Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The cryptocurrency market has almost recovered from the recent correction; however, some coins remain in the red zone. Primarily, XRP, Bitcoin Cash (BCH) and Bitcoin SV (BSV) have declined over the past 24 hours. On many digital assets charts, a triangle model is forming, the breakdown of the upper border of which implies a continuation of the current trend. However, buyers' reluctance to move higher could increase the likelihood of a downward correction.

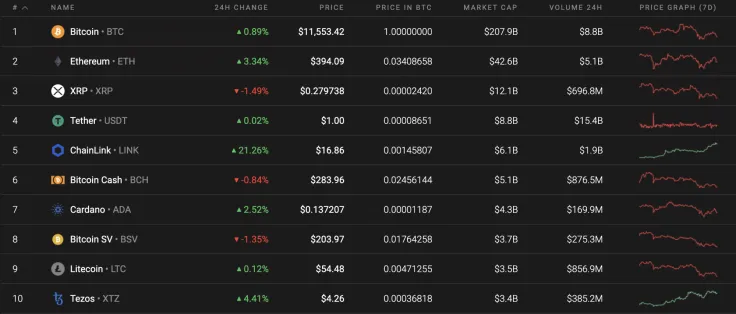

The key data for Bitcoin (BTC), XRP, Cardano (ADA), EOS, Dash, WGRT and Chainlink (LINK):

|

Name

Ripple Partners With Deutsche Bank, $2 Billion in Bitcoin Scooped by Whales, Schwartz Criticizes Logan Paul, Shiba Inu Price Enters Consolidation — Top Weekly Crypto News

Crypto Market Review: Shiba Inu Price Momentum Returns In New Uptrend, Is Ethereum (ETH) Stuck in the Mud? Bitcoin Isn't Giving Up on $70,000

|

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Bitcoin |

BTC |

$212,117,283,280 | $11,490.94 | $25,564,174,449 | -0.44% |

|

XRP |

XRP |

$12,551,797,014 | $0.279434 | $1,843,756,346 | -2.48% |

|

Cardano |

ADA |

$3,538,096,345 | $0.136463 | $418,671,242 | 1.46% |

|

EOS |

EOS |

$2,839,480,266 | $3.04 | $2,229,124,271 | -0.69% |

|

Dash |

DASH |

$857,623,265 | $88.86 | $311,377,686 | -1.50% |

|

WaykiChain Governance Coin |

WGRT |

$0.016488 | $198,000,000 | 11.17% | |

|

Chainlink |

LINK |

$5,874,498,732 | $16.78 | $3,641,060,428 | 17.58% |

BTC/USD

On the daily chart, Bitcoin (BTC) continues to correct near the important resistance level of $12,150. The nearest support area is located at $10,605.

The values of the RSI indicator practically tested the support line, which could provoke another attempt to increase the value of the asset. One should not rule out the development of a minor correction with the test of the support area at the level of $10,605.

After that, traders can expect a continuation of the rise to the potential target at $13,865. Cancellation of the positive option will be the breakdown of the lower border of the ascending channel with the price fixing below the $10,500 level. In this case, the target of the decline may be the $8,690 mark.

Bitcoin is trading at $11,456 at press time.

XRP/USD

XRP quotes are back below the upper boundary of the rising channel. Bear pressure remains.

For continued growth, it is important to go beyond the $0.33 level again. An additional signal in favor of the price rise is the test of the support line on the RSI indicator. Cancellation of this scenario may mean a breakdown of the support area with the price fixing below $0.234, in which case the price can be expected to fall to $0.216.

XRP is trading at $0.2770 at press time.

ADA/USD

Even though the rate of Cardano (ADA) has risen by 1.46% over the last day, the short-term scenario remains bearish. The price change over the last week has made up -4.55%.

On the daily chart, Cardano (ADA) has entered the correction phase based on the long wicks. Also, the trading volume is going down slightly, which means that the drop is likely to continue. What's more, liquidity is low, which is another reason for an upcoming decline. In this case, the nearest support is $0.1196, which may be attained shortly.

Cardano is trading at $0.1349 at press time.

EOS/USD

EOS on the daily chart continues to trade above the support level. There is potential for a rebound and a continuation of the rally toward the first target of $3.50. An additional signal in favor of such a scenario is a rebound from the trend line on the RSI indicator, where a new test is likely after a breakout.

The cancellation of this option may mean a breakdown of the lower border of the ascending channel with the price fixing below the $2.50 level. In this case, we would expect a continuation of the fall to the $2.15 level.

EOS is trading at $3.01 at press time.

DASH/USD

Dash is among our losers today, as the rate of the altcoin has gone down by more than 2% since yesterday.

According to the chart, DASH is going down amidst a decreasing trading volume. A further drop is more probable than growth as there is no liquidity to hold the rate of the coin at the current levels. DASH is forming a triangle pattern at the moment with an endpoint of $81.86 likely by the end of the month.

DASH is trading at $88 at press time.

WGRT/USD

WaykiChain Governance Coin (WGRT) is a relatively new coin as trading started at the beginning of summer 2020.

WGRT has shown significant recent growth. Once it started to be traded, the coin has been rising for most of the summer. From a technical point of view, the bullish trend remains relevant. However, the altcoin may face a correction to gain more steam for further growth. Besides, the value of the RSI indicator is already located in the overbought zone, which considers a possible decline. In this regard, the closest support is at $0.01390 and may be attained shortly.

WGRT is trading at $0.0168 at press time.

LINK/USD

Chainlink (LINK) is trading similarly to WGRT. It is the biggest gainer in our list. Its price has grown by almost 20% over the previous 24 hours.

The long-term scenario is bullish, however, and a correction is needed to keep the rise going. That is why the short-term trend is likely to be bearish as the altcoin is overbought and the trading volume has slightly declined. Bulls may also show strength at the $12.60 mark.

Chainlink is trading at $16.88 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin