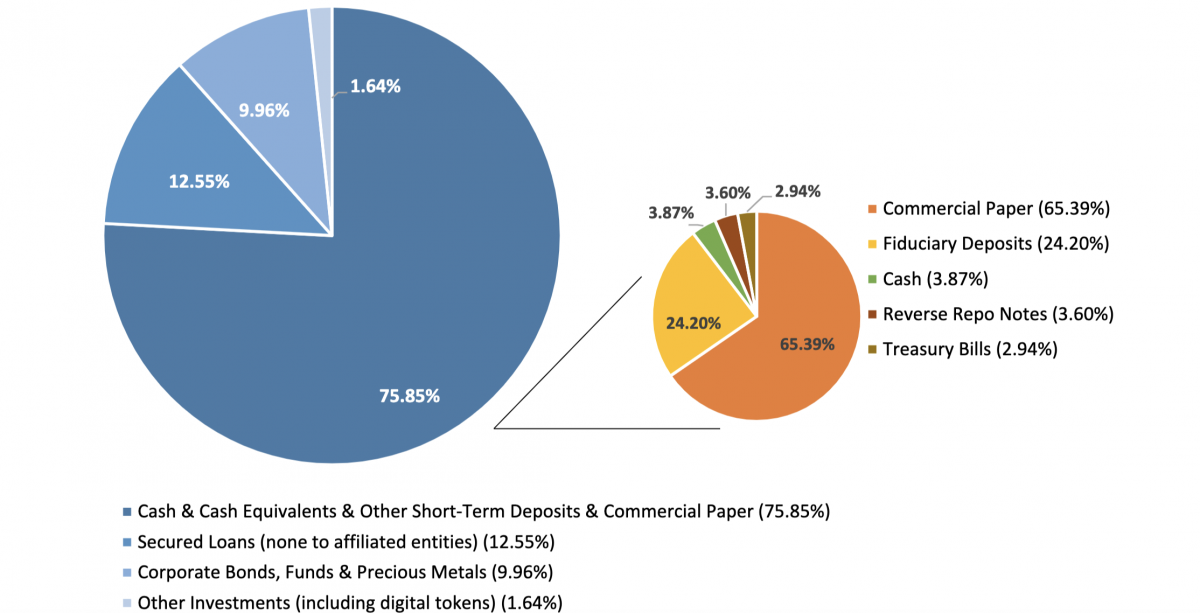

According to the company's reserve breakdown from May 13, 75 percent of the funds that are backing up the USDT stablecoin are cash or equivalent, short-term deposits and non-disclosed papers. Out of 75 percent of those holdings, 65 percent are commercial papers. On March 31, reserve breakdown cash alone accounted for only 3.87 percent of all USDT-backed assets.

It was not the first time that Cramer expressed his frustration about Tether's fund disclosure policy. During a testimony, the 16th Chair of the Federal Reserve expressed his concern about Tether, a move that Cramer welcomed on Twitter.

Powell concerned about Tether and commercial paper.. i do not blame him!

— Jim Cramer (@jimcramer) July 14, 2021Advertisement

Jim Cramer's concern was the actual papers that Tether is holding. The value of commercial papers that Tether owns is close to $60 billion. Due to a lack of transparency, the CNBC host is worried about the nature of those assets and expresses hope that they are legal.

The Mad Money host has also assumed that SEC chairman Gary Gensler may ask Tether about commercial papers being securities. Cramer suggested that there is a general belief that many of the commercial papers that Tether holds may be Chinese bank papers.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin