With the first Bitcoin futures, ETF starts trading in the U.S., and the country's investors and retail traders cannot miss the opportunity to receive convenient exposure to the crypto market without going through the relatively complicated process of actually purchasing crypto. But high demand, unfortunately, creates the "contango effect" that is not welcome among futures-backed ETF investors.

With massive retail and institutional interest hitting the digital assets market, ProShares had to buy a large number of Bitcoin futures contracts, which the current liquidity could not satisfy and which then led to the strong price increase of the derivative.

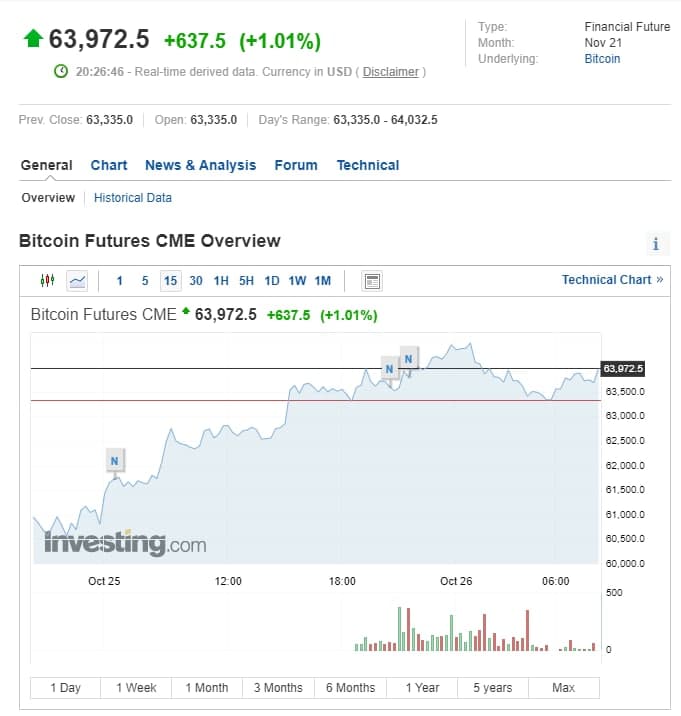

Since the ETF is tied to the Bitcoin futures contract rather than actual Bitcoin, the main exposure is achieved with the futures contract. By adding up large buying power, the price of the contract has started to overcome the price of the actual underlying assets. Such an effect is called a "contango."

Contango is one of the problems that investors face when getting exposed to the market via futures-backed products like ProShares Bitcoin ETF. Right now, if an investor wishes to enter the market through the aforementioned product, he has no other choice but to buy it at a premium, which immediately puts him at a loss.

The only way to avoid this tracking issue is to invest in physically-backed ETFs which, in the case of Bitcoin and the U.S., are nonexistent at the moment.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team