Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

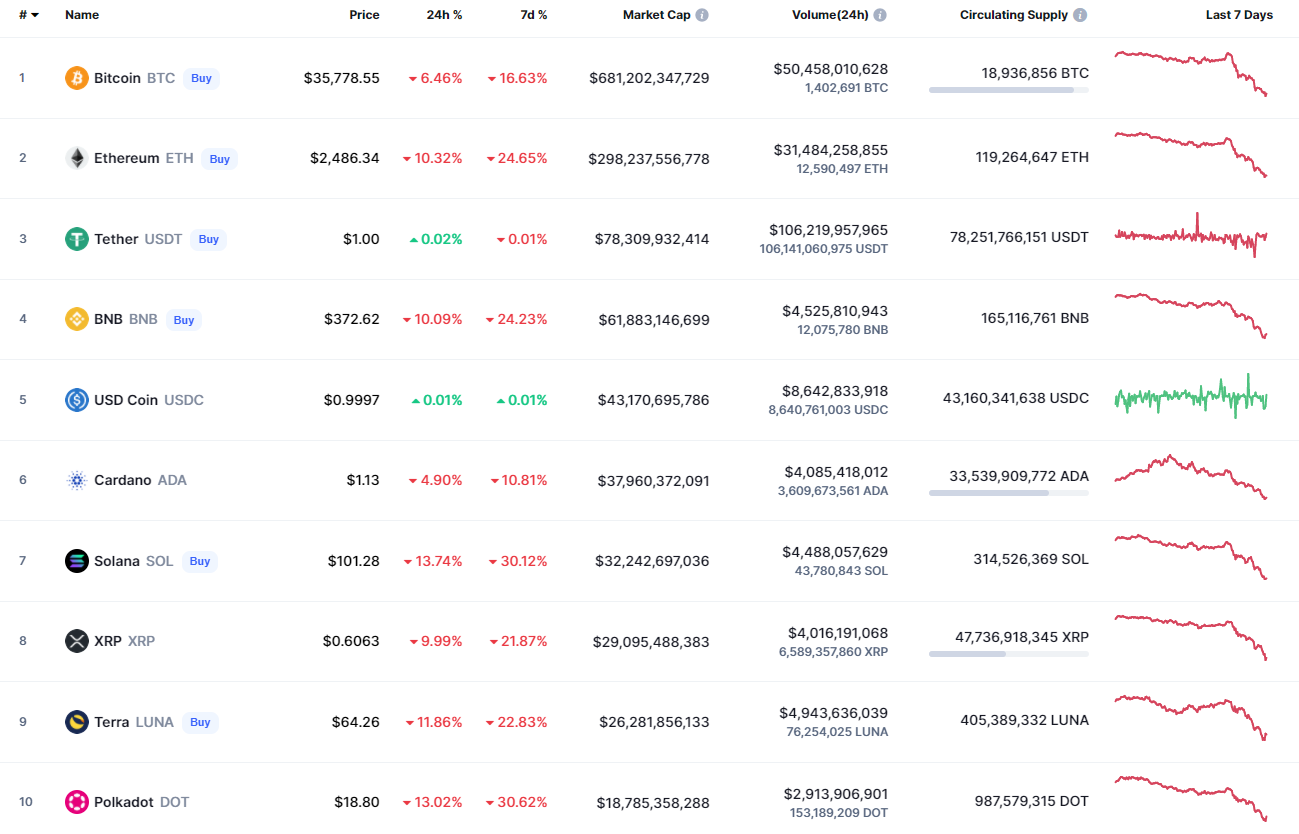

The sell-off has continued on the cryptocurrency market as the coins have followed the sharp drop of Bitcoin (BTC).

BTC/USD

Bitcoin (BTC) has lost the least compared to other coins from the list. It has dropped by 7.23% since yesterday.

On the daliy chart, Bitcoin (BTC) has fixed below the support of $39,573, having confirmed the bears' dominance over bulls. At the moment, the price is located in the channel with the new support at the area around $30,000.

If sellers keep the drop, there are chances to expect short-term growth from the support level; however, the trend remains bearish.

Bitcoin is trading at $35,665 at press time.

ETH/USD

Ethereum (ETH) is the biggest loser today with a fall of almost 12% over the last 24 hours.

Ethereum (ETH) has confirmed the support level at $2,410, having successfully bounced back from it. At the moment, one needs to pay close attention to where the daily candle closes. If bulls can hold the crucial level at $2,500, there is a possibility to see the correction to the mirror level at $2,900 next week.

Ethereum is trading at $2,468 at press time.

XRP/USD

XRP is not an exception to the rule, going down by 11%.

From the technical point of view, XRP is trading similarly to Bitcoin (BTC) as it is also located between the resistance of $0.6959 and the support of $0.50. The selling trading volume has increased, which means that traders may have begun fixing their short positions.

In this case, the ongoing fall might be stopped soon, followed by a bounceback.

XRP is trading at $0.6028 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin